Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Ledger Account Dimensions Part 2: Advanced Rules Setup Guide

Create and Assign Advanced Rule Structures in Dynamics 365

Advanced Rule Structure | Financial Dimentions | Ledger Setup | Dynamics AX

This blog post will explain how to create and assign an advanced rules structure to an account structure. Regardless of the business’s size, bookkeeping has always been essential for an efficient company. Keeping a record of all your financial transactions, including income and expenditures, gives your management team a clear picture of the company’s financial condition and even aids in the decision-making process.

You may already have a team of certified accountants and numerous tools like D365 FO to keep up with all monetary records and track them efficiently. D365 Finance is popular for structuring complex rules for financial dimensions. In the end, we all want improved financial reporting to keep up with the fast-paced businesses.

In the first part, we went through account structures in detail and how you can create them using Dynamics 365 Finance. For this part, we will dive deep into advanced rules for financial dimensions, why you would need them, and how to set them up using Dynamics 365 FO.

Dimensions and Microsft Dynamics 365

Since its early releases of AX 2009, Microsoft has been a great aid in ensuring that we get accurate numbers while removing the added strain from employees. Back then, we were only limited to a maximum of ten dimensions in a fixed order. Here is a comparison table for the changes between AX 2009 and AX 2012.

|

AX 2009 Vs. AX 2012 |

|||

| Abilities | AX 2009 | AX 2012 | Significance |

| Number of Dimensions | Three Default and Seven User Dimensions | Unlimited Dimensions | Implement more complex tracking and reporting |

| Effortless Configuration | Create one Dimension at a time using the wizard. Then, require compilations and synchronizing for changes to take effect | Create Dimensions using a form, a similar process as the setup task | Easy to create and deploy dimensions |

| Renaming | A complex process of renaming dimensions and often requires IT assistance | AX 2012 offers a User-friendly UI to modify dimensions | No requirement for third party customizations |

| Link Dimension to Legal Entity | Manually define every entity instance as a financial dimension value to track an existing entity | Users can now link a financial dimension to an entity in the system and use the entity values as the Dimension themselves | Able to build a more complex database |

| Set Range for Dimension Value | AX 2009 offered no way to predefined date range for posting | Users can now enter the date range on each financial dimension value | Using Ax 2012, users can have added controls for sensitive data activities |

Keeping the increasing demand for more dimensions, Microsoft Dynamics AX expanded them to a maximum number of 50. Well, this was possible with the implementation of SQL databases. Therefore, now you could also dynamically create new dimensions and sort them in your desired order.

Here is our instructor-written blog on SQL for General Ledger Data, which might also help you with dimension value sorting and data flattening.

What are Financial Dimensions?

Financial dimensions are data classifiers we use to group financial information by departments, business units, and cost centers. The below tree shows the elements of financial dimensions.

You would see that we have different departments here, as one would have in any organization. So, by including these dimensions in your financial management, you can see which department is performing well, which business unit is making more profits, and which cost center is getting costly.

Using Dynamics 365 FO, you can set values to each Dimension or set of dimensions.

Here is how the set of dimensions works.

The above chart shows that a set of dimensions can have two dimensions, A and B. Then, these dimensions consist of their own value, two and three. Combining dimensions into the set is an excellent strategy for accurate reporting.

Further, you can also restrict financial dimension value to be posted in the record unless the specific value is selected. This also ensures that the transactions consist of proper dimensions and dimension values.

SUMMARY

Your financial data consist of multiple dimensions to illustrate more about the report. Like every other data, we can put rules on how that data defines our Account structure, which explains the order of dimensions.

Go back above, and you will see that main account dimensions appear within the business unit, department, and Cost Center. We can use all 3 of these terms to describe any transaction.

Advanced Rules

Microsoft Dynamics FO is all about having all the options you can get and the ability to do it the right way. Advanced rules in the chart of accounts are a great example of this. This tool is all about tracking your money, where it is coming from, and where it is going. While putting the data into your journal entity, you always need to select an account to withdraw or deposit your cash.

Moreover, the advanced rules in the account structures allow you to acquire more information than just which accounts you can use to move your money or which department is spending more. The below diagram illustrates the concept of accounting structure for advanced rules.

Using Advanced rules, you can build a complex or straightforward tress of validation combinations. For example, sometimes, instead of just constraining the valid value displaying the dimensions, you may have to show a dimension as a segment in your ledger account combinations, depending on the requirements of your business. Luckily, advanced rules are up for all such types of conditions.

You can add multiple rules to your account structures and constraints. However, these advanced rules are very versatile, so to undertake the best performance and usability, you need to follow some rules and guidelines while setting up advanced rules for your account structures that are as follows:

- You can have rules without any account structure

- Your account structure must have at least one main account segment

- Advanced rules can not add dimensions to segments that are already on your account structure

- Regardless of the primary account, you cannot use rules to replace constraints in your account structure for added dimensions

- You can not use rules to duplicate segments existing in the account structure

- Rules should not be used to replicate segments in the account structure or replicate other rules

- Any replication will automatically use the most restrictive constraint

- You will only see replicated segments in the first occurrence of the segment

- You must link the rule structure specifying the additional segments, hierarchy order, and constraint definition

While defining an advanced rule, make sure to specify a filter. That filter will control the additional segments added to the General ledger. Your rule structure may resemble your system as well.

You can create an advanced rule to provide added dimensions already part of your account combination. However, they must not be a part of your account structure.

When to use Advanced Rules

There are several ways advanced rules can be a convenient tool. For example:

Manage Exceptions

Advanced rules can help you manage exceptional conditions. For example, suppose a particular legal entity of your organization needs to behave a little differently than the other ones. In that case, you can use an advanced rule for the subset of that entity and have sorted reporting or maybe remove it.

Add Dimension to Subset Account

You can use an advanced rule to put in an additional dimension to the main account or even the subset of the main account.

For example, you have a few production accounts and want to track an additional production purpose for those accounts.

Add Combination Based Dimension

Advanced rules are also helpful when you need an additional dimension, specifically when a particular combination is in effect.

Let’s use a similar example as above and imagine you have several expense accounts and a department dimension called production. However, you want to track an additional production purpose for your other main accounts this time. However, with combination-based dimension, you can trail only when the production department is selected.

When Dimension Value is Limited to Small Combination Set

Say one of your dimension values only applies to a small set of combinations. Then, instead of putting that combination in your account structure, you can put that combination in your advanced rule.

By doing this, you would save yourself from adding a lot of rows to the account structure, and you can manage those exceptions in the advanced rule. Further, allowing you to use ranges in the account structure.

SUMMARY

In a nutshell, advanced rules signify how you want to track your financial dimensions.

An advanced rule structure can consist of one or more financial dimensions. These dimensions contain information you want to track about your organization. However, they must not be a part of the accounting process.

Instead, each advanced rule is linked with a specific account structure and can consist of one or more advanced rule structures.

Configuring Advanced Rules

Advanced rules

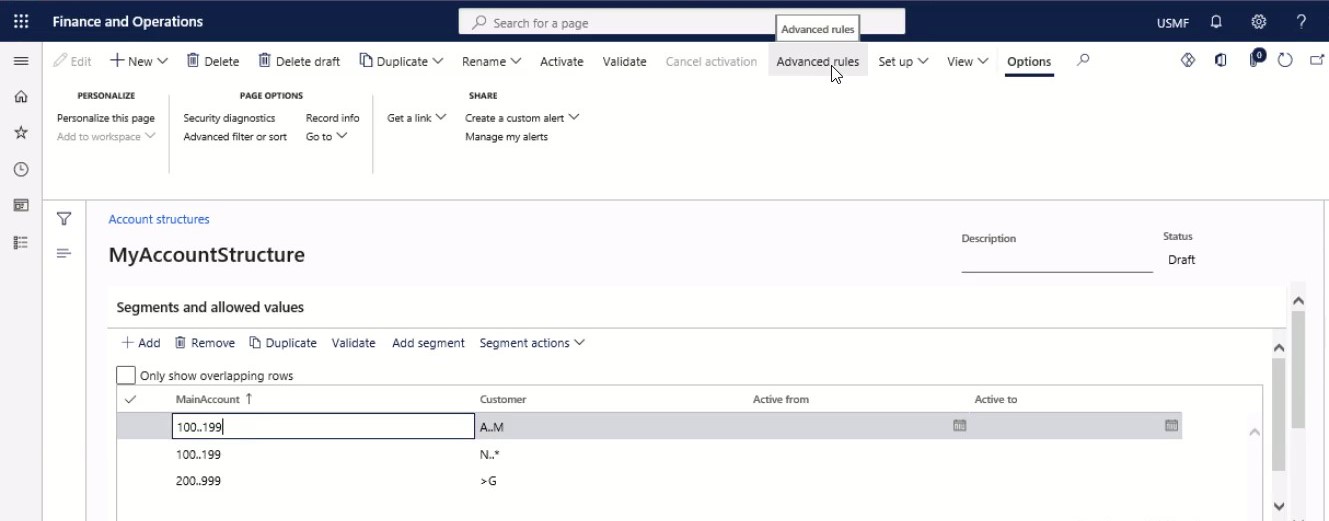

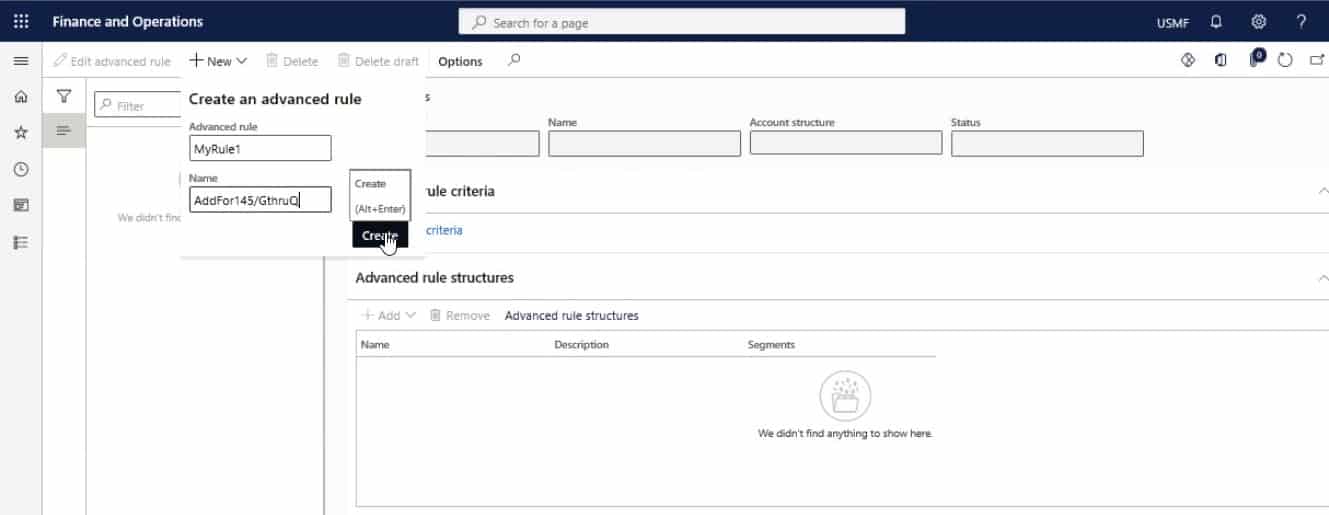

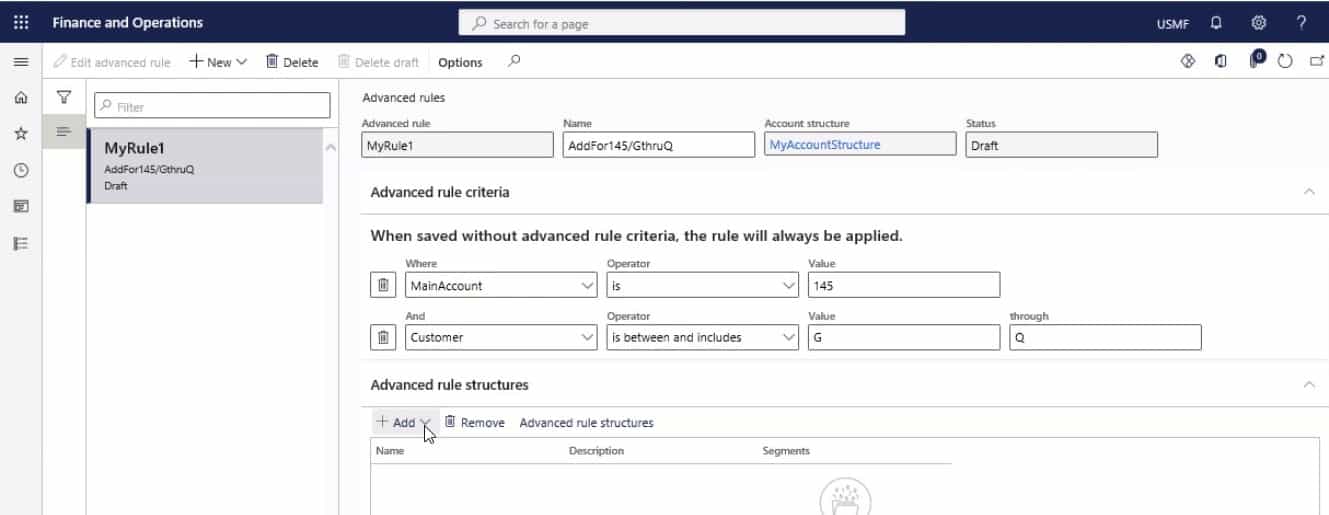

Step 1

In the action pane, select Advanced rules. Make sure the status of the account structure is ‘Draft’.

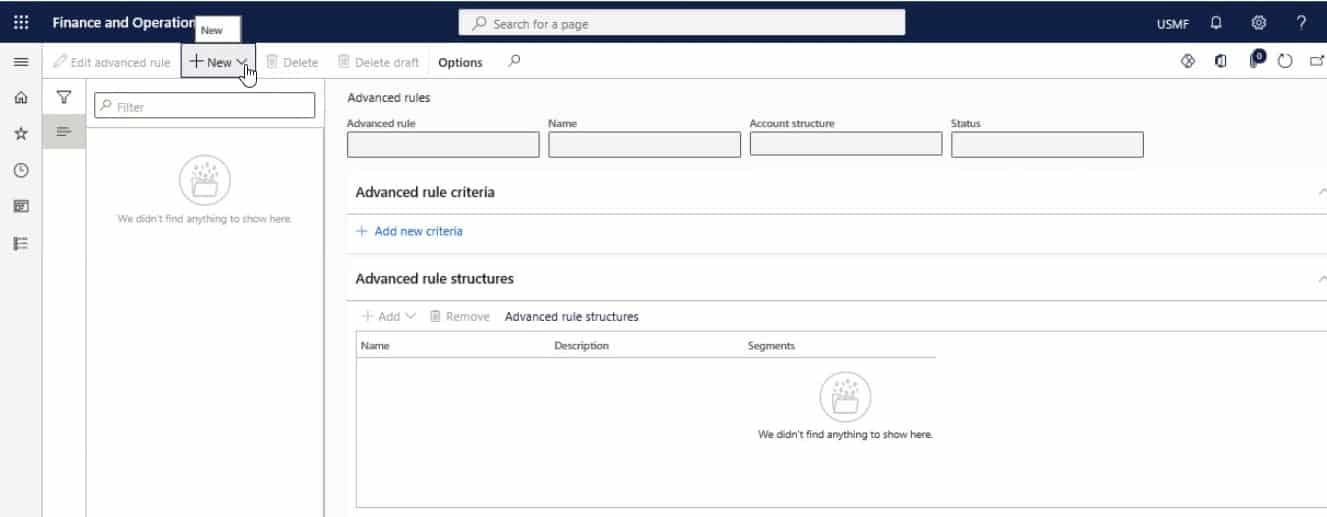

Step 2

Select New.

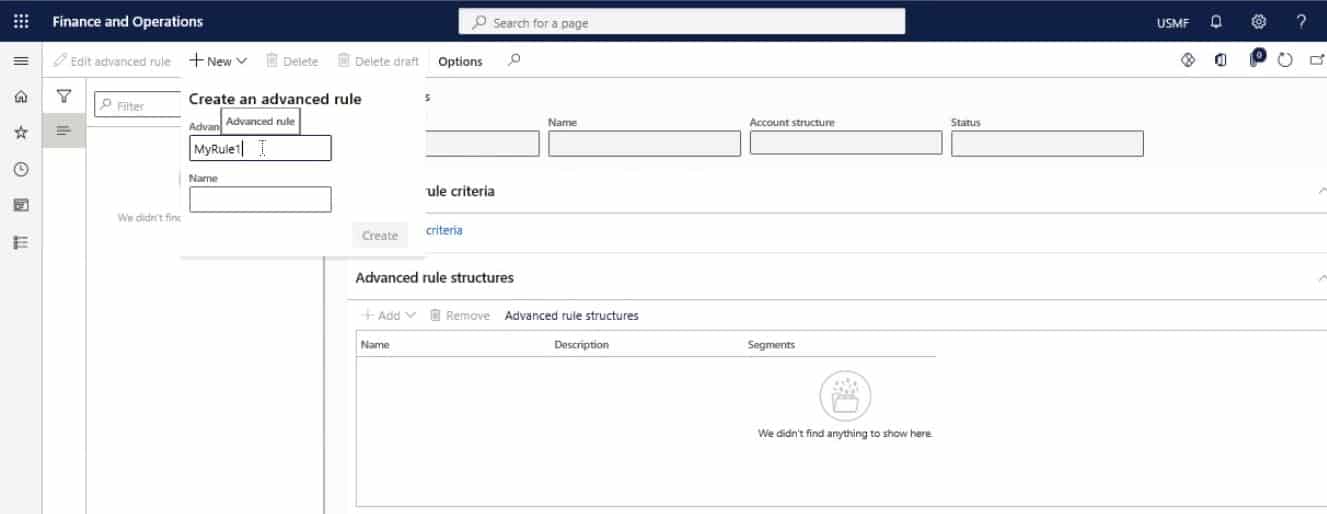

Step 3

Enter Advanced rule.

Step 4

Enter a name for the advanced rule.

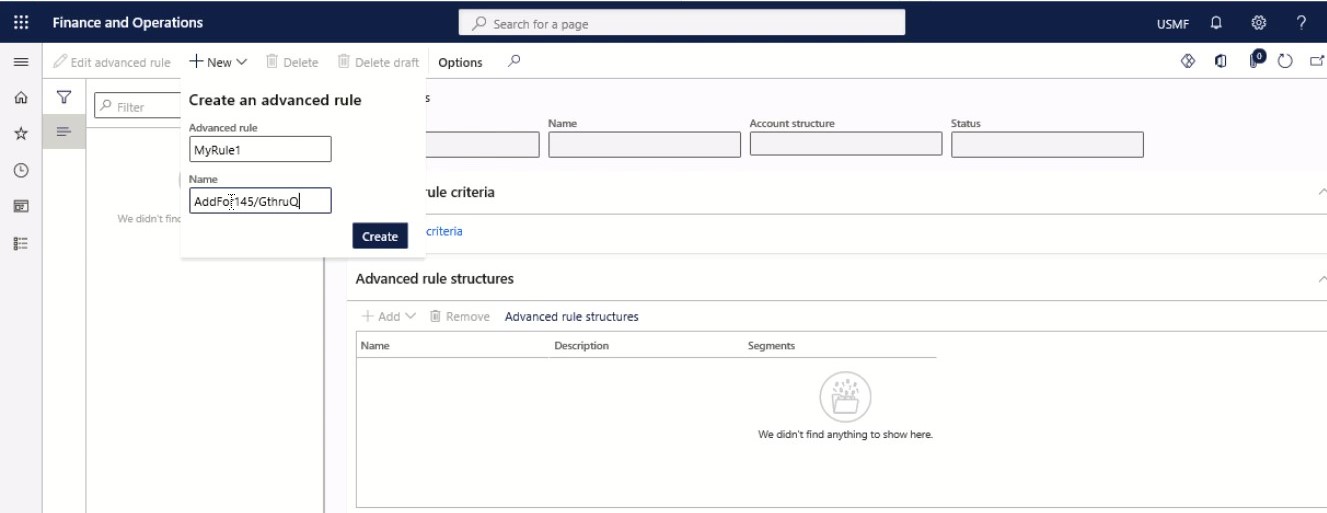

Step 5

Click Create.

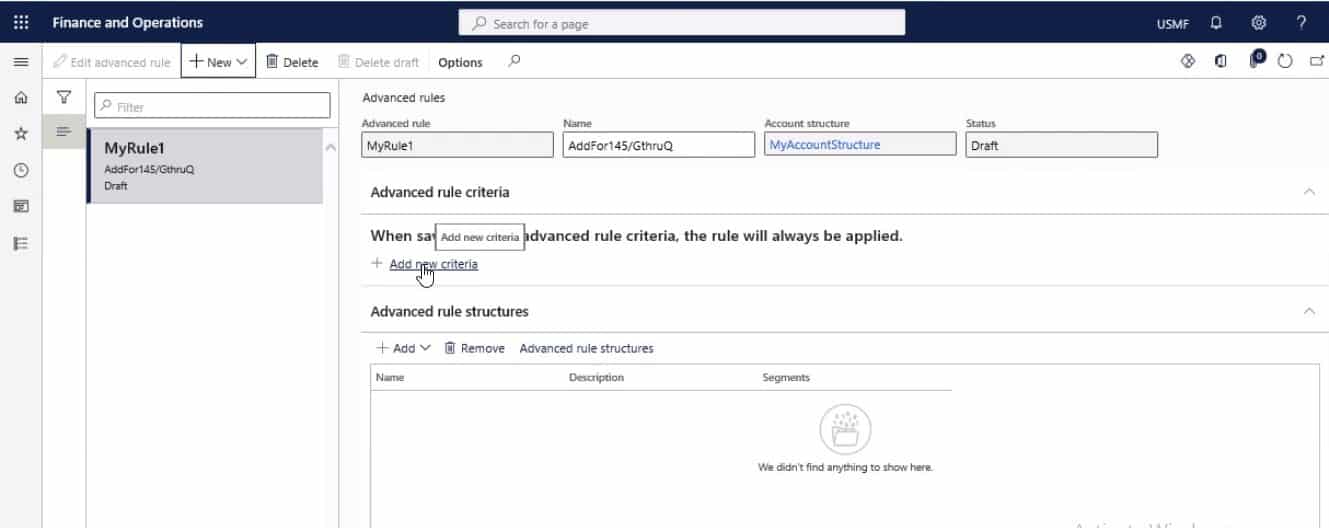

Step 6

On Advanced rule criteria FastTab, select Add new criteria.

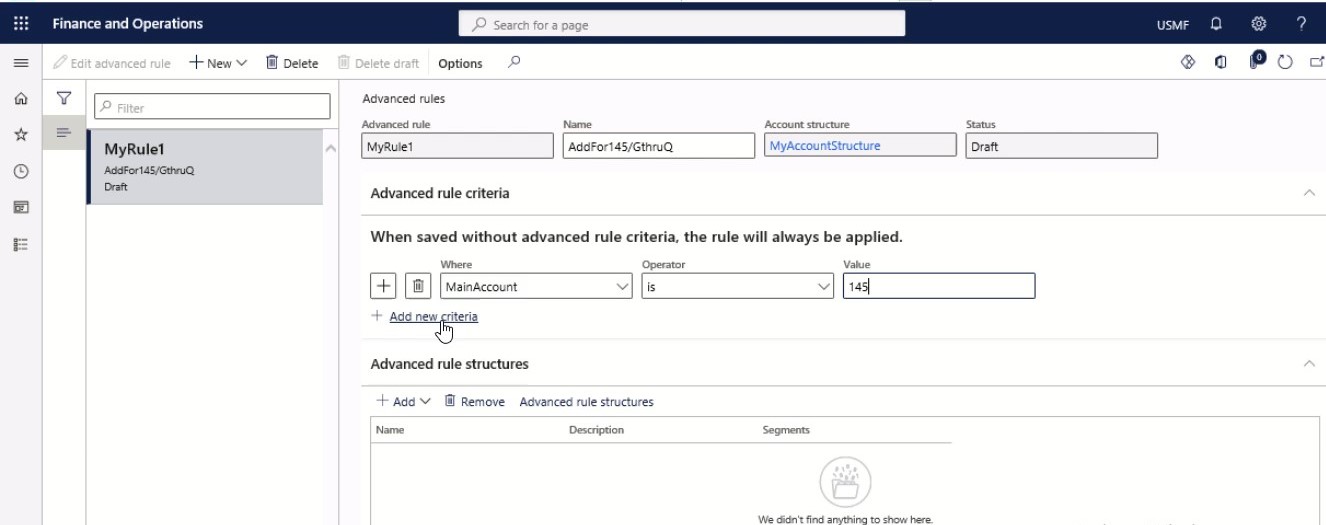

Step 7

Enter criteria information for Main Account.

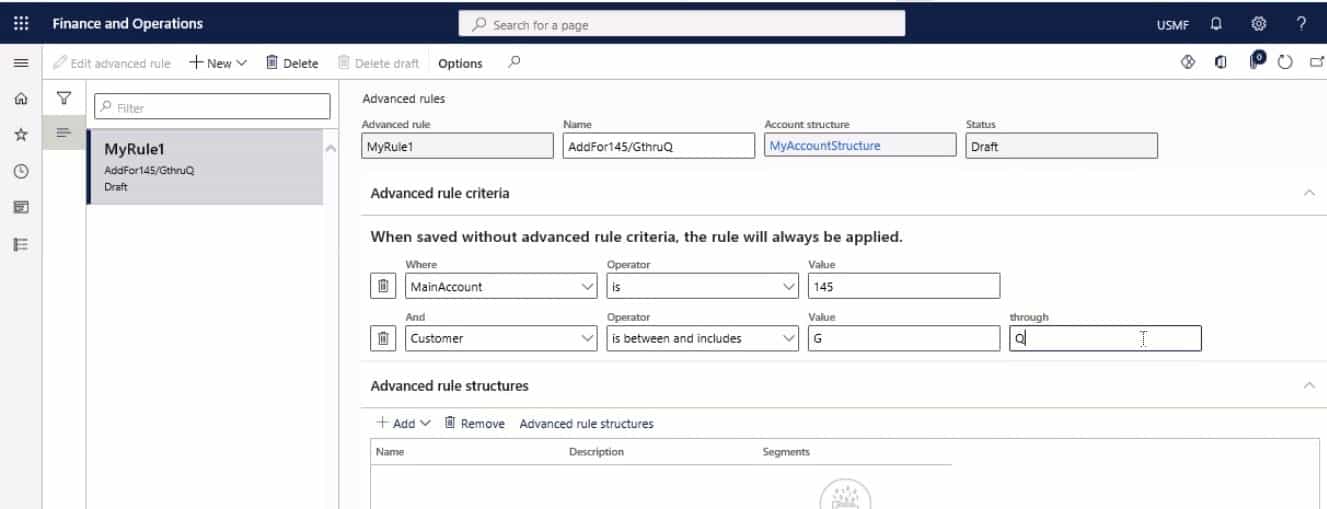

Step 8

Enter criteria information for Customer.

Step 9

On Advanced rule structures FastTab, select Add.

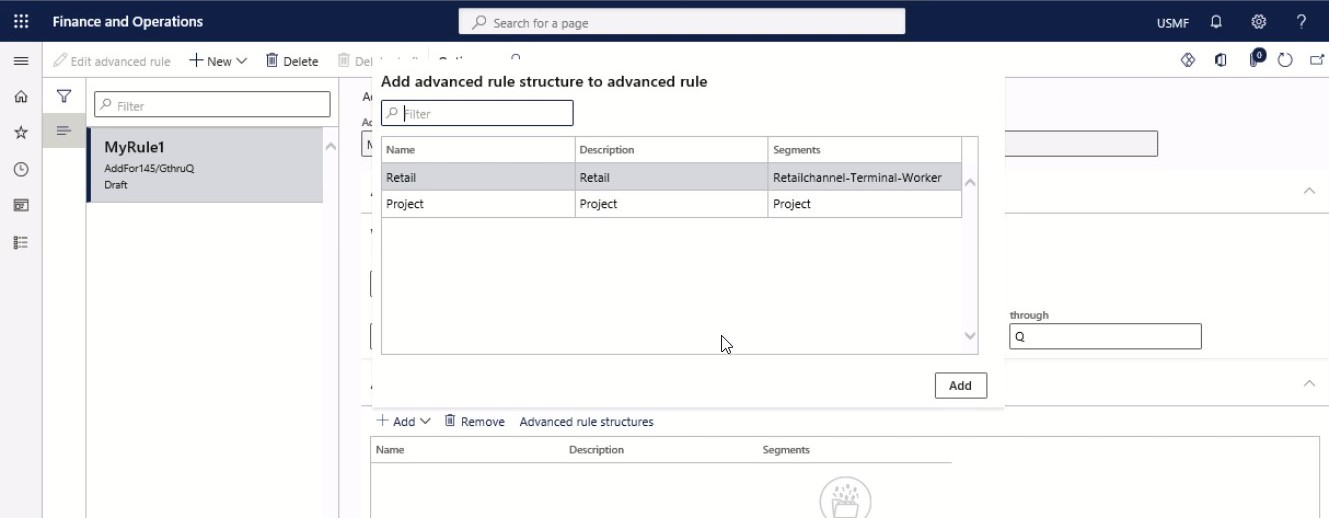

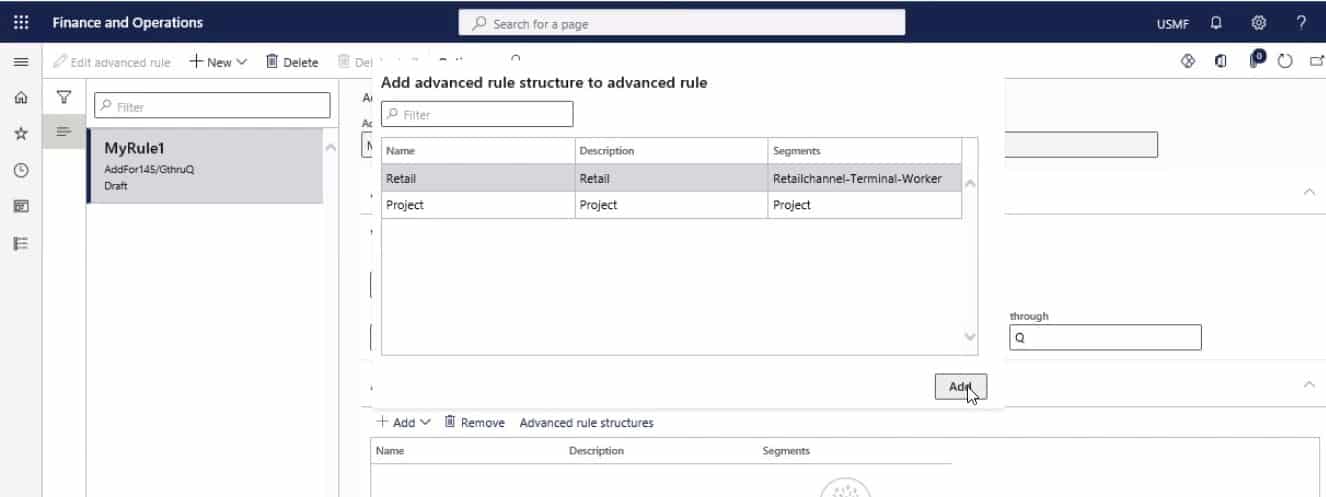

Step 10

Select Advanced rule structure to the advanced rule.

Step 11

Click Add.

Step 12

Close the page.

SUMMARY

Before setting up advanced rules, make sure that the status of your structure is set to ‘Draft.’ After that, follow the above steps and put in your values for name, criteria, and main account information to create an advanced rule.

Our outlook on Advanced Rules

Considering the advancement between AX 2012 and D365 FO. Microsoft has bought us the eternal nature of finance models, the progress with upgraded database designs, and all optimization and performance enhancement opportunities. However, with such additions, we are now using a data storage model that is more complex than ever.

Queries relating to ledger setup, dimension storage without rules, and advanced topics visit our mailbox now and then. So, here are our thoughts on Advanced rules:

- At Dynatuners, we recommend keeping the Account structure as simple as possible if you are looking for easier comprehension and management.

- We suggest arranging account structures to use only business units and departments for balance sheet accounts. Then, with the proper arrangement, you can use the business unit, department, cost center, and employee for your account records.

- Even if your account structure has a few parts, only the three basic ones, Business Unit, Department, and Cost Center, you can still employ the advanced rule to track additional account details. You can, for example, record your expenses with added information available in an Advanced rule for a specific brand or a list of all brands.

- In the account structure, it’s best not to use the dimensions like Vendor, Customer, and Item. Instead, you can track such master details using Supply Chian Modules. Therefore, the Dynamics 365 Finance and Operations departments can use reports from the Accounts Payable and Receivable modules, such as vendor and customer item statistics and item vendor and customer statistics reports.

You can set up custom and complex rules for your structure with advanced rules. Even if your structure requires more financial dimensions for specific General Ledger accounts, you can do it using advanced rules. Deploying appropriate rules will serve all the needs of your business, covering several modules in the operations.

These forms will improve the productivity and performance of your business within Dynamics 365 with the accurate execution of advanced rules.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our technical solution experts on how we may help you structure advanced rules to track and maintain your financial records, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What are the four sections in a general ledger? ” answer-0=”General ledgers cover four parts: the chart of accounts, financial transactions, account balances, and accounting periods. Usually, accountants refer to the reports from the chart of accounts as general ledger accounts. ” image-0=”” headline-1=”h2″ question-1=”How are the accounts in the general ledger arranged? ” answer-1=”A general ledger account is a record to sort, store and summarize a company’s transactions. The system organizes these accounts in the general ledger (and in the chart of accounts) with the balance sheet accounts appearing first, followed by the income statement accounts ” image-1=”” headline-2=”h2″ question-2=”What is Allocation Journal in D365? ” answer-2=”You can use Ledger allocation rules to automatically calculate and generate allocation journals and account entries to allocate ledger balances or fixed amounts. Allocation methods can be variable or fixed ” image-2=”” count=”3″ html=”true” css_class=””]

8074

8074