Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series, Supply Chain and Logistics Management

How to Track and Report Days Sales Outstanding (DSO) in Sales Order Purchases using Dynamics 365 Finance and Operations

Track & Report Days Sales Outstanding DSO with MS Dynamics 365

Days Sales Outstanding DSO | Dynamics 365 | Risk Score | Credit Limit | Total Order

What is a Purchase Order?

A purchase order (PO) is a document submitted to a supplier when you or someone in your organization buys something. This might be for stationery, office furniture, or even inventories. However, before a PO is submitted to a supplier, a purchase requisition needs to be approved by an authorized person. As soon as a request is confirmed, a PO is subsequently submitted to the supplier, which instantly turns into a legal agreement. Generally, all purchase orders should reflect:

- The name of the product or service

- Quantity

- Price

- Any additional conditions for sale such as discounts, etc.

- A PO number

- The time for payment

- A delivery timetable

Purchase orders may be either paper-based or computerized. One of the advantages of implementing an electronic purchase order is that decision-makers can monitor purchases, view information, and execute payments quicker.

SUMMARY

A purchase order (PO) is a document submitted to a supplier when you or someone in your organization buy something. This might be for stationery, office furniture, or even inventories. Purchases can be either paper-based or computer-based and are subject to approval by an authorized person.

What Does DSO Mean and Why is it Important?

Days Sales Outstanding, abbreviated as DSO, is a critical metric to watch and to ensure that business’s cash flow remains healthy. DSO is the number of days required for a company to convert its receivables to cash. Given that cash flow is the essence of every organization, the sooner a firm receives that money, the healthier its cash flow and financial conditions are likely to be.

Years of low-interest rates and cheap credit have caused businesses to lose focus on DSO management. If a company can readily borrow money at an affordable interest rate, there is less need to worry about DSO growing by a few (or more) days.

Due to the critical need for money for corporate operations, prompt collection of accounts receivable is important. Additionally, DSO may be used to assess a business’s overall efficiency and profitability. Reduced charges receivable collection timelines enable businesses to spend their capital more effectively to increase sales.

Evaluate DSO

Additionally, it is critical to evaluate the DSO since it may be used to assess the accounting department’s performance and detect any potential issues or weaknesses to be addressed before they occur. Additionally, the DSO may be utilized to develop financial models that can be used to enhance or eliminate these dangers or issues.

Managers, investors, and stakeholders depend on DSO to gauge a company’s effectiveness in recovering unpaid customer balances. In addition, business acquirers use the formula to identify firms with high DSO values to buy them and improve their collection and credit operations. Finally, DSO is a critical metric for analysts comparing organizations to see how well they manage credit and use receivables to expand their company. Should you like to read more on our latest blog, click here.

|

Sr. |

Important Accounts Receivable KPIs | |

| KPI | Description | |

|

1. |

Average days late | The average day’s late calculation gives insight into how many invoices are paid in a specified time period past the due date. By using this calculation, you can see how often the accounts receivable department is allowing customers to pay 15 days late, 30 days late, 60 days late of 90 plus days late. |

|

2. |

Collection effectiveness index | The collection effectiveness index looks at what can be collected because it is currently due, as opposed to what is simply an open invoice and likely won’t be collected on as DSO does. |

SUMMARY

DSO is the number of days required for a business to convert its receivables to cash. Low-interest rates and cheap credit have caused companies to lose focus on DSO management. However, DSO may be used to assess a business’s overall efficiency and profitability.

How to Calculate DSO?

Now let’s learn how to compute DSO for a certain time. The days sales outstanding formula is as follows:

DSO = (accounts receivables / total sales) * number of days

For example, let’s say that last month, Example Enterprise sold $50,000 worth of goods, with $35,000 in accounts receivable on its balance sheet at the end of the month. Its DSO is: (35,000 / 50,000) * 31 = 22.3 days.

This means that, on average, it took Example Enterprise 22 days to collect payment after a sale had been made.

SUMMARY

To compute DSO, the formula is as follows:

DSO = (accounts receivables / total sales) * number of days

What Distinguishes DSO from DPO?

The DPO (Days Payable Outstanding) is the mirror indicator: it indicates the average number of days it takes to settle your invoices.

DPO = (accounts payables / cost of goods sold) * number of days

For example, imagine that in the fiscal year 2020, Example Enterprise spent $280,000 worth of COGS, with $30,000 in accounts payables on its balance sheet at the end of the year. Its DSO is: (30,000 / 280,000) * 365 = 39.1 days. This means that on average, in 2020, it took Example Enterprise 39 days to pay its bills and invoices to its creditors (suppliers, vendors, etc.).

SUMMARY

The DPO (Days Payable Outstanding) is the mirror indicator of DSO.

Average Days Sales Outstanding Benchmarks by Country & Industry

While North American firms do better than those in the majority of Europe and Asia, a 2019 analysis of Days Sales Outstanding by Euler Hermes found that it still takes an average of 51 days for US businesses to get paid, compared to 52 days for Canadian enterprises. Additionally, 25% of North American firms examined received payment after more than 65 days.

Additionally, the research demonstrated the wide variation in DSO among industries. The electronics, machinery, and construction industries continued to have the longest DSO, at 89 days, 86 days, and 82 days on an annual average, respectively, much longer than the worldwide average of 65 days.

Not unexpectedly, the 2016 Hackett Group Working Capital Survey found that 1,000 public businesses in the sample had a combined DSO exposure of $316 billion.

SUMMARY

It takes an average of 51 days for US businesses to get paid, compared to 52 days for Canadian enterprises. However, 25% of North American firms received payment after more than 65 days. The electronics, machinery, and construction industries continued to have the longest DSOs.

How to Reduce Days Sales Outstanding in Accounts Receivable

DSO reduction is not entirely within the financial and accounting departments of your business. Other business units also affect this measure. As a result, decreasing DSO involves a concerted effort on finance executives and the collaboration of different departments within the organization. Let’s discuss six straightforward techniques for minimizing your company’s days sales outstanding in accounts receivable.

Compile data on the present condition of the DSO

Any attempt to lower DSO must begin with collecting data on a company’s existing DSO status and the creation of a benchmarking study that compares that level of DSO to peers and rivals. This information serves as a jumping-off point for the endeavor and gives insight into the DSO ratio that the firm may achieve. The Hackett survey provides some basic industry statistics to help you compare your business’s state to that of others. Then, consider further industry surveys or private benchmarking studies for more precise data.

Accounting and finance executives may also utilize this data to create a case for DSO reduction to senior management and the numerous departments needing collaboration. By prioritizing DSO reductions as a strategic target, executives may more easily justify the resources allocated to the project and include DSO improvement measures into the individual performance objectives and incentives of individuals leading the effort.

In general, businesses should prioritize DSO reductions that are realistic and sustainable in light of their operational reality. For instance, organizations may lower DSO by 20 days by drastically restricting credit approvals for customers, but this would not be very helpful if customer acquisition and retention suffer.

Focus on a customer credit

DSO is often determined by your customers’ ability to pay on time. As a result, every attempt to enhance DSO must take consumer credit risk into account. A decent initial step is to establish acceptable consumer credit risk boundaries. A business may then utilize those criteria to verify that no new clients provide an unacceptable risk of late or non-payment. Companies may also apply this criterion to current customers, beginning with those tardy in paying.

Consumer credit risk. Salespeople do not want to lose a deal due to credit issues with a consumer. As a result, businesses may need to institute particular incentives and sanctions to ensure that salespeople and sales managers stick to the company’s credit standards for customers. Occasionally, businesses may carefully employ products such as credit insurance to assist limit these risks without losing an otherwise desirable consumer.

Specify payment arrangements for customers

DSO indicators are highly impacted by the payment arrangements offered to customers by a business. Therefore, these payment periods must be carefully balanced against the company’s own DSO targets, as well as industry standards and customer demand and expectations. This includes defining the situations under which the firm will provide customers incentives for speedier payment, demand deposits, or advance payments, backed by a transparent approval procedure.

Payment conditions must be stated clearly and plainly on invoices to avoid misunderstanding about when payment is required. Additionally, the business should communicate with consumers regularly regarding unpaid bills and how the company may make it simpler for them to pay them. For instance, some clients may be migrating to electronic payments or prefer that their staff make specific purchases using payment cards.

Examine invoicing procedures

Inefficient or slow accounting procedures may also extend DSO. As a result, increasing DSO often demands a focus on ensuring that invoices are sent on time, include all relevant information, and are error-free. A complete assessment of the billing process, including spot-checking invoices, may reveal problems that may cause payment to be delayed. False charges, invoices that do not reflect agreed-upon discounts, and mailing incorrect addresses are just a few instances of typical mistakes that may cause payment delays.

Additionally, businesses should evaluate and update their rules about issuing invoices regularly and ensure that those policies are being followed. Consider giving bills at contract execution, upon delivery, or at any other contract milestone. Additionally, businesses should conduct audits of their billing procedures to discover delays or inaccuracies.

Prudently manage accounts receivable

Once bills are received, a business must establish a process for tracking delinquent balances and notifying customers of unpaid invoices. This correspondence should be directed at identifying any obstacles to the client paying the invoice. In rare instances, an ordinarily solid client may be experiencing cash flow difficulties, making a necessary customized arrangement or payment plan.

If non-payment persists, the business should have a clear policy and procedure for dealing with these circumstances and any resulting disputes, including recommendations on when and how to escalate the problem as necessary. For instance, this guideline may include when overdue bills should be turned over to a collection agency.

Maintain momentum

Businesses must commit to minimizing DSO and to maintaining this effort over time. DSO reduction often demands behavioral adjustments in addition to administrative processes and procedures. As a result, businesses must ensure that the changes stay and that individuals do not revert to their old methods. Companies may maintain attention on these activities and underline their relevance to the organization by holding frequent evaluations and conversations regarding DSO indicators.

Dynatuners is at your service to provide Help Desk Support during the implementation, upgrade, or migration of your projects with Microsoft Dynamics 365. To get assistance, contact our experts.

SUMMARY

DSO is often determined by your customers’ ability to pay on time. Every attempt to enhance DSO must take consumer credit risk into account. By prioritizing DSO reductions as a strategic target, executives can more easily justify the resources allocated to the project. Salespeople do not want to lose a deal due to credit issues with a consumer. Increasing DSO demands a focus on ensuring invoices are sent on time and are error-free. Once bills are received, a business must establish a process for tracking delinquent balances and notifying customers of unpaid invoices. In rare instances, an ordinarily solid client may be experiencing cash flow difficulties. Businesses must commit to minimizing DSO and to maintaining this effort over time.

Functional Walkthrough in Dynamics 365

Enter sales order header details

Step 1

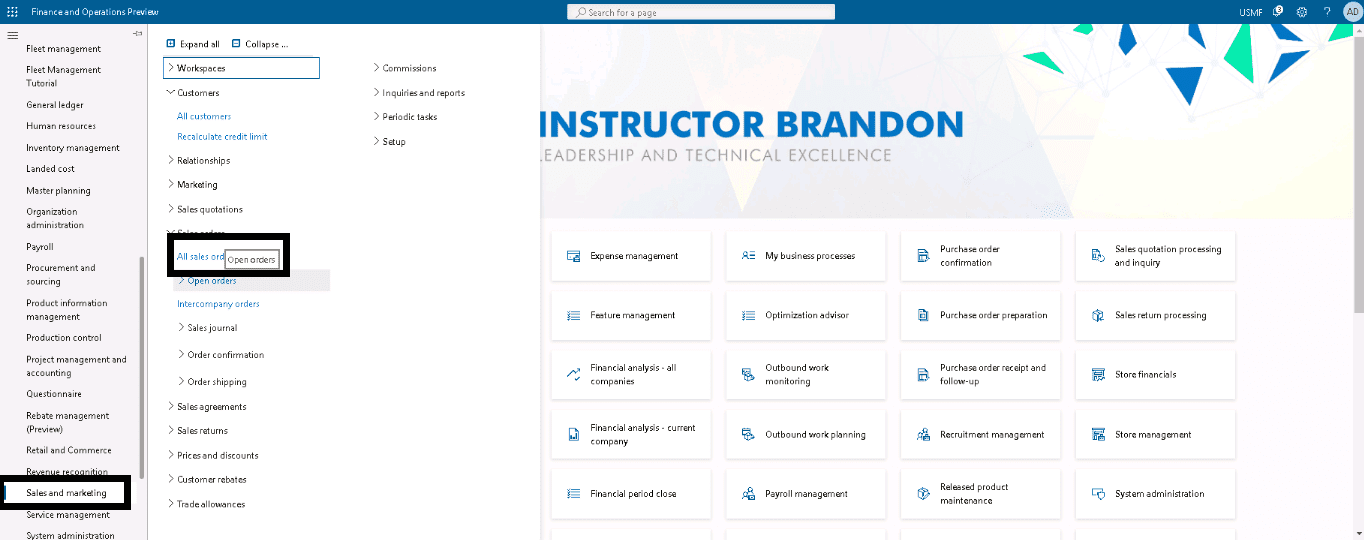

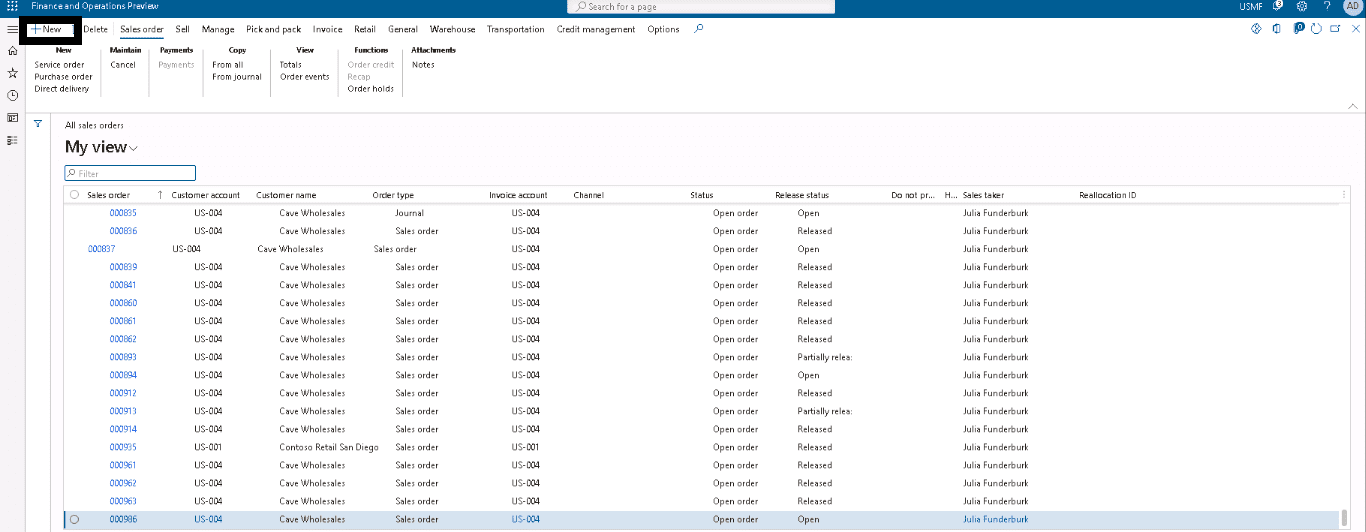

Go to Navigation pane > Modules > Sales and marketing > Sales orders > All sales orders.

Step 2

Select New.

Step 3

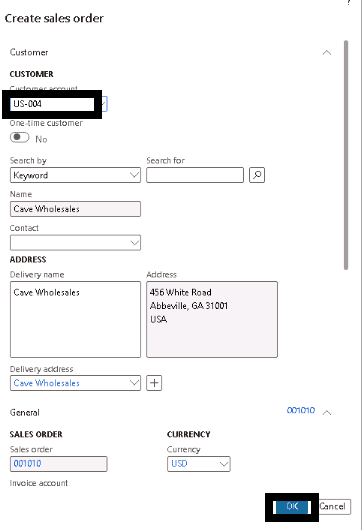

In the Customer account field, select the drop-down button to open the lookup.

Step 4

Select OK.

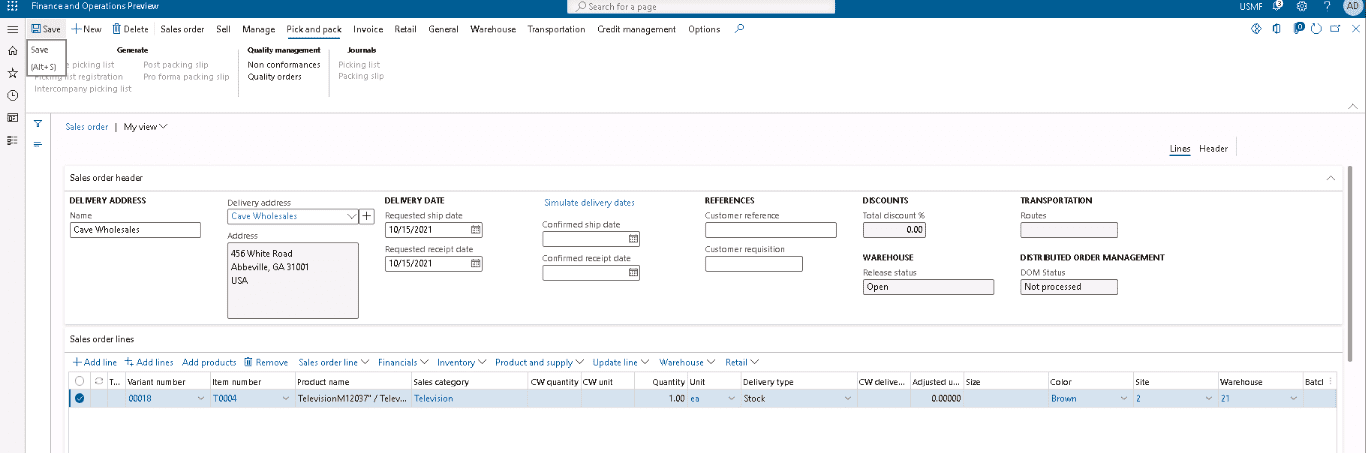

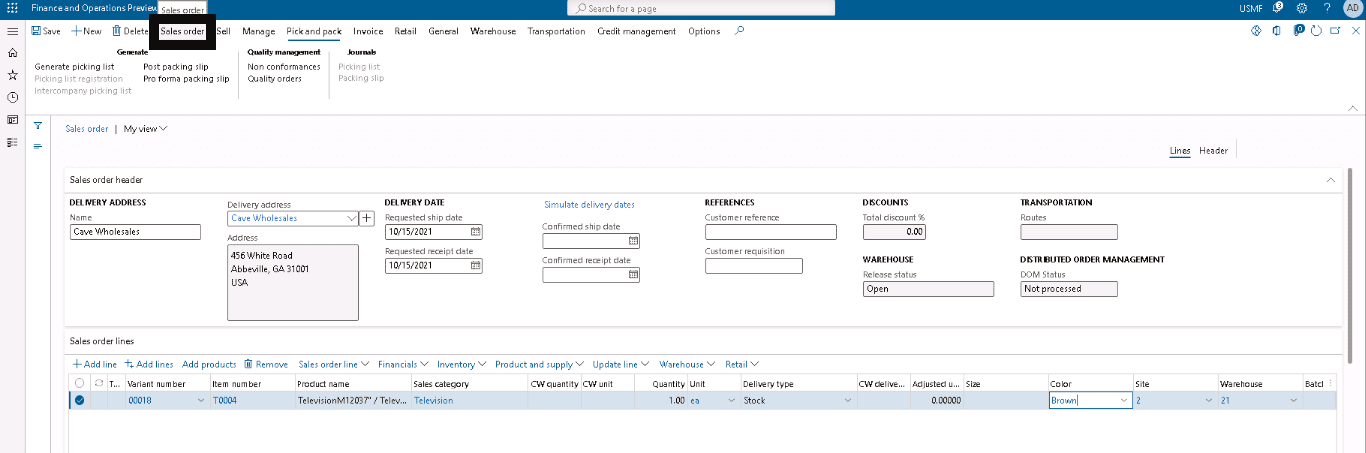

Enter sales order line details

Step 5

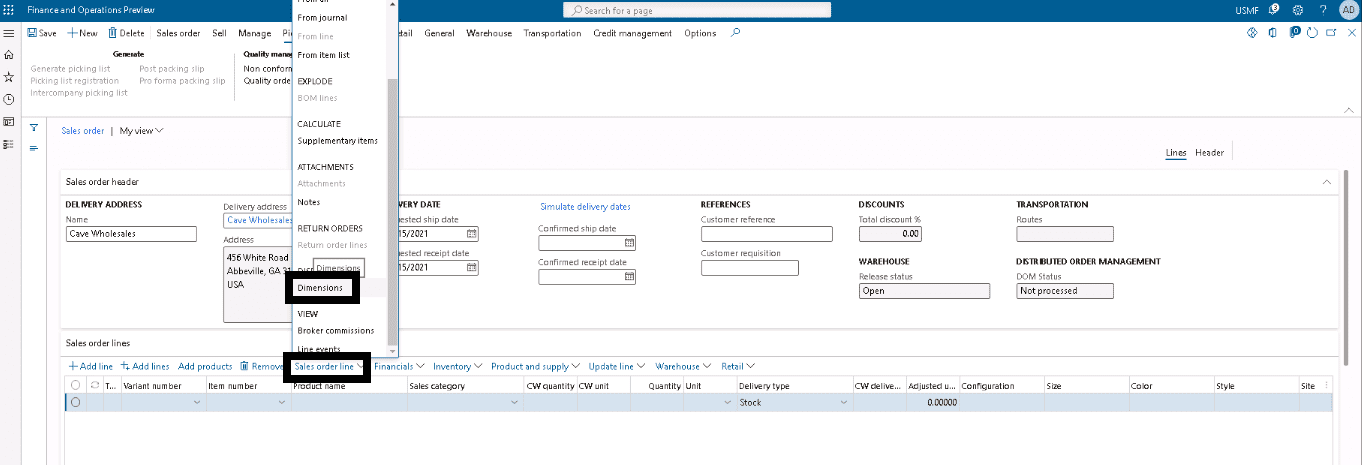

Under the Sales order lines section, select the Sales order line.

Step 6

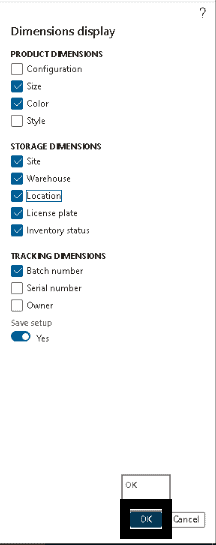

Select Dimensions.

Step 7

Select OK.

Step 8

In the Item number field, select the drop-down button to open the lookup.

For this example, select item number T0004.

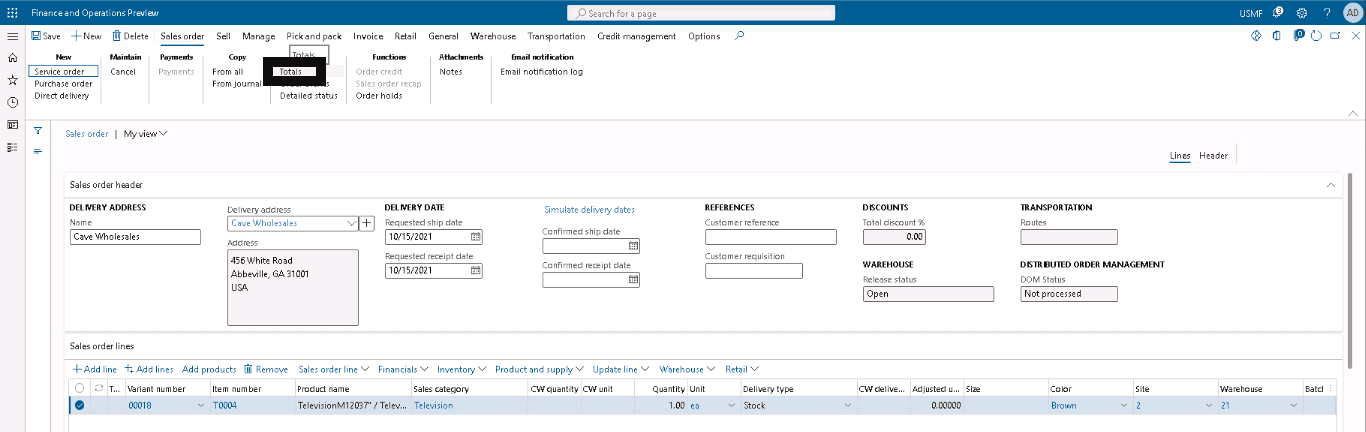

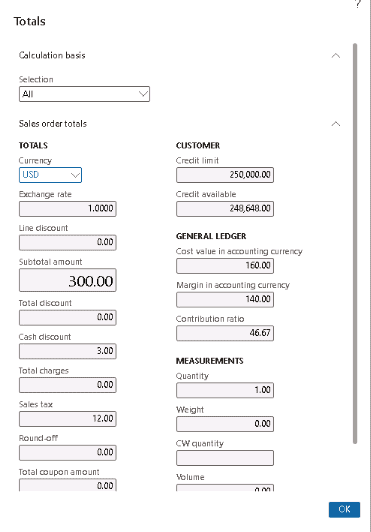

Review the order totals

Step 1

On the Action Pane, select Sales Order.

Step 2

Select Totals.

Step 3

Select OK.

SUMMARY

This procedure shows you how to create a sales order. Doing the steps as outlined above you will be able to create one. You can use the procedure in demo data company USMF.

Maximize Cash Flows by Reducing DSO

Reduced DSO is a reasonably simple technique to improve your business’s cash flow. It just requires a concentrated and consistent effort. When executives understand the potential effect of reduced DSO, they are more likely to offer the necessary support and strategic direction for the program.

Get the Full Microsoft Dynamics 365 Developer (F&S) Training Series and join our courses to get a real-world hands-on learning experience through our custom-designed labs.

SUMMARY

Reduced DSO is a very straightforward approach for increasing your business’s cash flow. It just demands a sustained and determined effort. When executives realize the potential benefits of lower DSO, they are more inclined to provide the program with the necessary support.

Limitations of Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) should continuously be assessed in light of the terms and structure of the business. Following are some limitations of DSO calculations and their information: DSO does not account for cash sales; it only accounts for credit transactions.

DSO cannot be used to compare firms with significant variances in their credit-to-cash sales ratios since the measure excludes cash payments.

DSO fluctuates in lockstep with sales and other short-term factors. As a result, DSO should not be considered the only measure of an organization’s accounts receivable efficiency. A drop in the DSO number may not always represent increased collection attempts by the organization’s collection department. It is possible that sales grew, but past due payments stayed constant, resulting in a reduced DSO figure. Additionally, evaluating DSO over a shorter time than a year might provide deceptive findings.

It’s challenging to apply the typical DSO strategy to seasonal firms. Confident financial analysts try to offset this issue by using an average receivables figure for the firm and a daily average of sales for the last 30 to 90 days rather than the whole year.

Due to the limited information offered by DSO, analysts should ensure that they do additional computations when assessing a company’s cash conversion cycle.

SUMMARY

DSO does not account for cash sales; it only accounts for credit transactions. Therefore, DSO cannot be used to compare firms with significant variances in their credit-to-cash sales ratios. As a result, analysts should ensure that they do additional computations when assessing a company’s cash conversion cycle.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on managing your cashflows perfectly, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What is the significance of a days sales outstanding? ” answer-0=”Days sales outstanding (DSO) is critical because the speed with which a business receives cash is critical to its overall efficiency and profitability. The more quickly a business obtains cash, the more quickly it can reinvest it to increase sales. ” image-0=”” headline-1=”h2″ question-1=”Do you want a greater number of days sales outstanding? ” answer-1=”Because days sales outstanding (DSO) represents the time required to collect due cash payments from consumers who purchased on credit, a lower DSO is preferable to a greater DSO. If DSO increases over time, it indicates that the firm is having a harder problem collecting cash from credit sales. ” image-1=”” headline-2=”h2″ question-2=”What does a rising DSO ratio indicate about a business’s operations? ” answer-2=”A high DSO indicates that a business is taking longer than necessary to recover receivables from customers. This may have a substantial effect on cash flow for smaller enterprises that depend on prompt payment to cover operating expenditures such as electricity and payroll. ” image-2=”” count=”3″ html=”true” css_class=””]

9760

9760