Dynamics 365 Tutorials, Supply Chain and Logistics Management

D365 Landed Cost: Key Ways to Streamline Shipping Operations & ROI

Micrsoft Dynamics 365 Landed Cost Module

Moving Weighted Average | Clearing Account | Inventory Adjusters | Journal Name | Accounts Payable | Estimated Cost

This blog post describes how to reduce the administration of costing and freight errors with costing parameter values setup in d365 landed cost module.

“Identify apparent and hidden costs across your supply chain to streamline shipping operations with increased financial and logistical visibility.”

Microsoft Dynamics 365 landed cost module helps businesses streamline inbound shipping operations by giving users complete financial and logistical control over imported freight, from the manufacturer to the warehouse. Business owners build up their inventories as part of a planned replenishment cycle to satisfy specific monthly predicted product needs and minimize needless back-ordering or customer churn during critical sales. They also could expand their supplies in advance of expected high foot traffic and sales occasions such as a new location grand opening or holiday. Having some surplus stock isn’t terrible for the company as long as you can sell it. However, you might lose money when inventory piles up for unforeseen causes.

Inventory control aims to preserve the value of the inventories at the lowest possible level while ensuring that the essential stocks are accessible at all times. These are two contradicting scenarios. If stocks grow, the worth of the inventory carrying will rise, resulting in stock-outs jeopardizing the production flow. Thus, a balance should be found between inventory buildup and inventory reduction. Both are mutually exclusive circumstances. The benefits of one will be the downsides of the other.

Disadvantages of Inventory Accumulation

- Locking up of working capital

- More storage space

- High insurance charges

- High taxes

- Greater handling and distributing of the cost

- High cost of recording and up keeping

- Deterioration in quality

- Chances of pilferage

- Evaporation of alcoholic materials

SUMMARY

The objective of inventory management is to maintain the lowest feasible inventory value while ensuring that vital products are always available. If stockpiles increase, the value of the inventory carrying will increase, leading to stock-outs that threaten production flow.

Cost Management Overview

In this scenario, each dollar spent is evaluated, and a cost-benefit analysis is developed. Similarly, cost estimation must be precise for all organizations. Logistics Management is a crucial aspect of the supply chain; thus, it is essential to determine the exact cost of inventory. Inventory Costing is an age-old concept that varies primarily depending on the varying Inventory Valuation Methodologies used by various sectors. Standard cost provides the advantages of deviation, variance accounting, simple costing and profitability assessment. However, determining the Standard Cost is very subjective, leading to a distortion of the actual financial picture and challenging its implementation in the current dynamic market.

Landed Cost Management

Similarly, Actual Costing (FIFO/LIFO) and Average Costing are generally recognized in various businesses. Average Costing differs significantly from the prices prevailing for identical items at a particular date; hence, Average Costing may not be appropriate for determining the current Inventory Valuation. Actual Costing (FIFO/LIFO) has the disadvantage of being difficult to maintain cost layers and producing inaccurate cost of goods sold depending on the elasticity of product pricing. In addition, a single costing system may not suit all of an organization’s reporting needs. Many businesses use various costing techniques that may be switched between or maintained in parallel to accommodate varying information reporting needs. With the digitization of the vendor-customer relationship, both sides of the company have a global reach, leading to an exponential increase in international commerce over the last several years. Landed cost management is an emerging idea in Cost Management that assists in obtaining an exact Inventory Cost, demonstrating the sound effect of these cost variables on the top line, and providing an accurate view of the bottom line.

What Is Landed Cost? How to Calculate and Manage It

Total delivered cost, total landed cost, and total delivered cost all relate to the same concept. When you hear any of these terms, they refer to the “total of all expenses connected with producing and distributing items to the point where they generate income.” Your landing costs are determined by several variables, including the industry in which you do business, unit costs, shipping expenses, taxes and tariffs, and inventory management costs. Other factors include corporate income tax, currency exchange rates (sometimes, the USD may make or break a business), brokerage costs, and the cost of your carbon impact.

Take your Data Visualization to the next level, use our portfolio dashboards.

Why Is Landed Cost Important?

The primary objective of determining your total landed cost is to identify apparent and hidden expenses across your supply chain. Finding a product’s actual cost may help you make more informed decisions about how to provide items to the end customer in the most cost-effective manner. For instance, if you purchase a product made in many nations based only on the lowest net purchase price, you may pay more than necessary. Transportation expenses, taxes, tariffs, customs duties, and several other things that may be termed hidden costs must be addressed. Having a firm understanding of how much the cost of your item can facilitate decision-making. You may make judgments based on insufficient information without knowledge of the overall landing cost.

You are aware of your overall landing cost to evaluate your financial success. In addition, you’ll be able to see the exact product costs and identify strategies to reduce them. This provides insight into the costs and costs trade-offs of implementing supply chain modifications.

SUMMARY

Logistics Management is an integral part of the supply chain; thus, it is necessary to identify the precise cost of inventory. Inventory Costing is a time-honored notion that differs largely based on the diverse Inventory Valuation Methodologies used by distinct industries. Landed cost management is an up-and-coming concept in Cost Management that facilitates the determination of accurate Inventory Costs. The true cost of a product may help you make better educated judgments about how to provide products to the end consumer.

Why Are Landing Costs Difficult to Estimate?

According to the research, most shippers do not compute TLC because they lack the necessary data, resources, or time. In addition, it may be challenging to conclude since so many variables are involved in the equation, many of which are difficult to acquire. Because many of these components aren’t easily accessible and need time and effort to get, many individuals choose to omit this quantity completely.

Before trying to perform the computation, it is essential to identify all relevant variables. This procedure may be time-intensive. Before a choice must be taken, many businesses do not have the time to compute within the given time restrictions. In addition, the landed cost model must be regularly updated, and its actual worth might be challenging to comprehend. This makes it more difficult to get shareholder backing.

To further complicate matters, many do not realize how deep down the supply chain they must incorporate in their calculations. It is impossible to establish whether everything that should be included has been covered since there is no specific formula. Some accessible formulae are pretty comprehensive, but the more specific your formulas are, the more complex your data will be.

Calculating Landed Cost: Getting Started

Although determining the landing cost might be challenging, several solutions are available. Numerous companies compute their total landing cost using spreadsheets or internally built software. You may also obtain assistance from third-party groups, like supply chain consultants and other supply chain specialists. There is also the possibility of acquiring commercial tools to assist in formula computation, such as enterprise resource planning systems, transportation management systems, supply chain design programs, etc. As the significance of this equation increases, more calculation-supporting tools include this capability.

Begin by gathering as many data points as possible so that you may begin formulating the equation. This gets you starting on the correct path to assist you in locating the missing components. Many believe that waiting to calculate TLC until they have amassed a more significant number of data will increase their chances of success. However, by starting the process early in the formula formulation, you will be able to detect what is lacking quickly. Start with KPIs such as:

- Payment terms

- Transit time

- Manufacturing lead time

Let’s examine more closely how it operates:

Initially, assuming you are purchasing 5,000 USB cables.

Supplier 1 costs fifty cents per USB cable, with a ten percent discount for purchases over one thousand pieces. This will set you back $2,250. If you sell each cable for $5, your profit margin is 0.91, and you will make $22,750. Supplier 2 costs 55 cents per USB cable and does not provide volume discounts. If you sold each cable for $5, your profit margin would be 0.89, and you would make $22,250. Based only on price, supplier 1 is the victor. Now, let’s delve a little deeper.

Supplier 1 charges a fixed fee of $500 for international shipment, and you have an import tariff rate of 25% since they are headquartered in a country with which you have no preferential arrangements.

Supplier 2 calculates delivery costs based on weight and your total amounts to $250. They are headquartered in a firm with a preferential relationship with yours. Therefore the significant duty rate is just 10%.

That implies:

Cost from Supplier 1: $2,250 + $500 freight + ($2,250 *.25) = $2,250 + 500 + 562.5 = $3,312.50

Cost from Supplier 2: $2,750 + $250 freight + ($2,750 *.1) = $2,750 + $250 + 275 = $3,275

In this instance, supplier 2 offers the superior value, although by a little margin.

However, a more significant disparity becomes apparent when these expenditures are incorporated into the profit margin.

Purchasing from Supplier 1 yields a profit of $21,687.50, or a profit margin of 86.75 percent.

Purchasing from Supplier 2 yields a profit of $21,725 and a profit margin of 86.9 percent.

Even if the difference is minute when the volume is considered, a substantial amount of money might be wasted by choosing the offer that seemed to be better based just on the price of a product. Even if you don’t have to deal with importing and customs brokers and costly shipping fees, the landed price will be more than the buying price.

Purchasing from supplier 1 resulted in a presumptive profit margin of 91 percent, compared to the more accurate profit margin of 86.75 percent. Supplier 2 estimated a margin of 89 percent, whereas the more realistic figure was 86.9 percent. Without the landing charges, your budget would have been wrong.

If you had bought from Supplier 1 and projected your profit margin without factoring in the landing expenses, you may have found yourself in the following situation:

You anticipated selling 500,000 USB cables over the year, and with a 91 percent profit margin, you would expect $227,500 in profit or $250,000 in revenue. Consequently, you build your budget on this number. However, because of the landing expenses, you only realize $216,875 in profit, leaving a discrepancy of $10,625.

As a starting point, here is a primary method for calculating landing costs:

Item Price plus Shipping/Freight Costs plus Customs Duties plus Risk plus Operating Expenses equals Landed Cost. If you are not transacting in your native currency, you must additionally factor in currency conversion.

You must handle this landing cost computation for every product sold. The retail price is much higher than wholesale, mainly if additional costs are incurred due to lengthy customs processing procedures. Sellers who export items must additionally account for fees, which they often include in the price of their products.

Don’t forget to include handling costs, port fees, payment processing fees, freight rates, etc., while determining any commodity’s safety stock and profitability. After investing time and money to estimate your landing costs, your business will begin to reap the rewards. In addition, spending a little more time on landed expenses while doing supplier due diligence, particularly in international commerce and imported products, will pay dividends in the long term.

If you want to read more content for resolving operational issues using D365, visit our latest blogs for insights.

SUMMARY

Numerous businesses calculate their overall landing costs utilizing spreadsheets or in-house developed software. You may also seek help from third-party organizations, such as supply chain specialists. The scenario if further explained with an example.

Costing Parameter Values Setup in D365

Landed Cost Parameters Setup

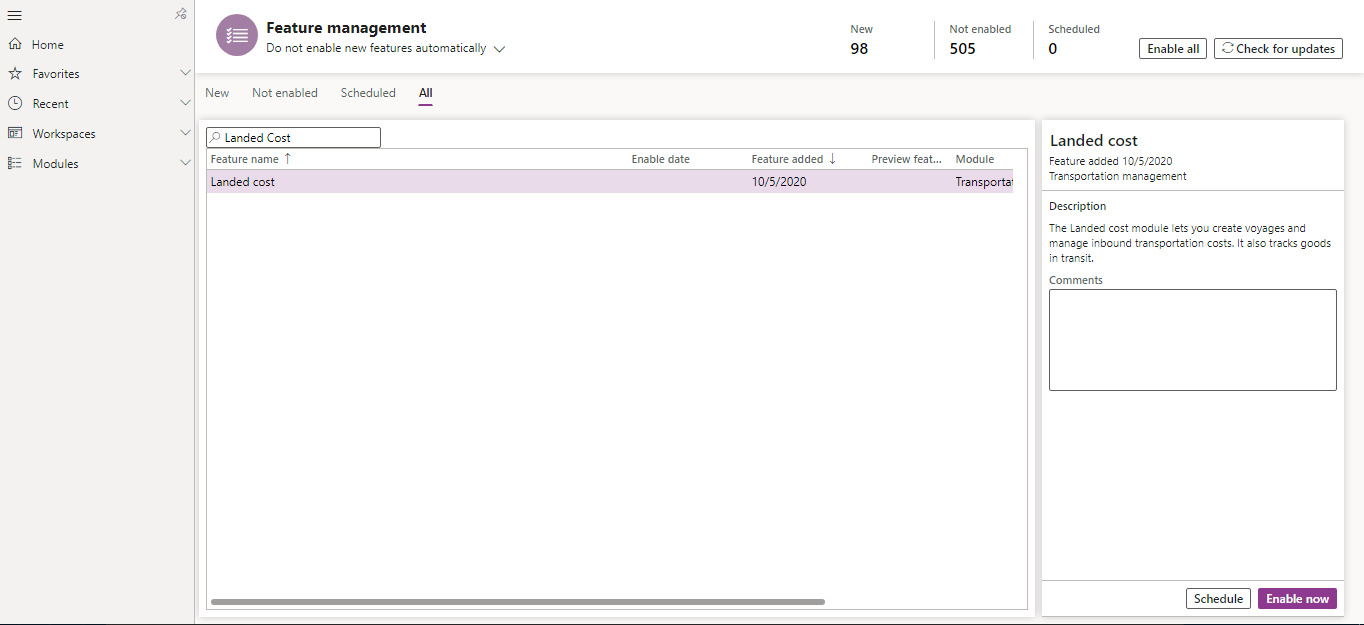

Step 1

To activate the landed cost, we have to open the Dynamics and then the Feature Management Workspace.

Step 2

In feature management select the all option in the search bar and enter the “Landed Cost”.

Step 3

Once the feature appears in the lowest right side there is an option of Enable now.

Step 4

Click “Enable now” button the feature will be enabled and will appear in all modules in the modules section.

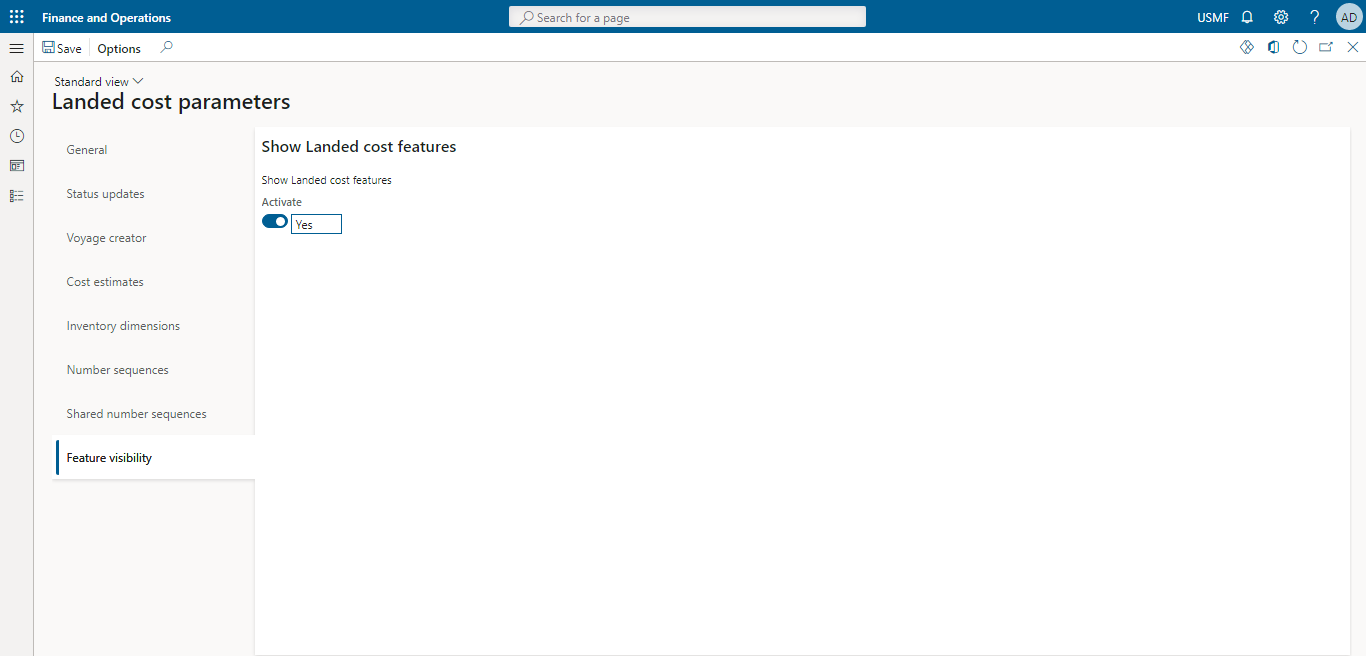

Landed Cost Parameters

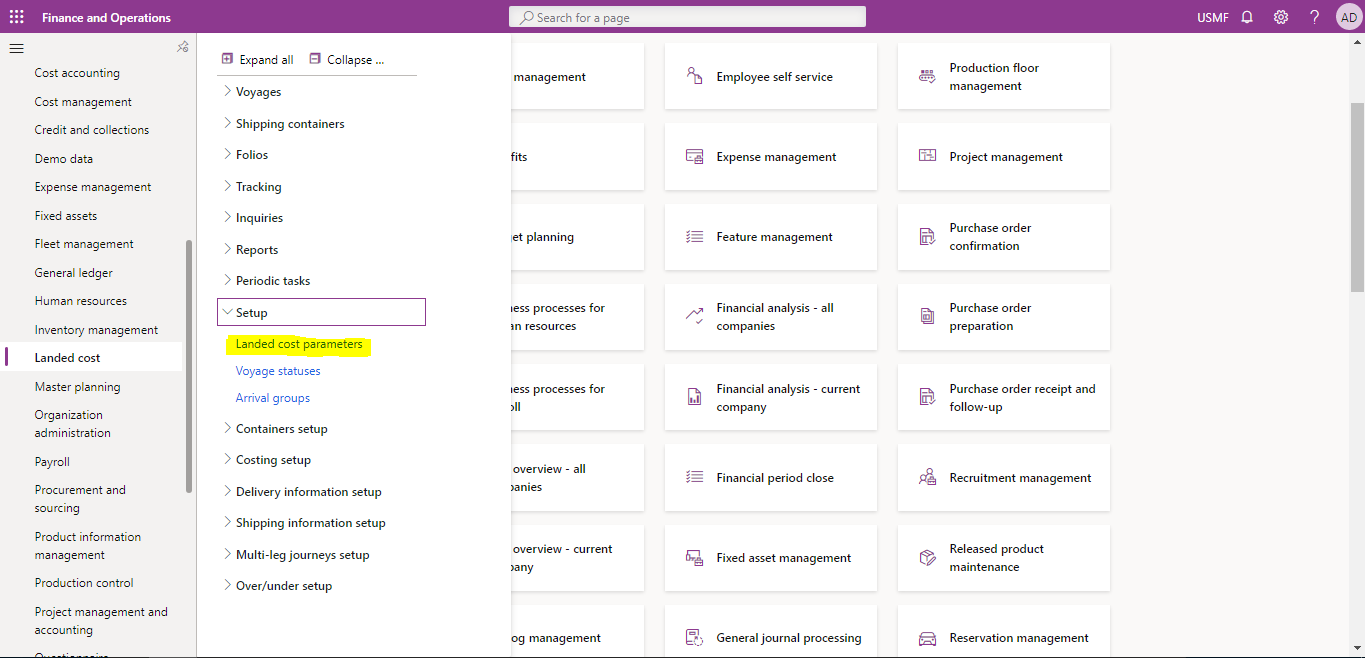

Step 1

To access the landed cost parameters page, go to Landed Cost module then setup => Landed cost.

Step 2

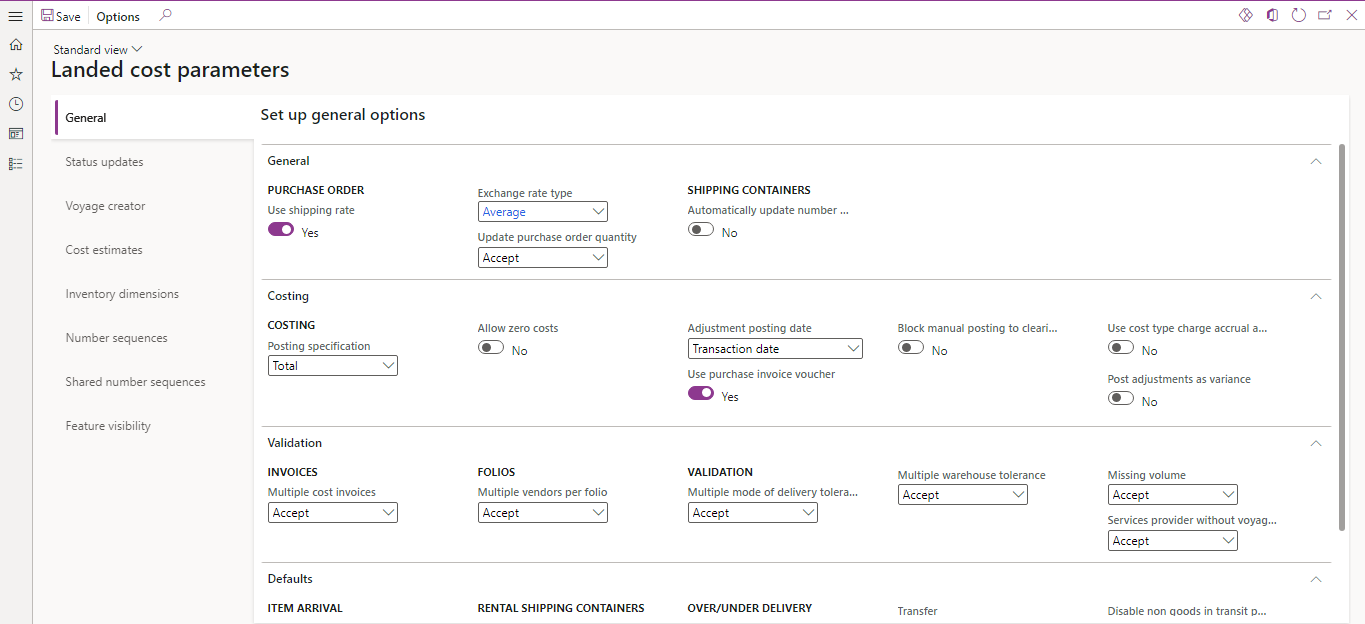

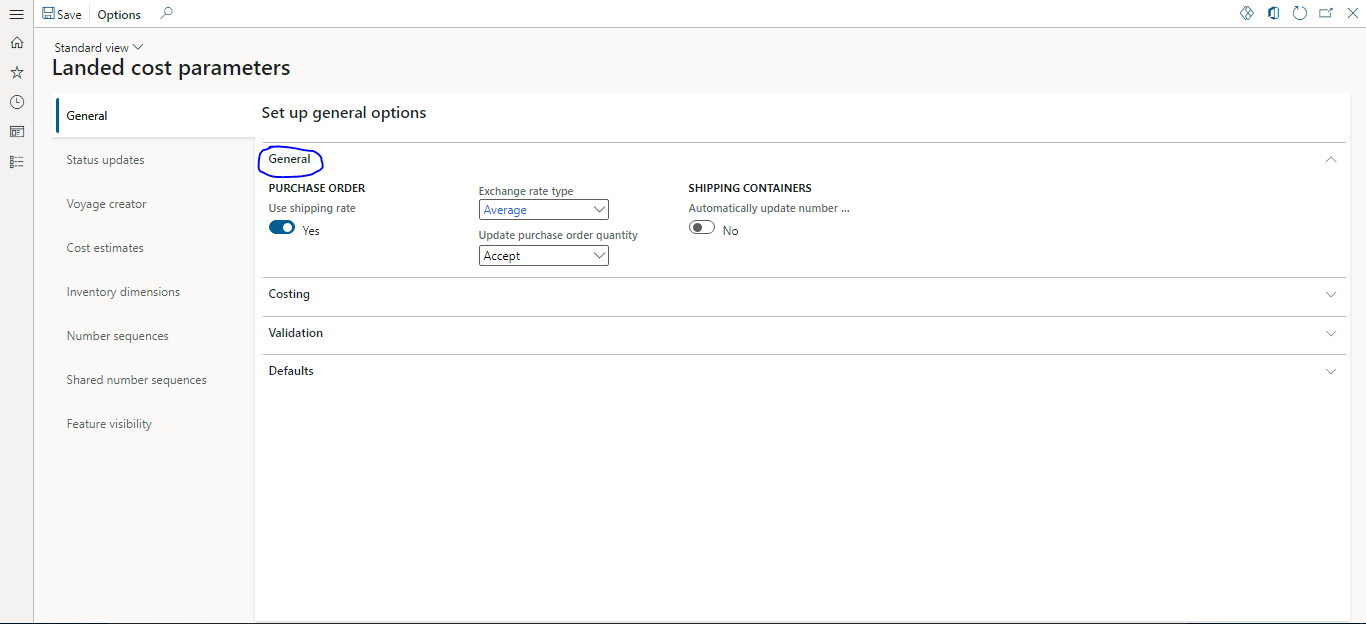

On the general tab of landed cost parameters page there are options of Use Shipping rate, Exchange rate type, under Purchase order quantity, automatically update number of cartons these fields should be selected or entered as per the requirement of the user.

Step 3

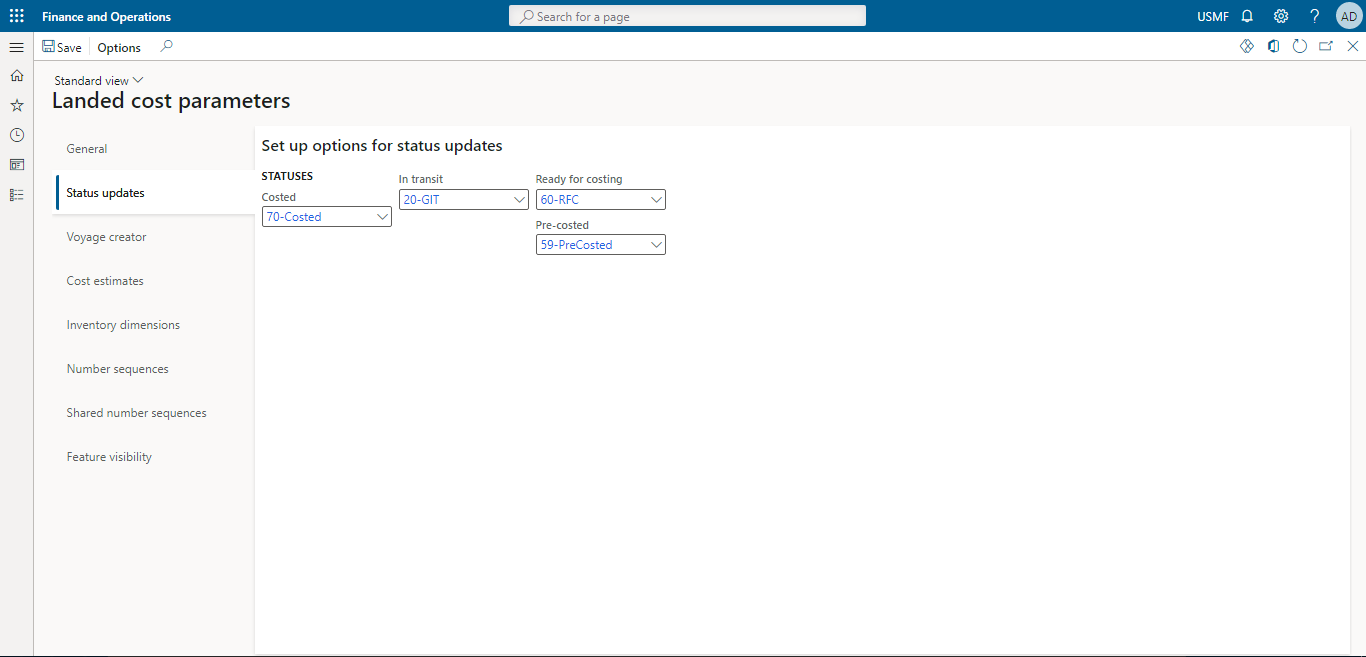

The next tab is status updates these field are used to get the updates costed, in transit and ready for costing details.

Step 4

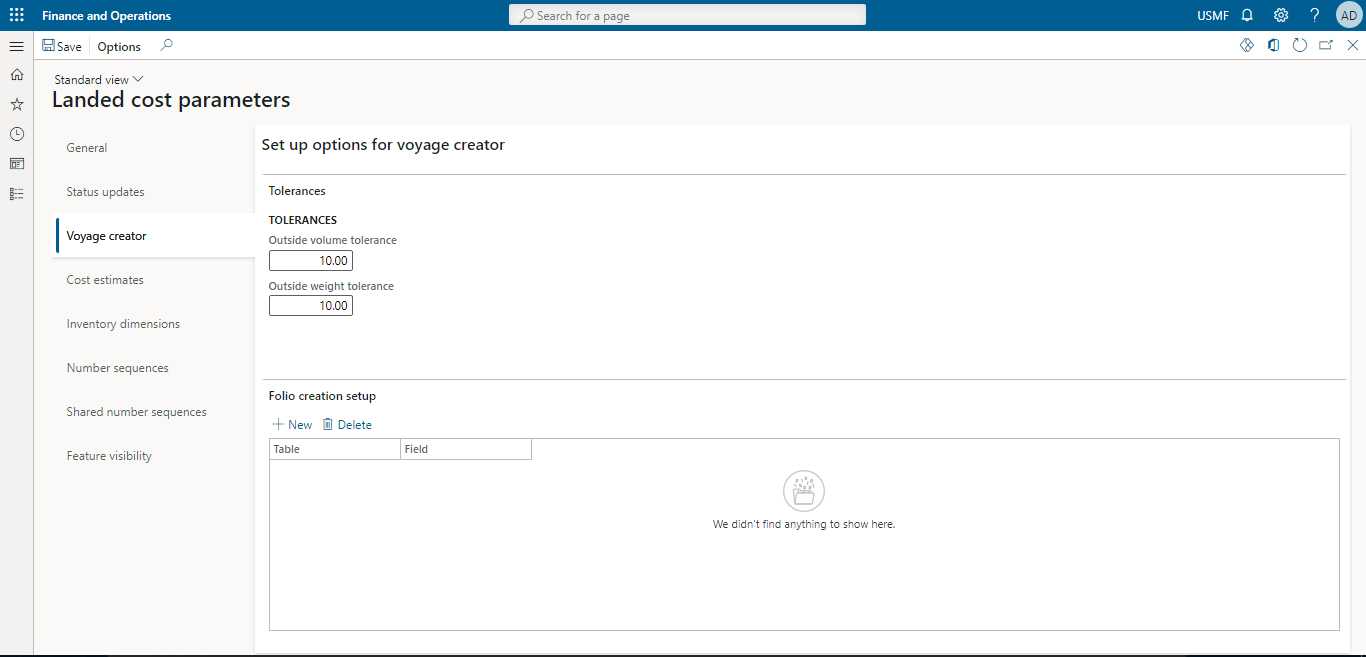

The next tab is voyage creator which is used to add the tolerance regarding the weight and volume. In folio creation setup there are the options for what purpose the tolerance is being made.

Step 5

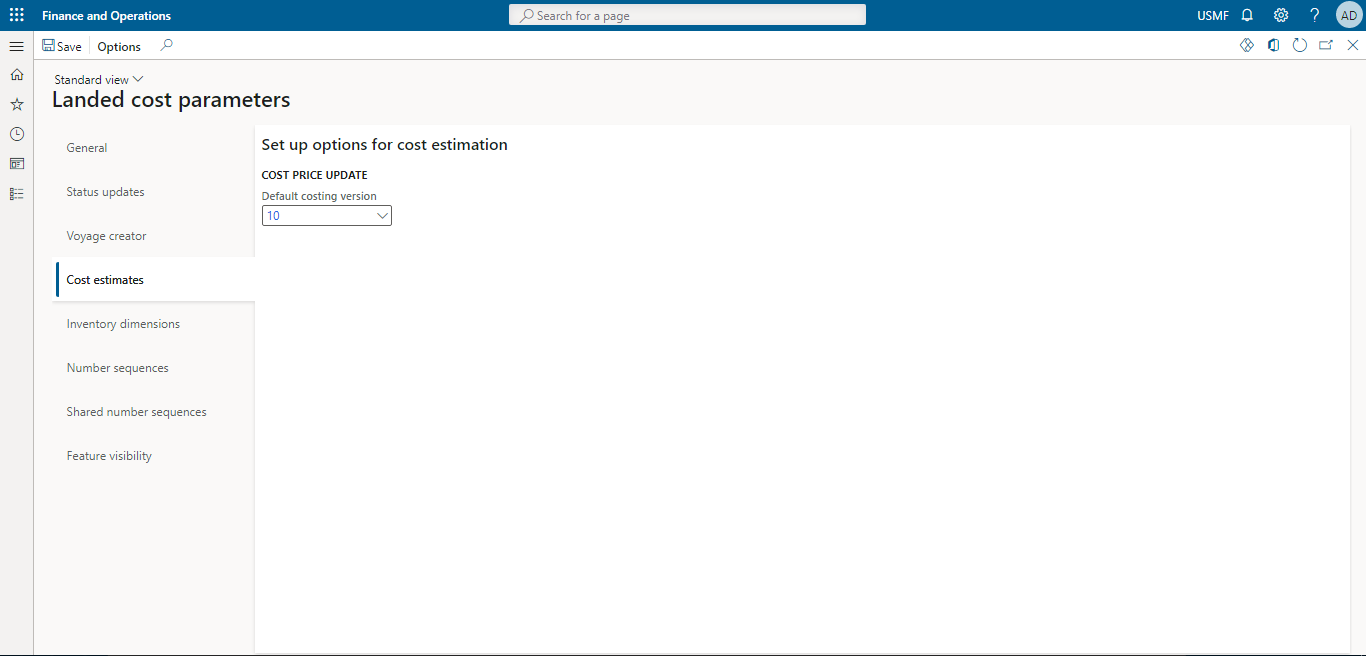

The next tab is of Cost estimates in which the current and future fiscal years are selected, both of them are assigned with the version numbers.

Step 6

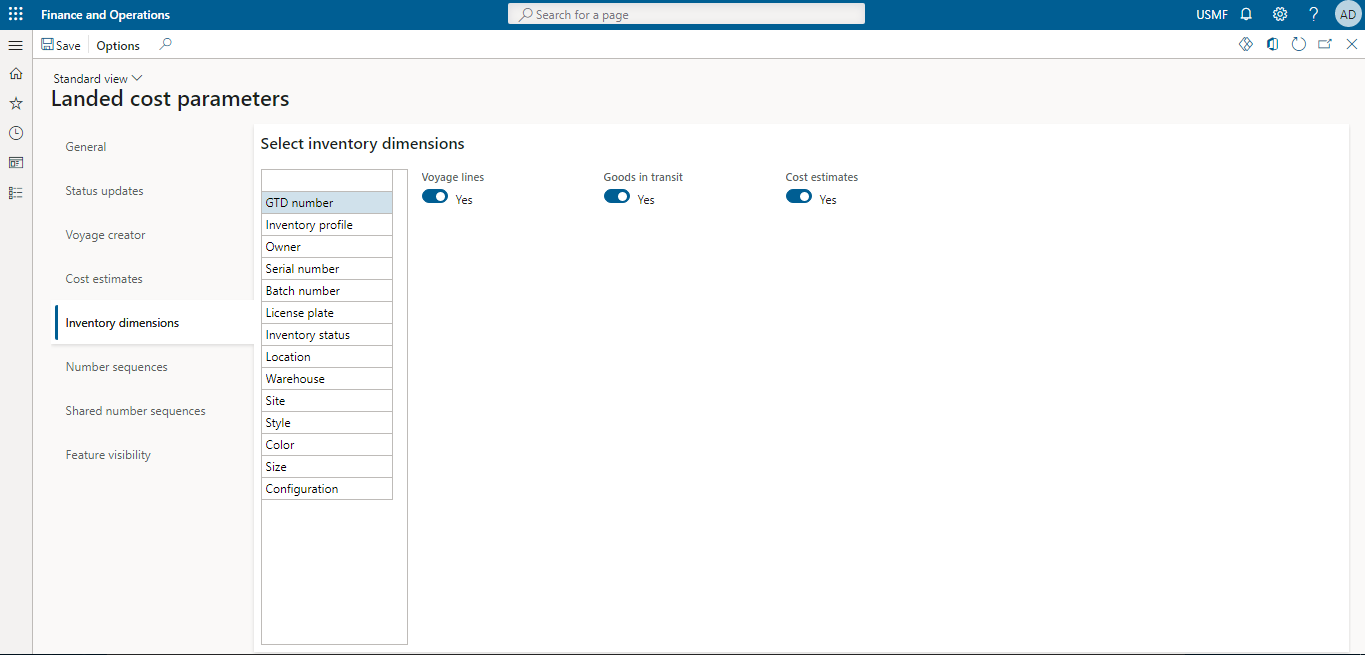

In the inventory dimensions tab, there are dimensions depending on the inventory size, color, warehouse etc. There is option of turning the option of yes or no for the goods in transit, cost estimates & voyage lines.

Step 7

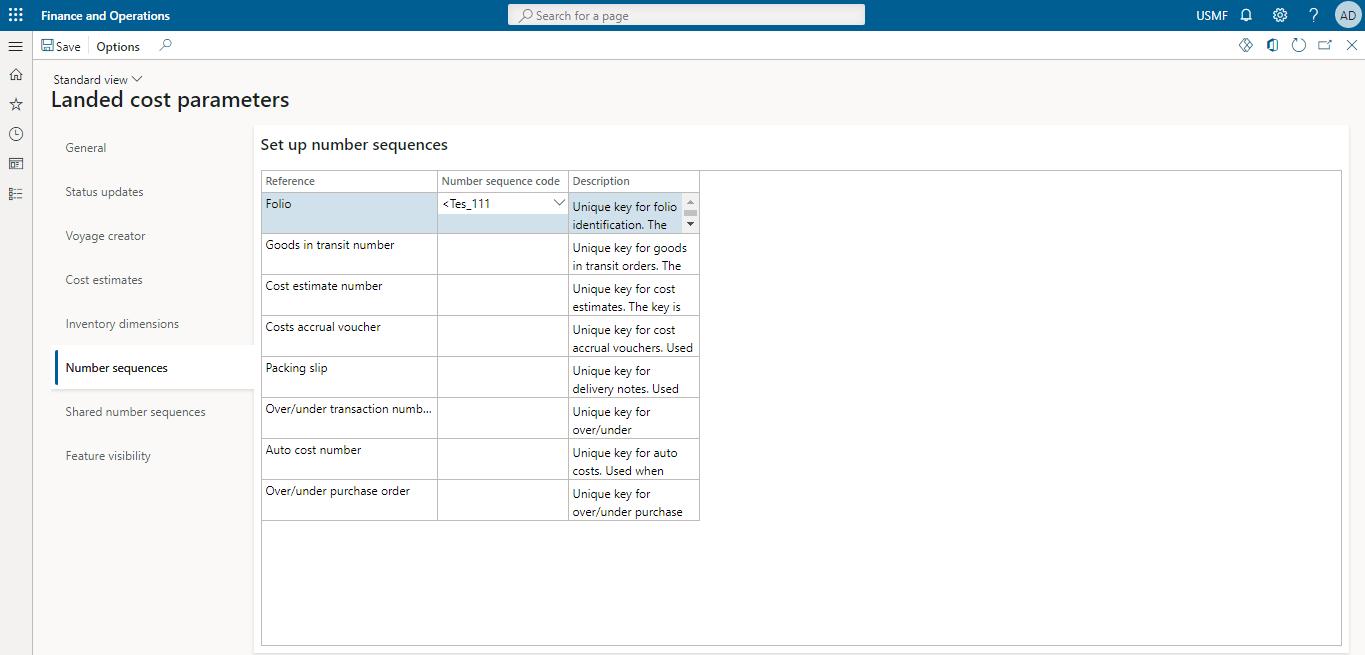

The next tab is of number sequence which shows the number sequence which are required for landed cost.

Step 8

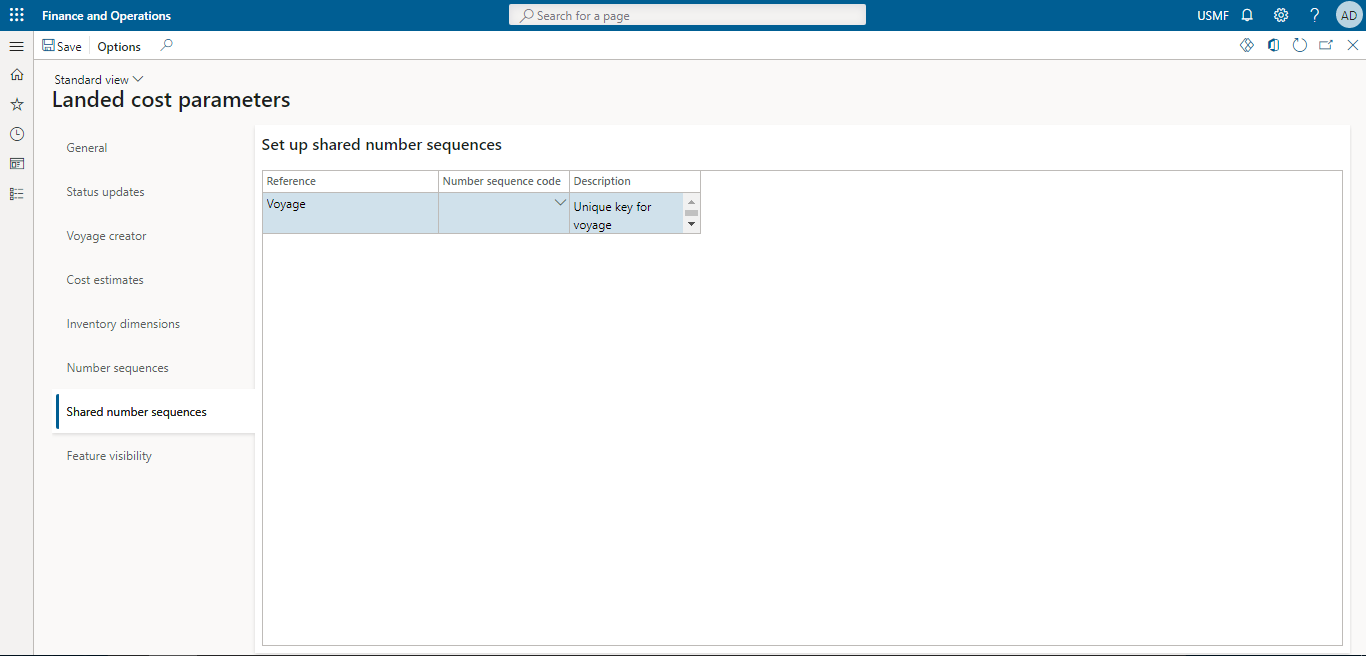

In shared number sequence there is a list of reference numbers which are shared between legal entities for the purpose of landed cost.

Step 9

The last tab is feature visibility which is used for the landed cost purpose.

SUMMARY

Using the above steps, you will be able to perform costing parameter values setup in d365.

How Can D365 Help Organizations Manage their Total Manufacturing Costs?

| Sr. |

How Cost Module Can Help Businesses in their Supply Chain Management |

||

| Advantage | Significance | ||

| 1. | Gives You More Accurate Information | Gives you an accurate calculation and helps you avoid unexpected expenses. | |

| 2. | Goods Tracking Information | A complete update on each step of transit.

Lead time and the shipment status are identified. Users are allowed to change these delivery dates. |

|

| 3. | Helps to Reduce Expenses | Look at all of their expenses related to the shipping items.

Helps to reduce unnecessary costs and make current costs worthwhile by increasing your profit margin. |

|

Again, efficiency is essential when managing a complex industrial process with numerous moving components. In this case, it is advantageous to use D365 capabilities to assist you in controlling your entire production expenses. D365 aids in the management of an organization’s essential supply chain, manufacturing, services, finance, and other functions. It may help simplify planning, budgeting, automation, and accurate operations reporting. D365 Costing parameter values setting capability helps you to decide when products are landed into the warehouse, charges are incurred, or the landed costs of the journey. When a cost is acquired over time or throughout a series of journeys and offset in a single transaction, ledger adjustments are employed.

Today, finding a streamlined, efficient manufacturing organization that does not include digital manufacturing technologies is difficult. Software solutions such as Production Resource Planning (MRP) technology and Quality Management Systems (QMS) may drastically alter the overall manufacturing expenses of a business.

The solutions provided by Instructor Brandon assist global manufacturers in increasing profitability, productivity, customer service, and managing their critical manufacturing business processes for scalable growth potential. Our solutions are created and deployed with best practices in the manufacturing sector in mind and these solutions give visibility and execution, and visibility enables businesses to make more strategic choices. Learn more about our solutions and how we can collaborate with you to enhance your company, optimize your production processes and lower your overall manufacturing expenses.

Find the best options for you through our beginner courses and certification courses.

SUMMARY

A digital system such as D365 facilitates the administration of a company’s critical supply chain, manufacturing, services, finance, and other operations. ERP software allows you to decrease inefficient resource use without sacrificing quality. Modern ERP systems for manufacturing are designed to support and integrate with every manufacturing business activity, giving your firm with a complete business management platform.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on how we can help you manage your warehousing costs, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What are the costs associated with storing inventory at a warehouse? ” answer-0=”Within a single supply chain, inventory holding costs are considered as part of the overall inventory costs. Storage, insurance, labor, transportation, depreciation, inventory shrinkage, damaged or spoilt goods, obsolescence, and opportunity expenses are included in the costs. ” image-0=”” headline-1=”h2″ question-1=”Which costs are included in the landing cost? ” answer-1=”Landed cost is the entire cost of a product or cargo after it has been delivered to the buyer’s door. The landing cost includes the product’s initial price, shipping expenses (both inland and ocean), customs, duties, taxes, tariffs, insurance, currency conversion, crating, handling, and payment fees. ” image-1=”” headline-2=”h2″ question-2=”How to account for the cost of carrying inventory? ” answer-2=”To calculate inventory carrying costs, sum the above-mentioned expenditures over one year: capital, storage, labor, transportation, insurance, taxes, administrative, depreciation, obsolescence, and shrinkage. The resulting percentage is calculated by dividing carrying costs by total inventory value and multiplying by 100. ” image-2=”” count=”3″ html=”true” css_class=””]

6664

6664