Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Letters of Credit: A Proven Solution to Compliance Challenges and Secure Payments

Letters of Credit: A Proven Solution to Secure Payments

International Transactions | Documentary Credit | Secure Payments | Cash Flow Forecast | Financial Reporting

What are Letters of Credit?

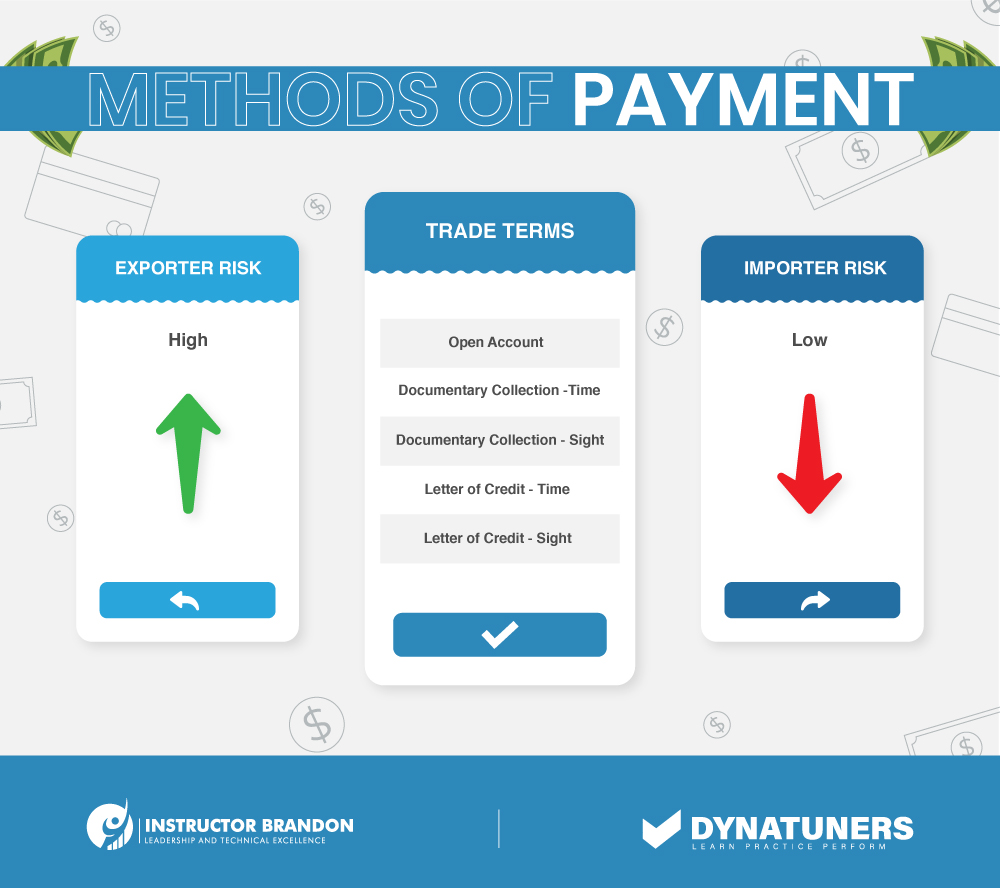

Businesses are sometimes required to perform international trade transactions and seek financial resources for large-scale projects. Certain risks are inherent in the payment and delivery of items if there are any business dealings with firm’s located across borders. Letters of credit are written guarantees from a financial institution that the seller will be paid on time and in full by the buyer.

A letter of credit helps streamline the transaction process. This blog will help you understand what a letter of credit is and why it is essential.

Letters of credit are written assurances from a financial institution that the seller will receive payment from the buyer on time and in full. If the buyer cannot pay, the financial institution will pay in their stead. Payments may be made in whole or in installments. This agreement is designed to mitigate both the buyer’s and seller’s risks in international trade. As long as specific requirements are followed, a letter of credit is one of the merchants’ most secure payment solution.

Utilizing a letter of credit is critical because it assures the customer that they will pay only when the seller receives evidence of shipment. As a result, the purchaser is not required to make any unnecessarily large upfront payments. Additionally, the letter may be used to demonstrate that you or your organization is prepared to undertake additional business with international firms. This is required when doing business on a global scale.

On the other hand, a letter of credit might act as an insurance policy for the seller if the buyer defaults on the payment. Additionally, this letter might shield the seller from legal liability as long as specific requirements are followed to avoid compliance issues.

SUMMARY

Letters of credit are written guarantees from a financial institution that the seller will be paid on time and in full by the buyer. As long as certain conditions are met, a letter of credit is one of the most secure payment methods available to retailers.

Features/Characteristics of Letter of Credit

Following are some of the features of a letter of credit:

- Negotiability: A letter of credit is a commercial agreement in which the terms may be amended/modified with each party’s consent.

- Letters of credit are either revocable or irrevocable. A revocable letter of credit cannot be verified, so the obligation to pay may be canceled at any moment. In an irrevocable letter of credit, all parties retain authority; it cannot be altered or amended without the unanimous permission of all parties.

- A letter of credit may be transferred; also, the recipient has the authority to transfer/assign the LC. No matter how many times the beneficiary assigns/transfers the LC, it will remain valid.

- Sight & Time Drafts: The recipient will only get payment from the issuing bank upon a letter of credit maturity if he shows all required drafts and papers.

- The following is a list of shipping documentation necessary for the Letter of Credit:

- Bill of Lading for Shipping

- Airline Bill

- Invoice Commercial

- Certificate of Insurance

- Origin Certificate

- Checklist for Packing

- Inspection Certificate

When it comes to LC, there are different prices and refunds. In most circumstances, all parties control the payment under the letter of credit. Banks on the other hand may levy the following fees:

Charges for opening, including commitment costs, are assessed upfront, as is a maintenance fee for the duration of the LC.

After the LC term, retirement expenses are due. They include the advising bank’s fee, reimbursements for responsibilities arising under foreign law, the confirming bank’s fee, and bank costs due to the issuing bank. The account must have a credit balance to balance the Inventory account’s debit balance. Explore our group learning options to maximize your return on investment and develop your team’s dynamics competence.

SUMMARY

A letter of credit may be revocable, nonnegotiable, or irrevocable. Additionally, shipping papers are necessary to begin letters of credit, as mentioned above.

Which parties are involved in a Letter of Credit?

The following are the principal parties to a letter of credit:

-

Applicant

An applicant (buyer) is a person who seeks a letter of credit from his bank.

A beneficiary is essentially the seller who gets paid due to the transaction.

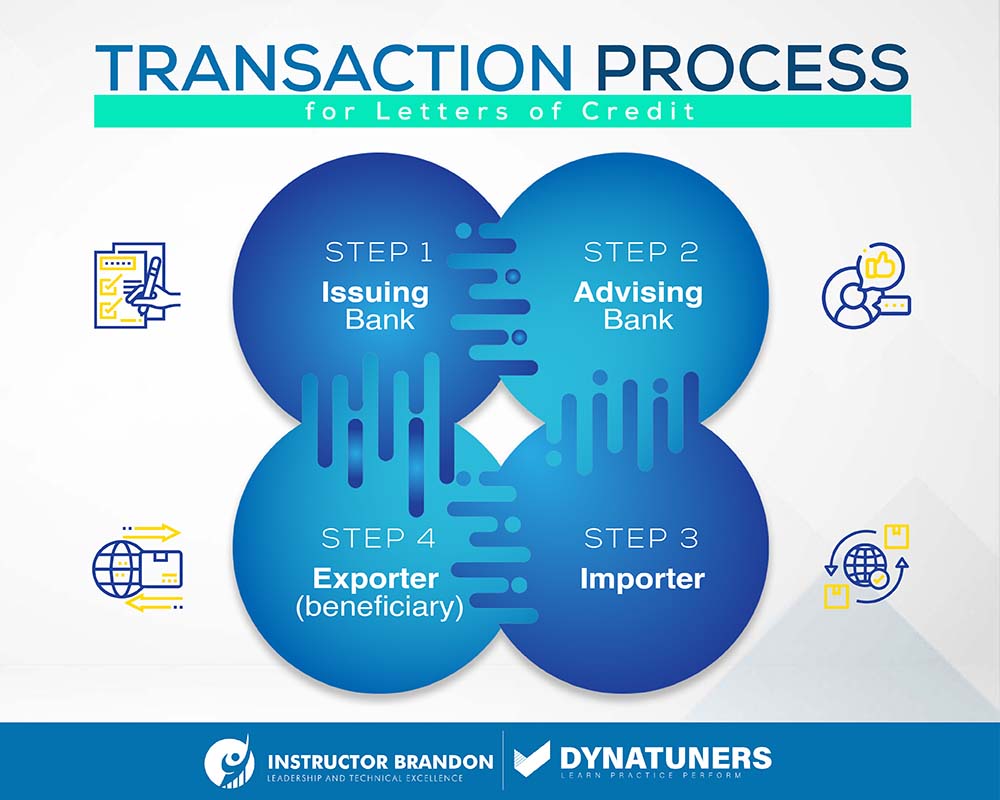

The issuing bank (alternatively referred to as an opening bank) is responsible for issuing the letter of credit upon the buyer’s request.

-

Bank Consultation

The advising bank is responsible for transferring papers to the issuing bank on the exporter’s behalf and is often based in the exporter’s nation.

Because letters of credit are primarily utilized in international commerce, they make it easier to develop your business into new markets.

Additionally, a letter of credit is very customizable. Trading partners may incorporate a variety of terms, conditions, and requirements that benefit them throughout the transaction. Additionally, this letter may be changed from one commercial transaction to another involving the same parties.

Get a hands-on, real learning experience with us, enroll now.

SUMMARY

There are four principal parties involved in a letter of credit. Letters of credit are largely used in international trade, and because they are very customizable, they make expanding your firm into new markets much easier.

Functional Walkthrough of Letters of Credit in Dynamics 365 Finance and Operations

Import letter of credit in D365

Create a Purchase order with a letter of credit.

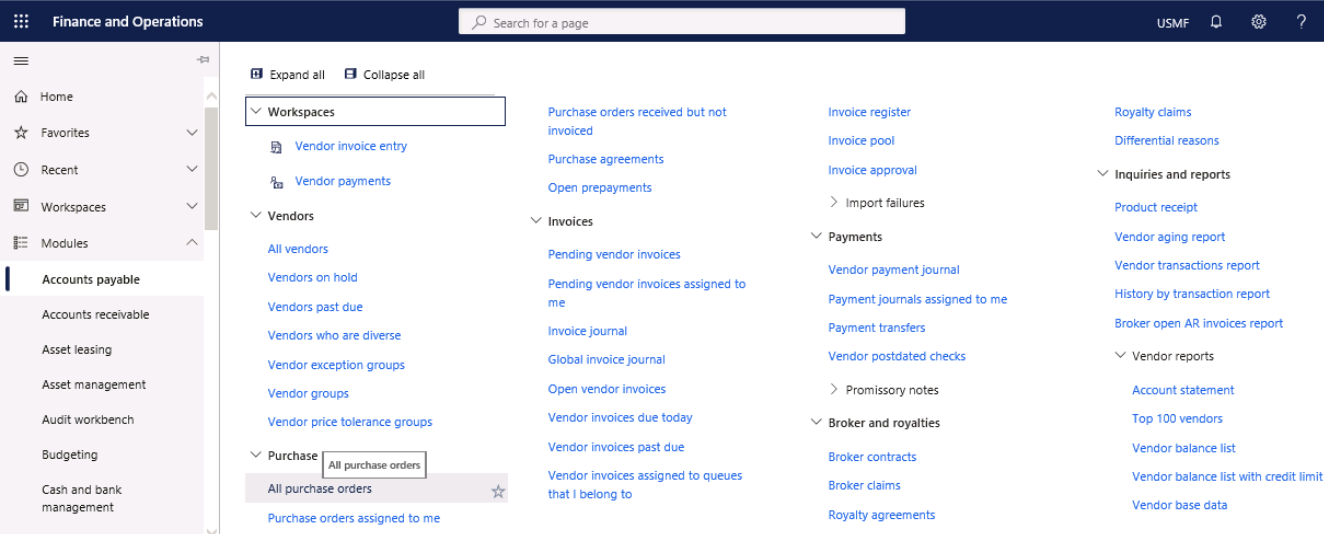

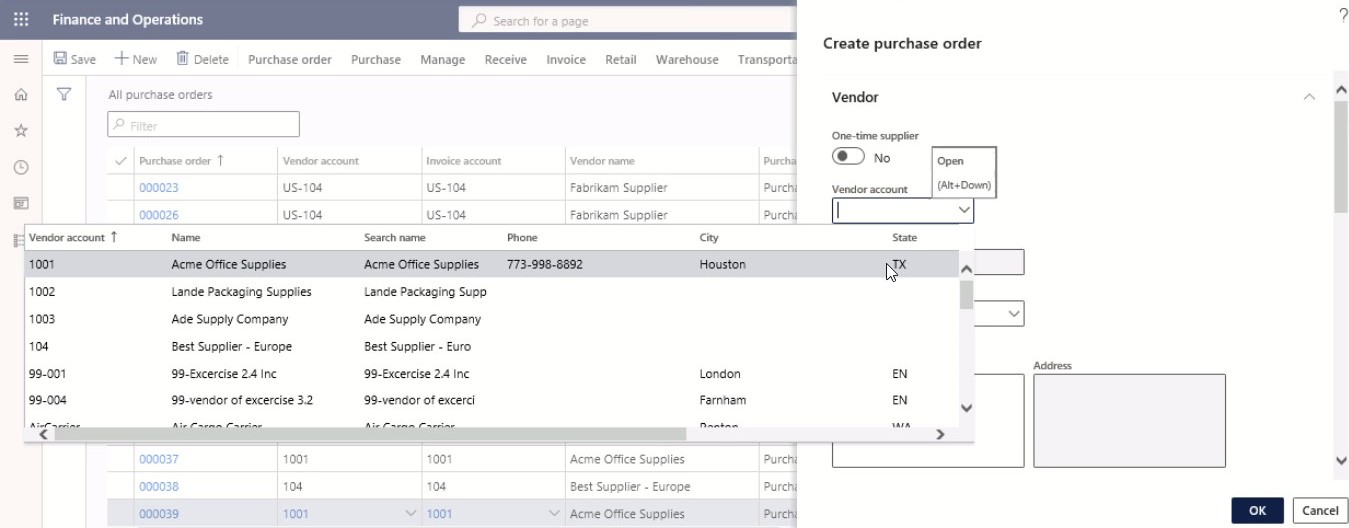

Go to Accounts payable > Purchase orders > All purchase orders.

Step 1

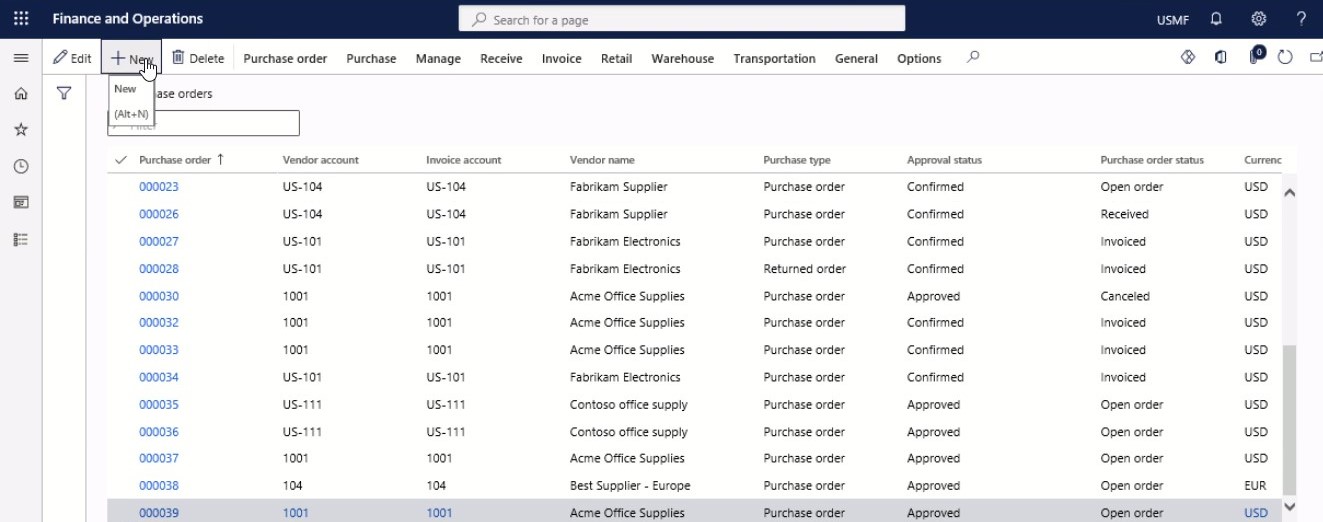

Click New.

Step 2

In the Vendor account field, enter or select a value.

Step 3

In the list, find and select the desired record.

Step 4

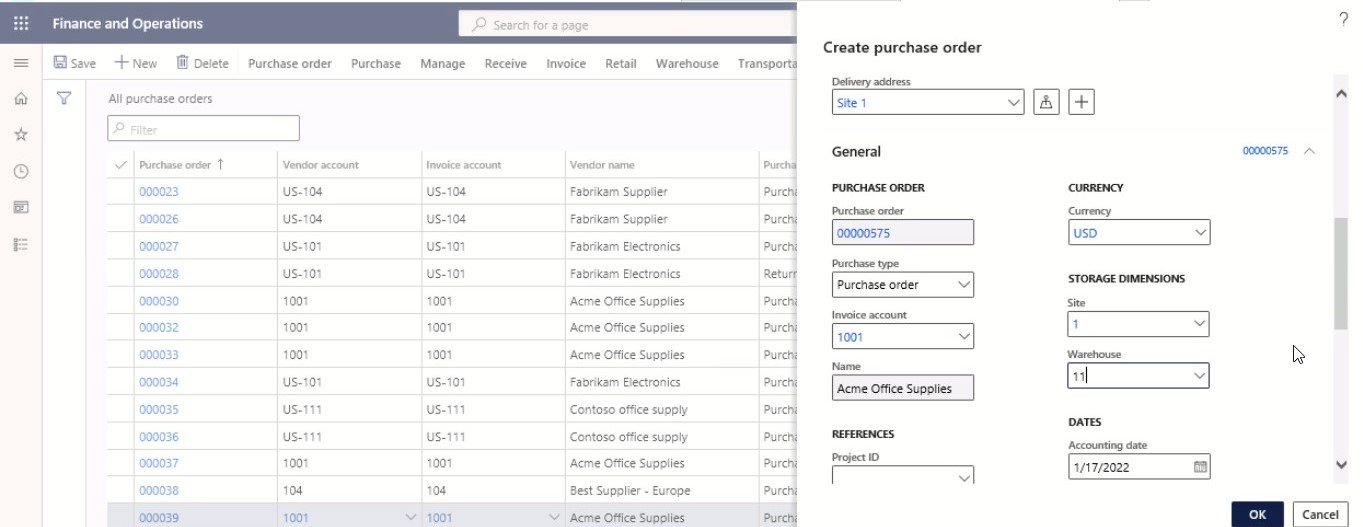

Expand the General section.

Step 5

In the Site field, enter or select a value.

Step 6

In the list, click the link in the selected row.

Step 7

In the Warehouse field, enter or select a value.

Step 8

In the list, click the link in the selected row.

Step 9

In the Accounting date field, enter a date.

Step 10

In the Delivery date field, enter a date.

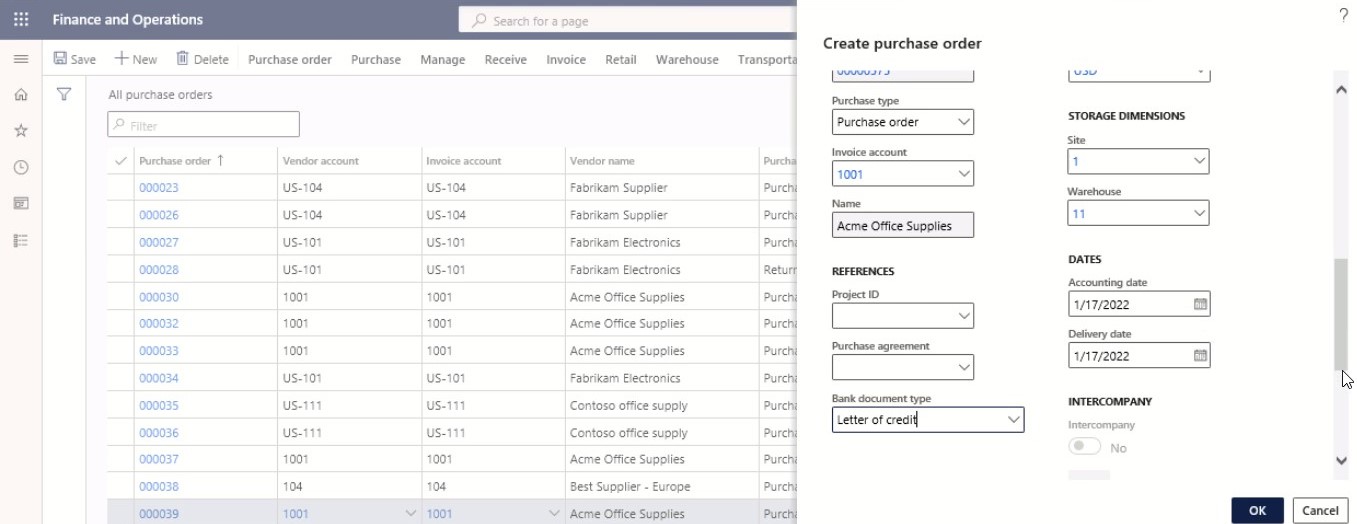

Step 11

The ‘Bank document type’ field should be selected with the letter of credit value.

Step 12

Click OK.

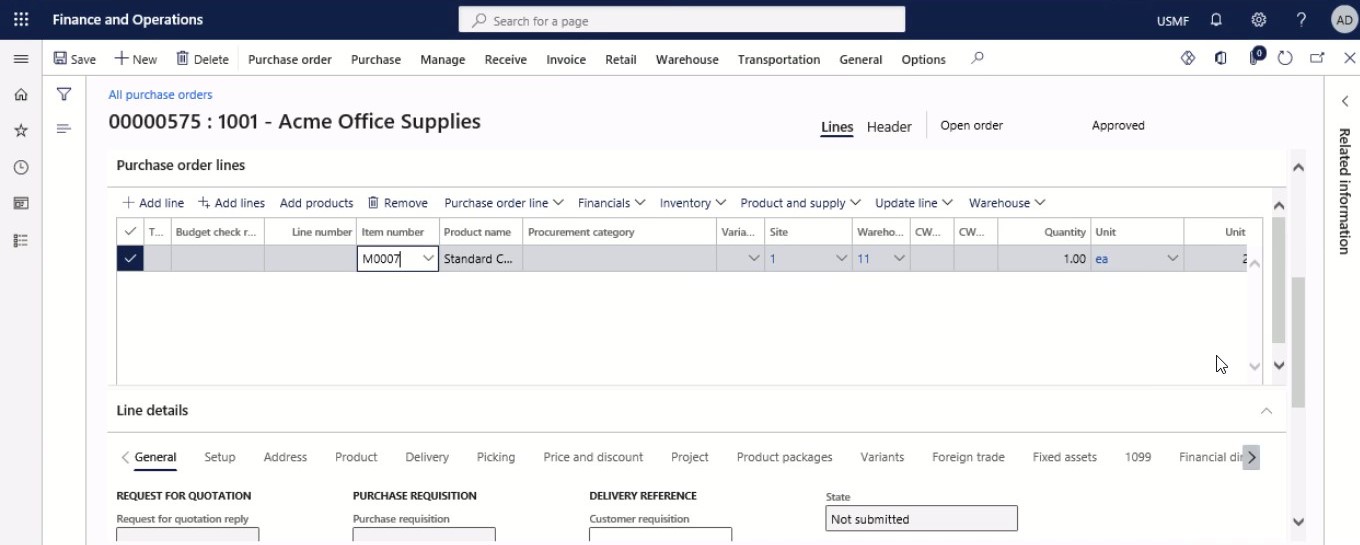

Step 13

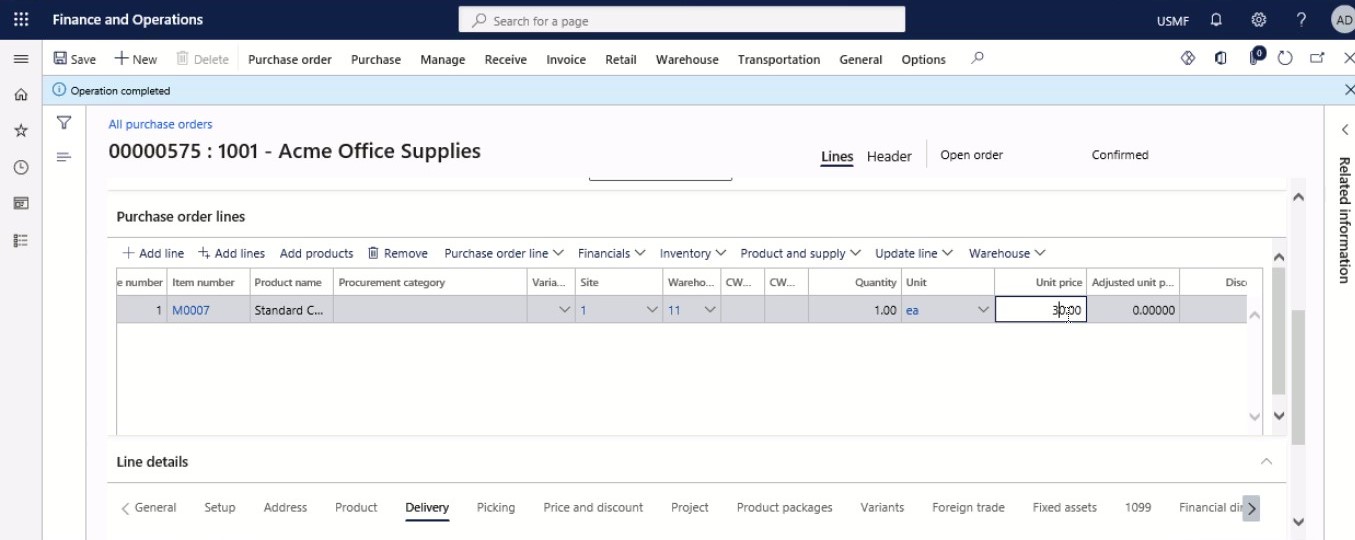

In the Item number field, enter or select a value.

Step 14

In the list, find and select the desired record.

Step 15

In the Unit price field, enter a number.

Step 16

Expand the Line details section.

Step 17

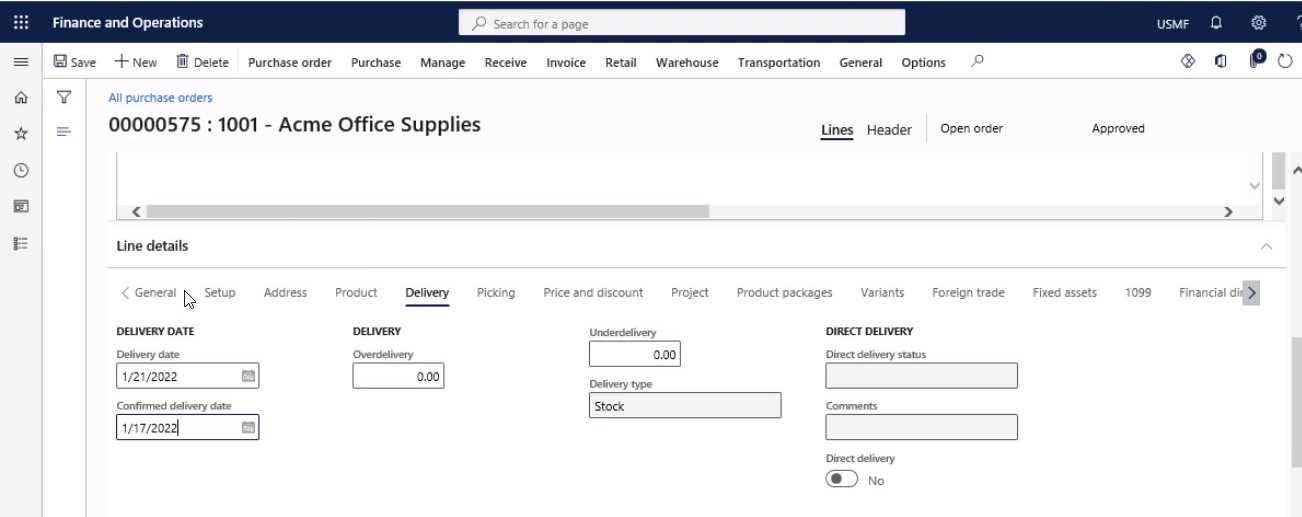

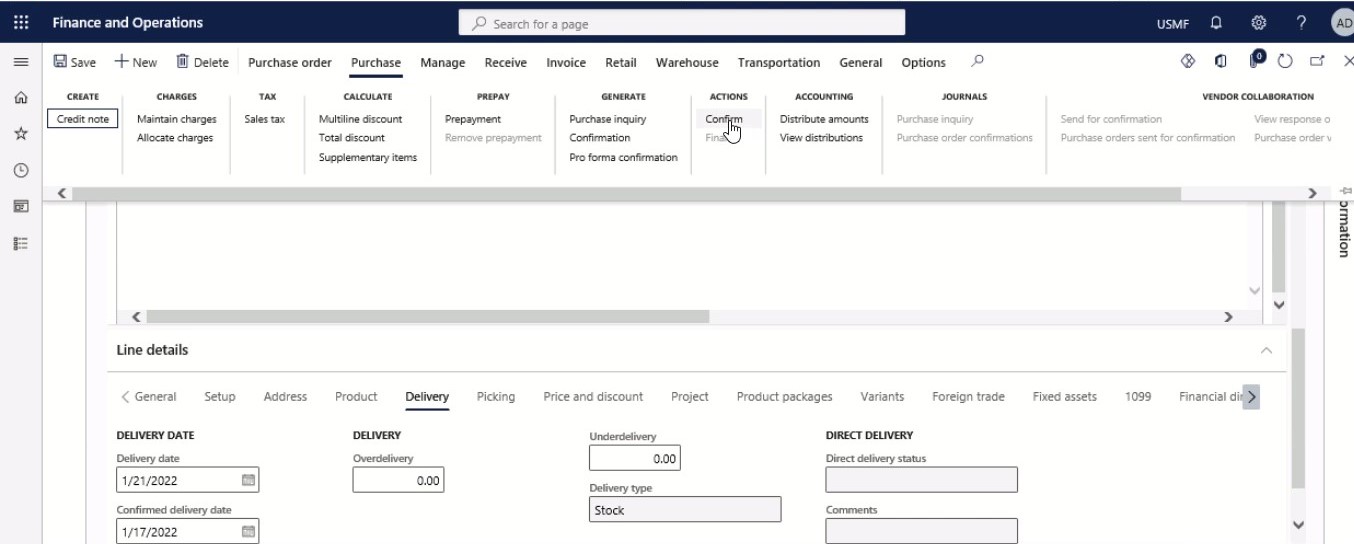

Click the Delivery tab.

Step 18

In the Delivery date field, enter a date.

Step 19

In the Confirmed delivery date field, enter a date.

Step 20

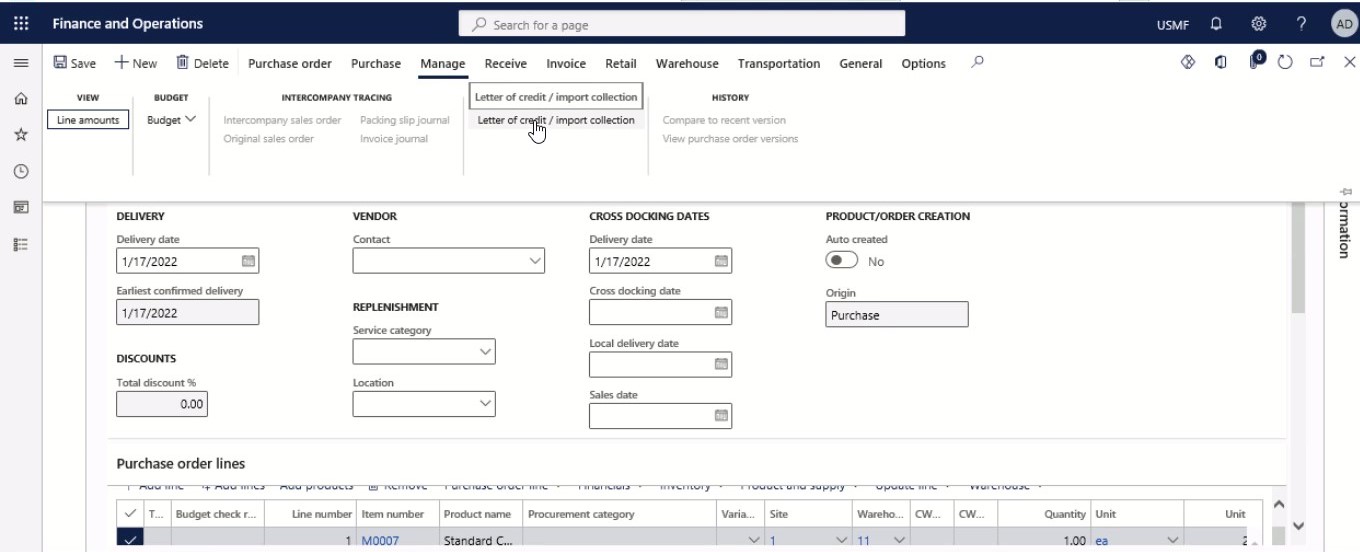

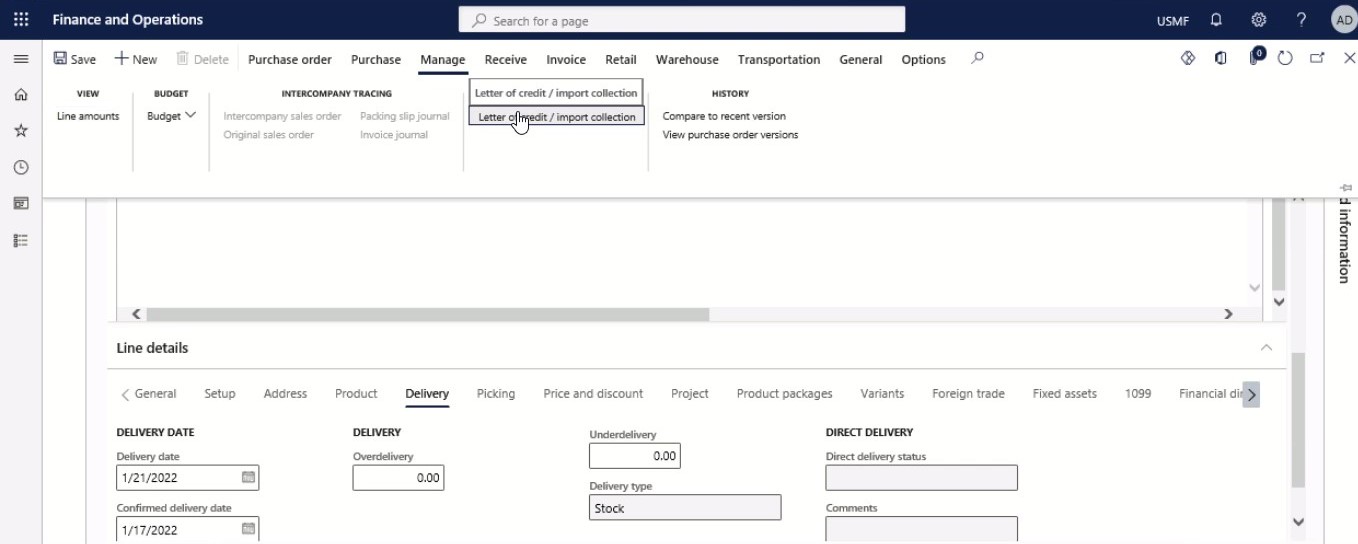

On the Action Pane, click Manage.

Step 21

Click the letter of credit/import collection.

Step 22

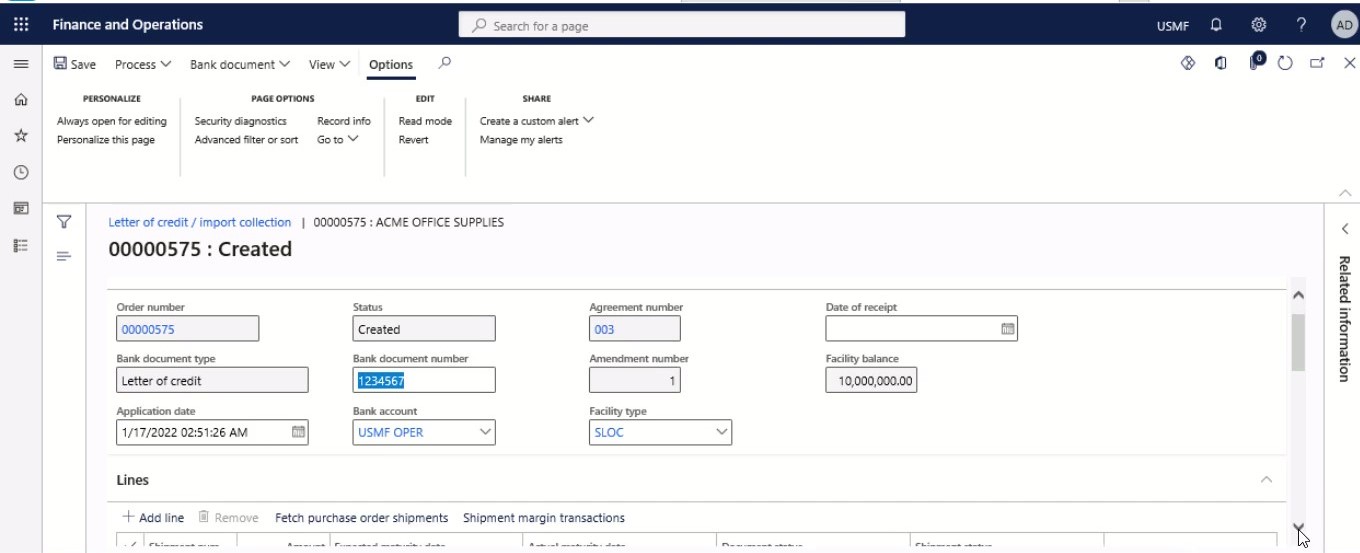

In the Application date field, enter a date and time.

Step 23

Verify that the ‘Bank account’ field has the default active Bank account based on the application date.

Step 24

In the Bank document number field, type a value.

Step 25

In the Date of receipt field, enter a date and time.

Step 26

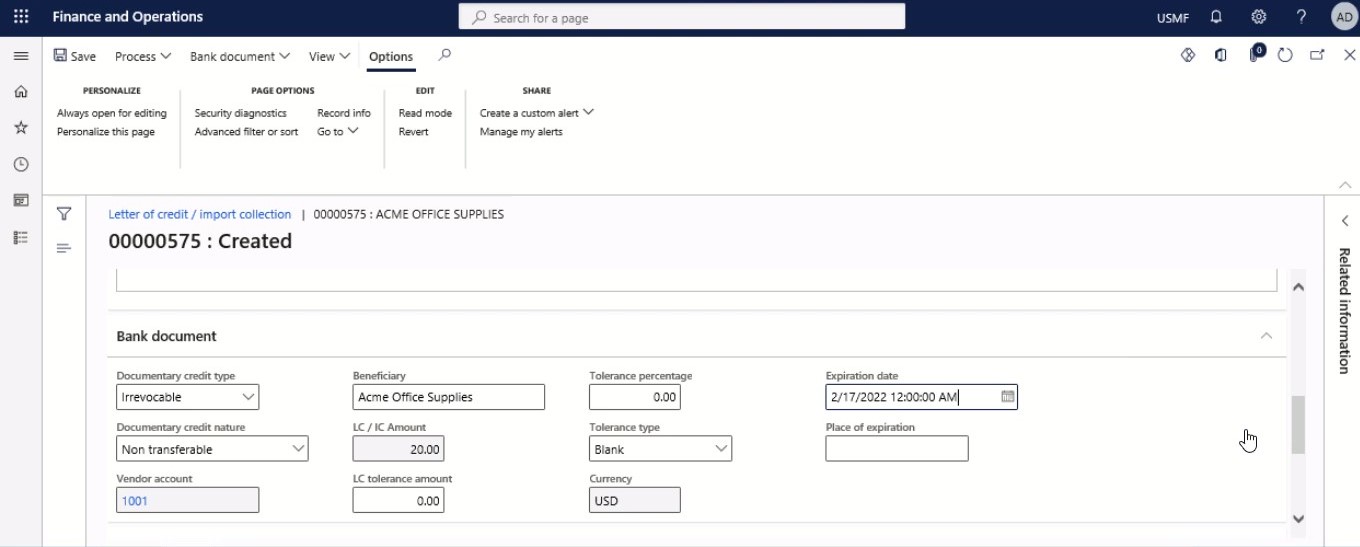

Expand the Bank document section.

Step 27

In the Expiration date field, enter a date and time.

Step 28

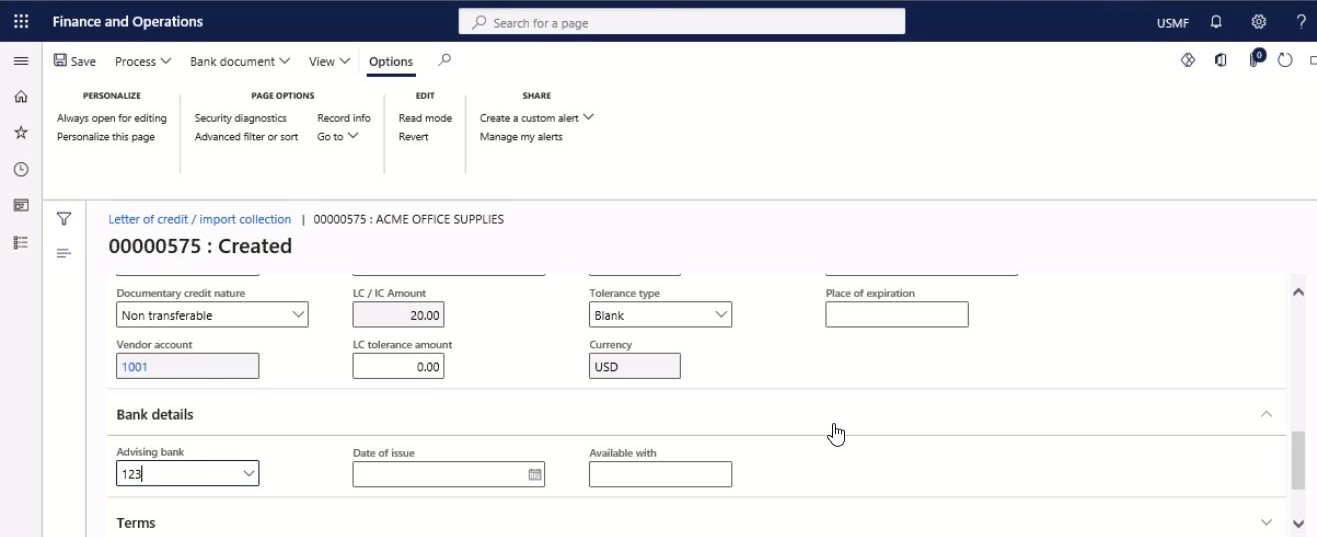

Expand the Bank details section.

Step 29

In the Advising bank field, enter or select a value.

Step 30

In the list, click the link in the selected row.

Step 31

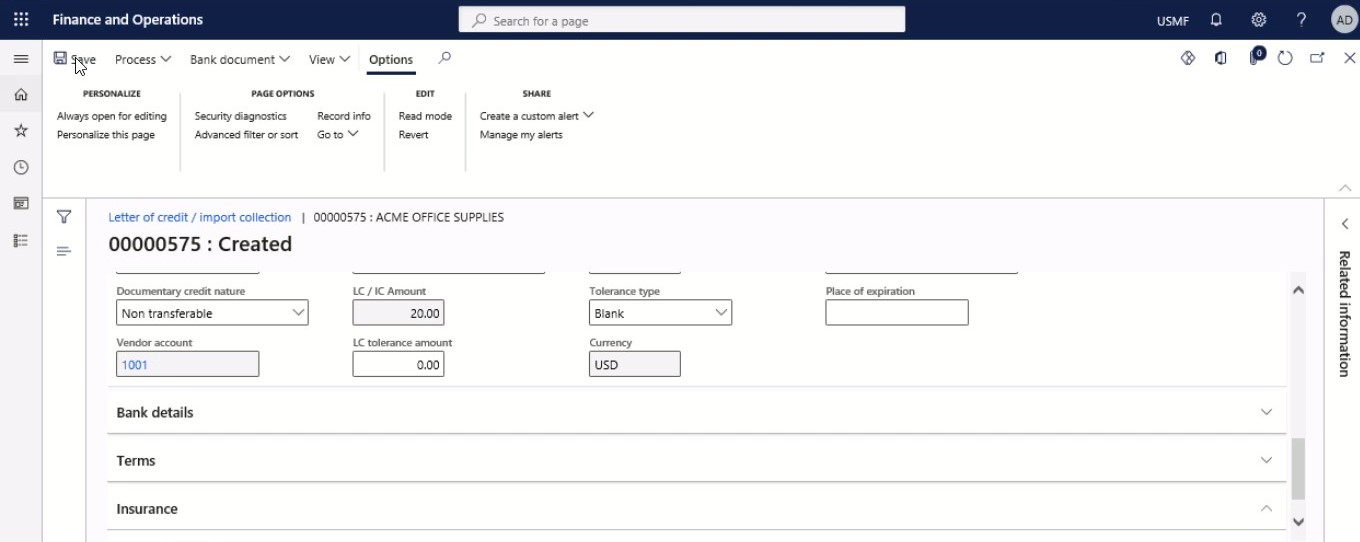

Click Save.

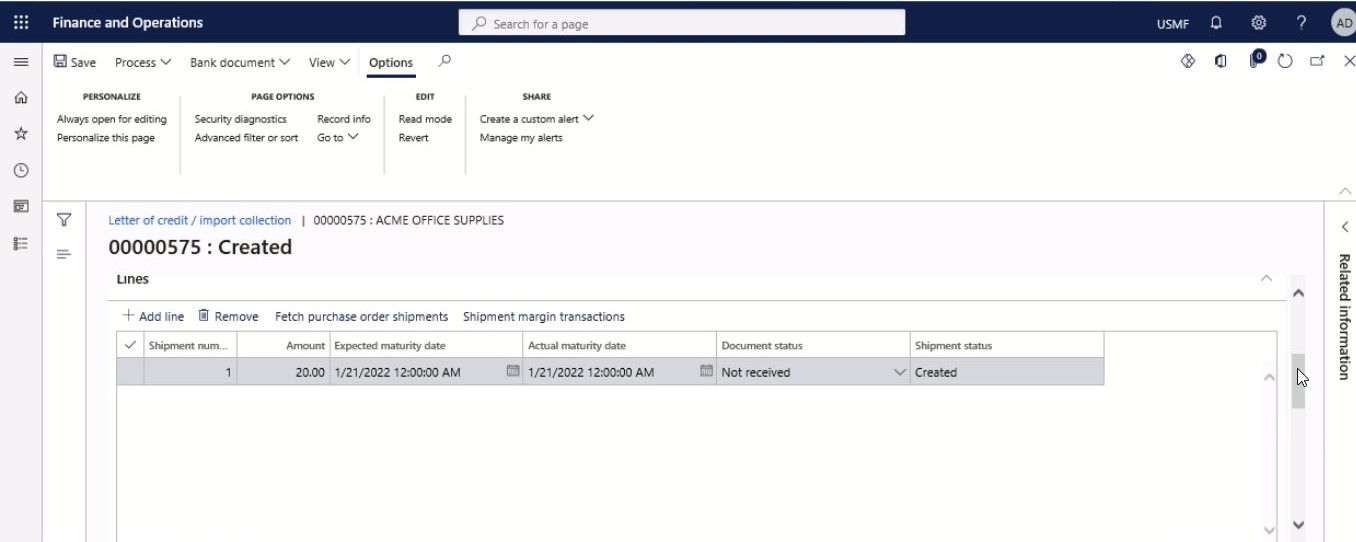

Step 32

Click Fetch purchase order shipments.

Step 33

Close the page.

Step 34

On the Action Pane, click Purchase.

Step 35

Click Confirm.

Step 36

On the Action Pane, click Manage.

Step 37

Click the letter of credit/import collection.

Step 38

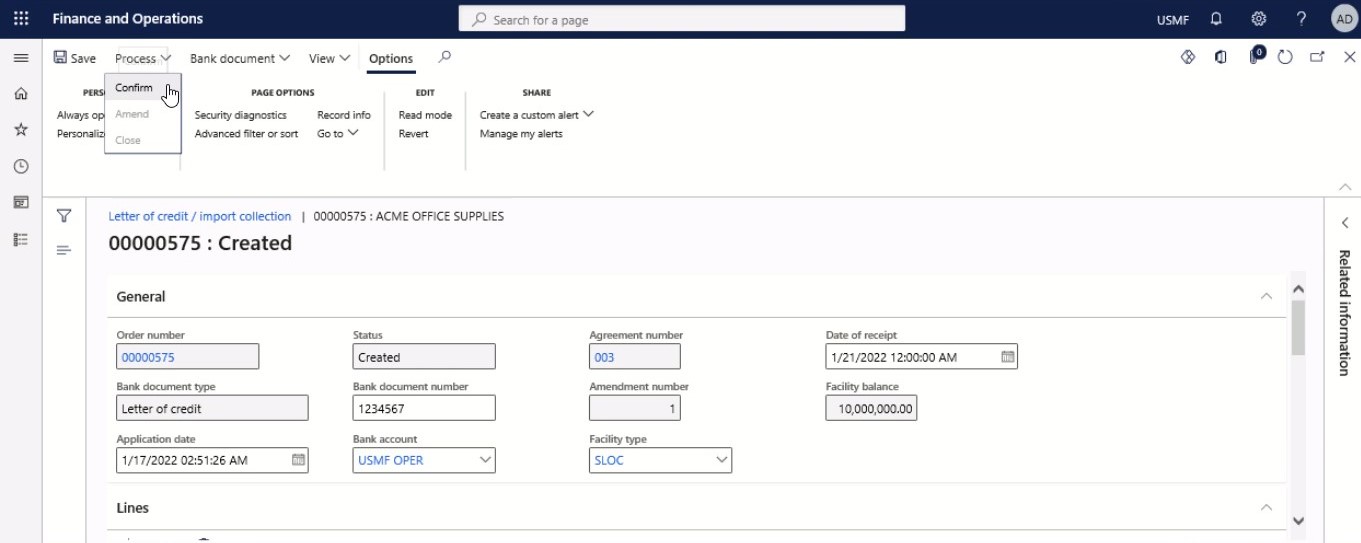

Click Process.

Step 39

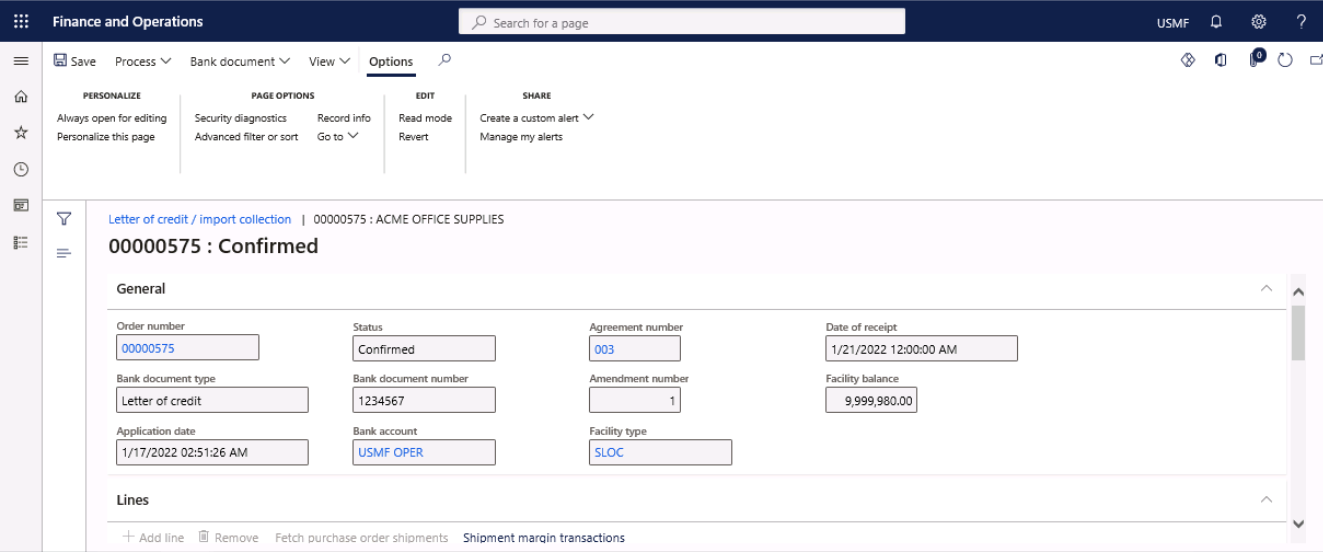

Click Confirm.

Step 40

Verify that the Facility balance reduces the purchase order amount. In this example, Purchase amount = 500.00, Facility limit = 10000.00, therefore, Facility balance = 9500.00.

Step 41

Close the page.

Step 42

In the Unit price field, enter a different number.

Step 43

Click Save

Step 44.

On the Action Pane, click Purchase.

Step 45

Click Confirm.

Step 46

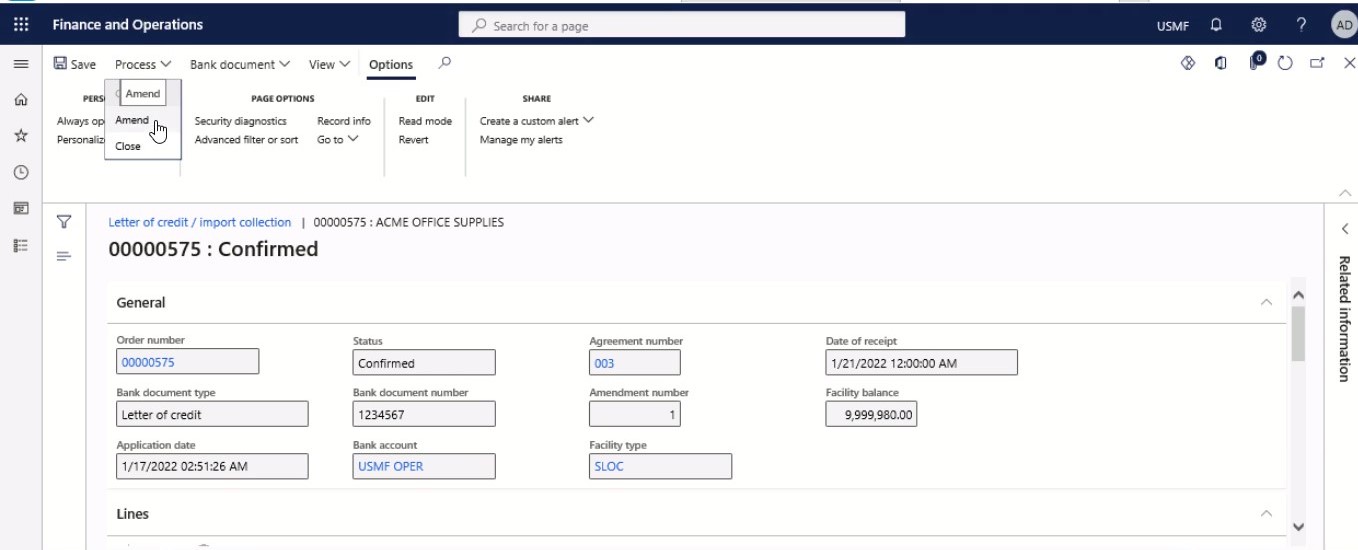

Amend the letter of credit due to the change in Unit price.

Step 47

On the Action Pane, click Manage.

Step 48

Click the letter of credit/import collection.

Step 49

Amend the letter of credit due to the change in Purchase unit price.

Step 50

Click Process.

Step 51

Click Amend.

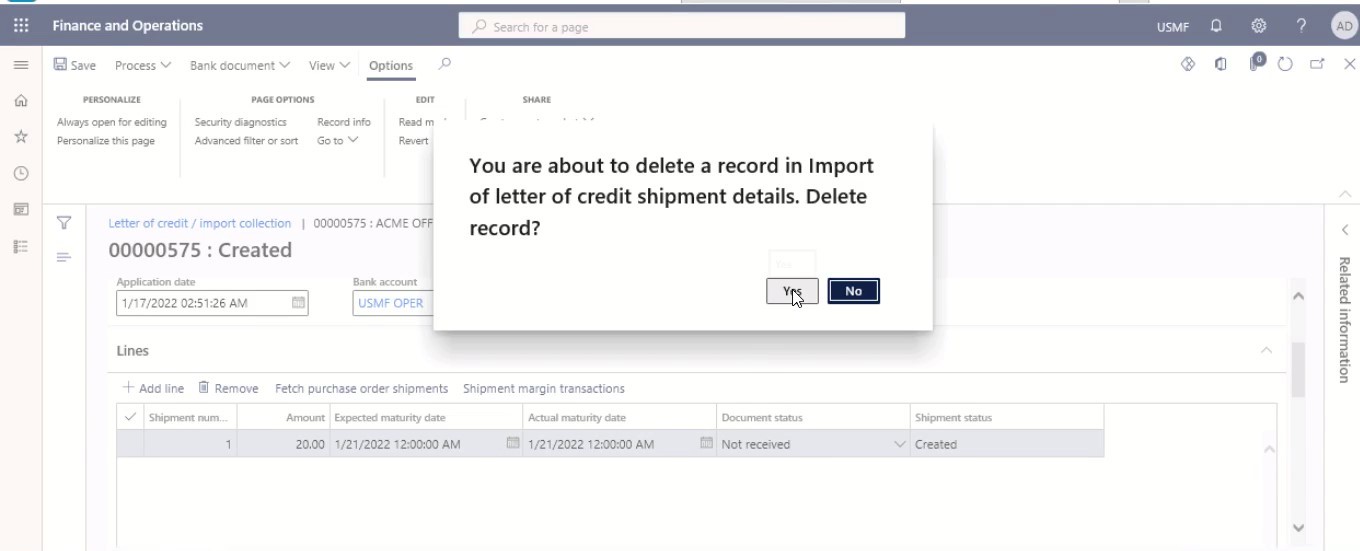

Step 52

Click Remove.

Step 53

Click Yes.

Step 54

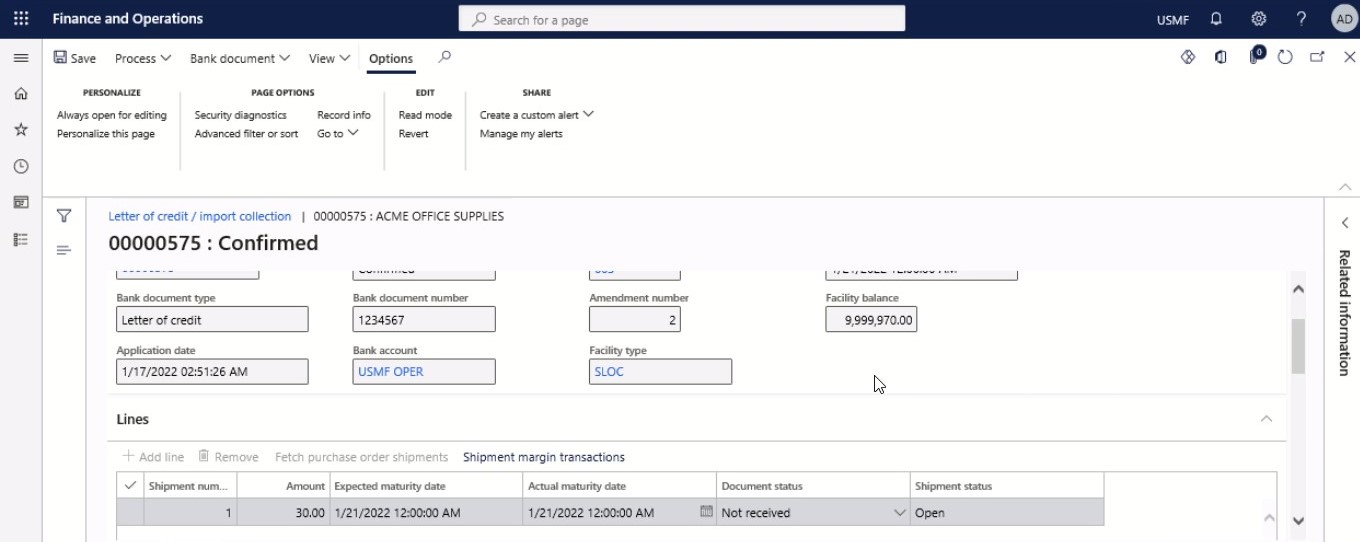

Click Fetch purchase order shipments

Step 55.

Click Process.

Step 56

Click Confirm.

Step 57

Verify that the Facility balance reduces the purchase order amount. In this example, edited Purchase amount = 600.00, Facility limit = 10000.00, therefore, Facility balance = 9400.00.

Step 58

Close the page.

SUMMARY

Following the above steps will help you import letters of credit in Dynamics 365.

What are the Associated Costs and Compliance Requirements in Letters of Credit?

A common misperception is that the buyer will bear all expenses related to an LC. On the contrary, the beneficiary’s bank charges the seller for general administration and advising services, LC modifications, and money transfer. These fees may be substantial, with expenses for a Confirmed ILC – which includes two banks – one in the buyer’s country and one in the seller’s country – ranging from 0.1 percent to 2% of the invoice value.

Nonetheless, ILCs do not provide 100% assurances of payment. Because all LCs are subject to stringent compliance requirements, banks are well-known for strictly enforcing the LC’s restrictions. They will undertake rigorous inspections to confirm that the seller has complied with all contract conditions including expiration, defined delivery dates and other contract milestones. If any of these are wrong or altered, modifying the requirements of an LC may be challenging and incur further costs.

Additionally, sellers must consider the expenses of hiring personnel or retaining outside counsel to verify that the conditions of an LC are entirely compatible with local legislation, as well as the paperwork necessary to assure payment is exact. Failure to do so may result in an irrecoverable loss, and legal issues involving LCs can be expensive too.

Do you want to learn more on how consignment replenishment order manages stock inventory in dynamics 365, check out our blogs.

A letter of credit is an excellent instrument for promoting secure international commerce. While LCs continue to be utilized globally, they are increasingly seen as unsuitable for a technology-driven global economy where a plethora of alternative solutions exists to assist businesses in optimizing their credit management requirements. Instruments like invoice discounting, bank guarantees, and credit risk insurance are included in this category.

|

Sr. |

KPIs for Imports | |

| KPI | Description | |

|

1. |

Order to Cash | Order to Cash (OTC) is the process of capturing and completing a customer’s order from beginning to finish. |

|

2. |

Purchase to Pay | P2P is the primary activity cycle that enables your goods to arrive. It involves the whole process of acquiring raw materials, components, ingredients, or completed products, transferring them to your storage facilities, and paying the vendors. |

|

3. |

Pick and Pack Costs | This metric is used to calculate the costs associated with selecting and packaging your orders. Testing multiple picking and packing processes and approaches on each line of work to discover which is more cost and time efficient for your organization is an excellent strategy to improve your pick and pack costs. |

|

4. |

Transportation Costs | The Average Transportation Costs determine the total costs associated with processing an order from start to finish. The objective is to reduce transportation costs while maintaining good delivery quality. |

SUMMARY

Confirmed Contracts (LCs) do not always guarantee payment. Sellers must include the costs of employing people and engaging outside counsel. Dealing with legal problems surrounding LCs can be costly and time-consuming thus a letter of credit (LC) is a fantastic tool for fostering safe international trade. Alternative credit management solutions help firms optimize their credit management needs.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on how to overcome compliance challenges and secure payments then, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”How are letters of credit payments made for imports? ” answer-0=”A Letter of Credit for Imports, also known as a documentary credit, is a financial instrument in which the issuing bank, acting on behalf of the importer, contractually agrees to pay the beneficiary or exporter the specified amount, subject to the fulfilment of the Letter of Credit’s specified conditions. ” image-0=”” headline-1=”h2″ question-1=”What does the term bill of exchange mean in comparison to letters of credit? ” answer-1=”Both letters of credit and bills of exchange assist international commerce by facilitating all transactions between buyers and sellers. The primary distinction between the two is that a letter of credit provides a vehicle for payment, while a bill of exchange is a payment instrument. ” image-1=”” headline-2=”h2″ question-2=”Is it true that all letters of credit are irrevocable? ” answer-2=”All credits are irreversible under the most recent letter of credit guidelines UCP 600. A letter of credit is a conditional payment obligation on the part of the issuing bank, and the recipient must always make an acceptable presentation in order to obtain payment. ” image-2=”” count=”3″ html=”true” css_class=””]

2815

2815