Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Ledger Account Dimensions Part 1: Tips to Optimize Financials

Optimize Financial Dimensions in Microsoft Dynamics 365

Validation Errors | Legal Entity | Financial Reporting | Ledger Setup | Invoice Processing

A general ledger account is the foundation of business documentation. It constitutes the foundation of a firm’s financial statements. It is used to organize, summarize, and store information about all transactions made throughout the company operations. The flow and structure of GL accounts are pretty similar, but the mix of numbers and letters that make them up are unique to each organization.

GENERAL LEDGER DEFINED

To comprehend what a general ledger account is, you must first have a particular concept of what a general ledger is and the primary function it serves.

A general ledger is a collection of all the numbered accounts used to keep track of every financial transaction that happens in the course of business. The general ledger might be filled with hundreds or thousands of accounts and transactions, depending on the kind and size of the company.

It is arranged to enable the double-entry method of accounting. The general ledger will reveal the entire individual amounts of debits and credits so that they are entered into the company’s trial balance. The general ledger is often kept inside a computerized record-keeping system. It is simply an automated file of all the accounts and transactions utilized to create the firm’s financial statements. It is also how a firm runs reports to produce vital financial records and other indicators. With accounting software, most day-to-day transactions are recorded in sub-ledgers, and subsequently, the totals are submitted to the main ledger.

Historically, the general ledger was an actual book that featured a different page, or ledger, for each account. As a transaction took place, it was recorded on the account page so that it could be looked up later. This is why accounting documents are often referred to as a business’s “books.” Explore our beginner courses to capitalize on our knowledge and unique blended learning approach to rapid professional training.

WHAT IS A GENERAL LEDGER ACCOUNT?

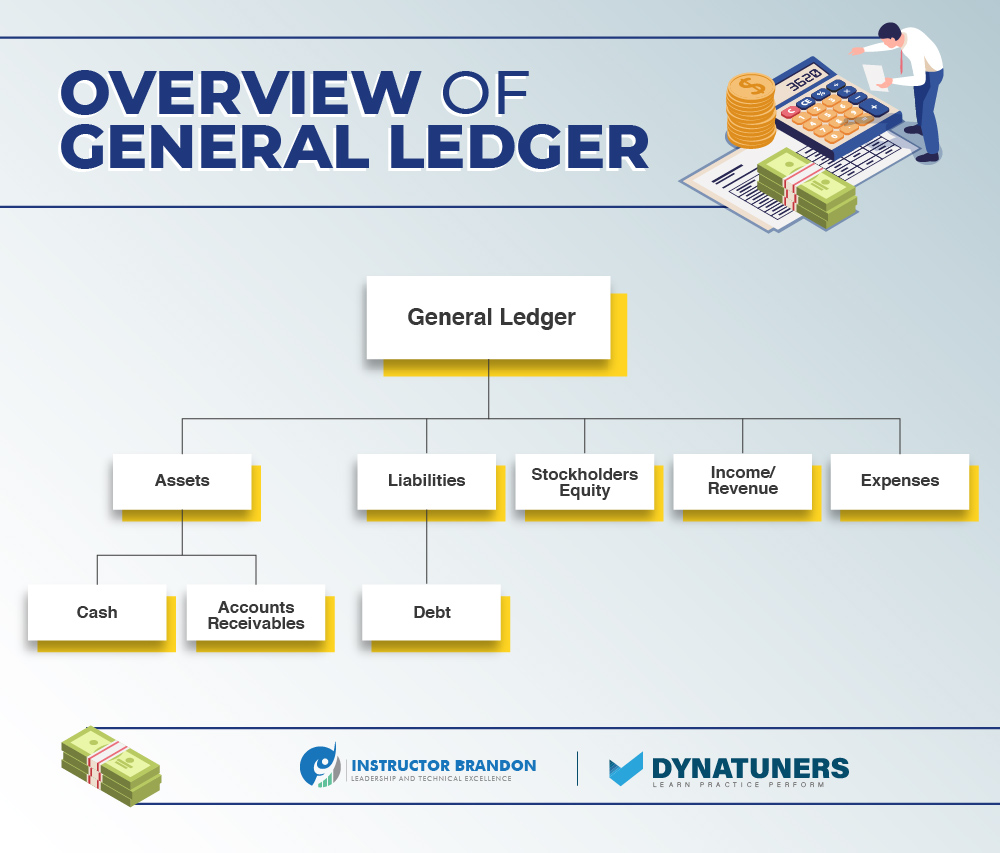

General ledger accounts, or GL accounts, are sequentially numbered accounts used to record, summarize, and organize a business’s transactions. They are kept in the general ledger, and each account is assigned to a particular form of asset, liability, equity, income, or cost. It may be composed of a sequence of numbers or letters, and the numbers they begin or conclude with, are often used to indicate the account type.

SUMMARY

Accounts in the general ledger are sequentially numbered accounts used to record, summarize, and organize the transactions of a business. Frequently, the general ledger is maintained inside a computerized record-keeping system. It is the compilation of all accounts and transactions that will be used to construct the financial statements for the business.

GENERAL LEDGER ACCOUNT TYPES

There are several general ledger accounts since organizations must manage and report on various sorts of transactions. These are classified as a balance sheet or income statement accounts. Accounts on the balance sheet encompass everything stated on the balance sheet, including assets, liabilities, and shareholders’ equity. These are perpetual accounts, also referred to as genuine accounts, since they are not closed after each accounting year. Rather than that, the balances are carried over to the next accounting year and represent the cumulative balances.

Balances on the income statement are referred to as income statement accounts. These accounts contain income and costs from operations and revenue, expenses, profits, and losses from non-operational activities. In contrast to balance sheet accounts, which are carried forward, income statement accounts are transient and are closed at the end of each fiscal year. They begin the year with a zero balance and roll the amount over to the retained profits account on the balance sheet at the end of the year.

Certain general ledger accounts may be transformed into summary records on their own; these are called control accounts. In this scenario, the subsidiary ledger has the details necessary to justify the summary amount reported in the control accounts. Control accounts comprise receivables and inventories. Want to learn more about inventory counting reports?

Read our blogs to say updated with attest insights.

SUMMARY

Balance sheet accounts include all information reported on the balance sheet, such as assets and shareholders’ equity. In addition, revenue, costs, earnings, and losses from non-operational activities are included in the income statement.

LEDGER ACCOUNT COMBINATIONS IN D365

The number of dimensions in Microsoft Dynamics AX 2009 was restricted to a minimum of three and a maximum of 10. Furthermore, the dimensions were added in a predetermined sequence. As a result, each dimension that was introduced needed customization of the code and database synchronization. Then, in Microsoft Dynamics AX 2012, the dimension framework was increased to support up to 50 dimensions (SQL database limits on total column counts in our tables). Additionally, the user may construct dimensions dynamically and input them in any sequence. Finance and Operations retain the AX 2012 behavior.

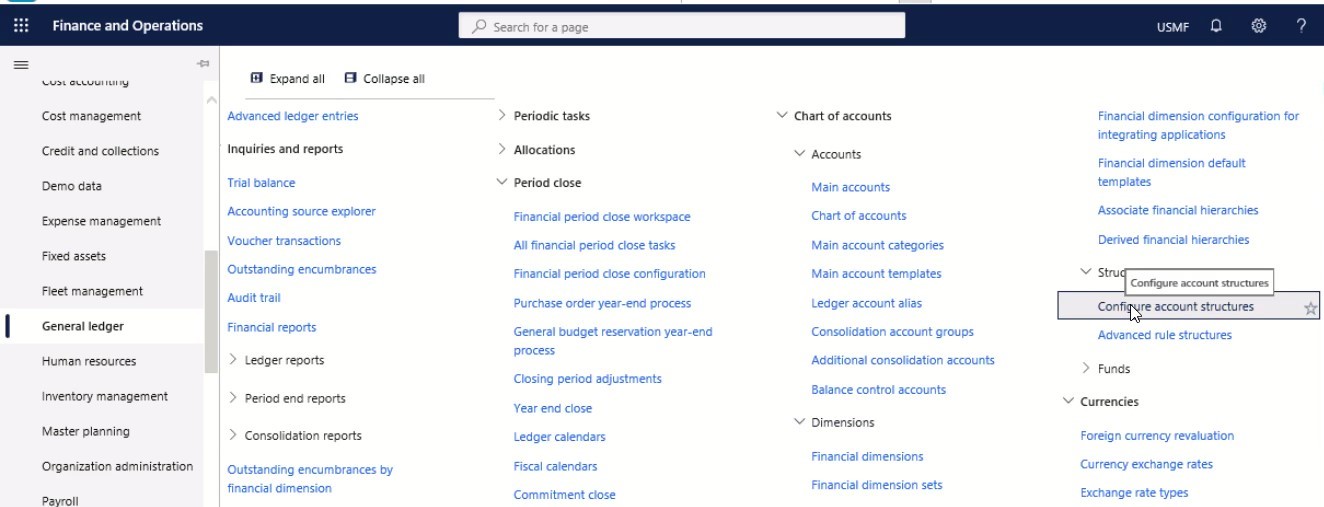

Account Structures

Account structures are recorded in the database’s DimensionHierarchy table. In addition, it is configured to demand the entry of a primary account as the first segment of a ledger account combination, followed by a customer and license plate number as succeeding segments. This configuration defines the hierarchical order. It is maintained in the database’s DimensionHierarchyLevel table.

Financial Dimensions

In Dynamics 365 for Finance, account structures are created by combining the primary account and financial dimensions to define rules that govern the order and values used when inputting an account number. D365 for Finance enables you to establish as many account structures as your firm need. Account structures may impose restrictions on the authorized account and dimension combinations, ensuring that only the proper groups are permitted. This enables you to restrict the combinations that others may use to make purchase orders, invoice vouchers, ledger entries, and timesheets.

The primary account is required for account structures. Although the primary account does not have to be the first segment in the structure, it serves as a reminder of the account structure utilized during the account number insertion. As a result, the primary account value can only exist in a single structure allocated to the ledger to avoid overlapping. Following the identification of the account structure, the authorized values list is filtered to aid the user in selecting only appropriate dimension values, reducing the likelihood of an invalid journal entry. While most businesses have a balance sheet and a profit and loss statement, you might have a variety of account structures depending on how you arrange your ledger accounts. These account structures start with the primary account and provide the available dimensions.

Example:

To demonstrate how to create an account structure, consider a business that wishes to monitor its balance sheet accounts (100000–399999) at the account and business unit financial dimension levels. They monitor financial dimensions Business Unit, Department, and Cost Center for revenue and spending accounts (400000–999999). They also watch Customers if they make a sale. In this case, it is advised that the company’s ledger be divided into two account structures – one for balance sheet accounts and another for for-profit and loss accounts. Customer should be an advanced rule utilized only when a sales account is used to maximize the user experience.

SUMMARY

Account structures are developed in Dynamics 365 for Finance by merging the principal account and financial elements. D365 for Finance enables you to create as many account structures as your organization requires. Businesses can then keep a close eye on financial metrics, explained with an example.

ACCOUNT STRUCTURES IN LEDGER ACCOUNT COMBINATIONS

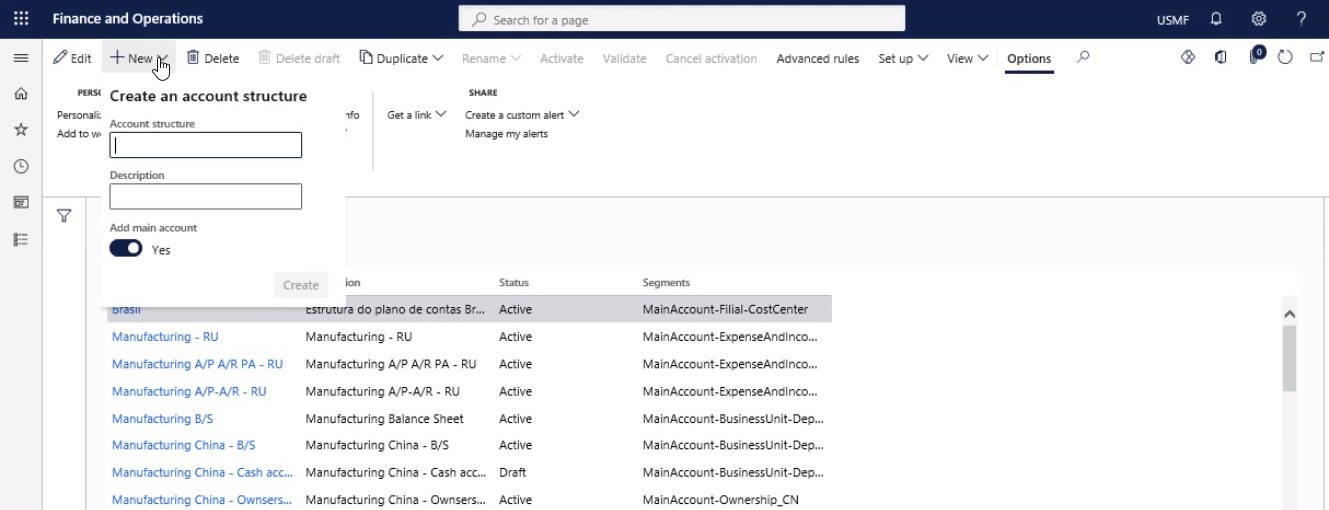

Account structures

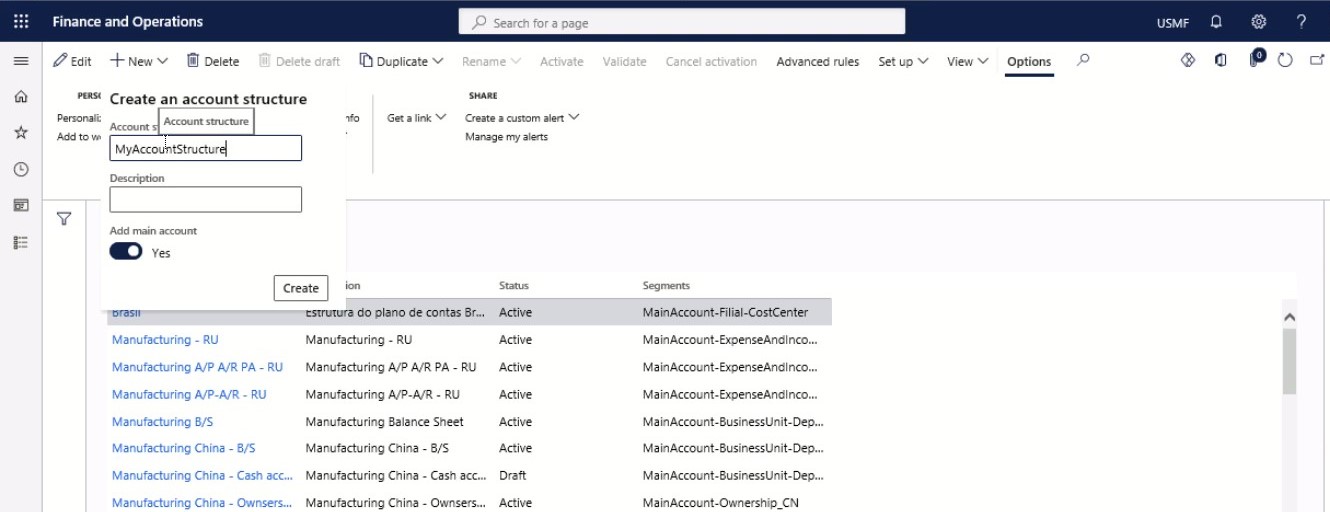

Step 2

Select New.

Step 3

Enter Account Structure and its Description.

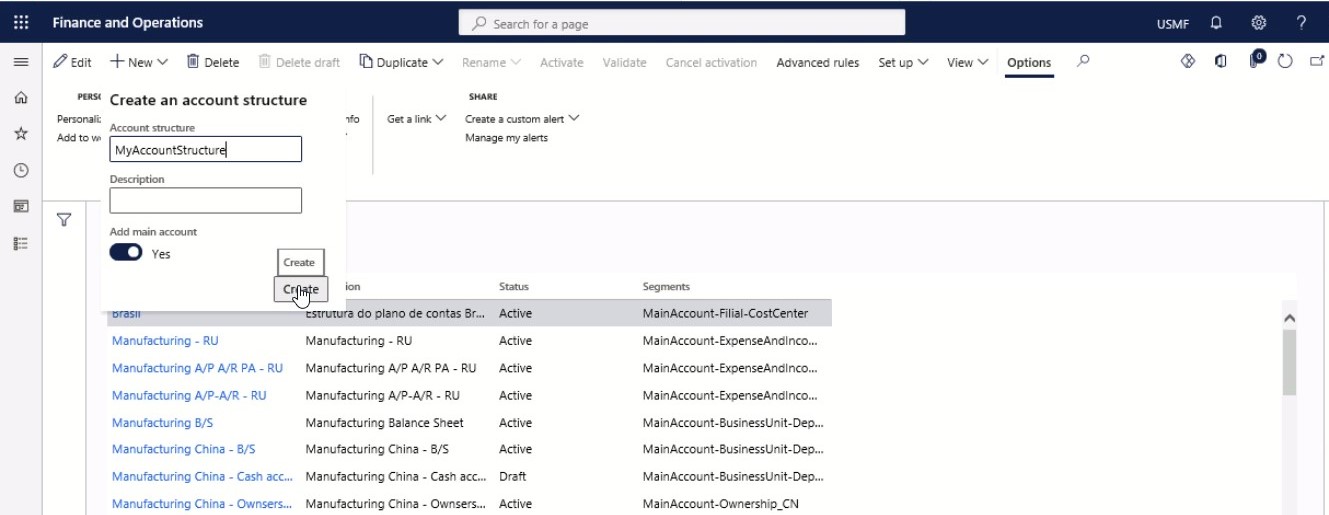

Step 4

Click Create.

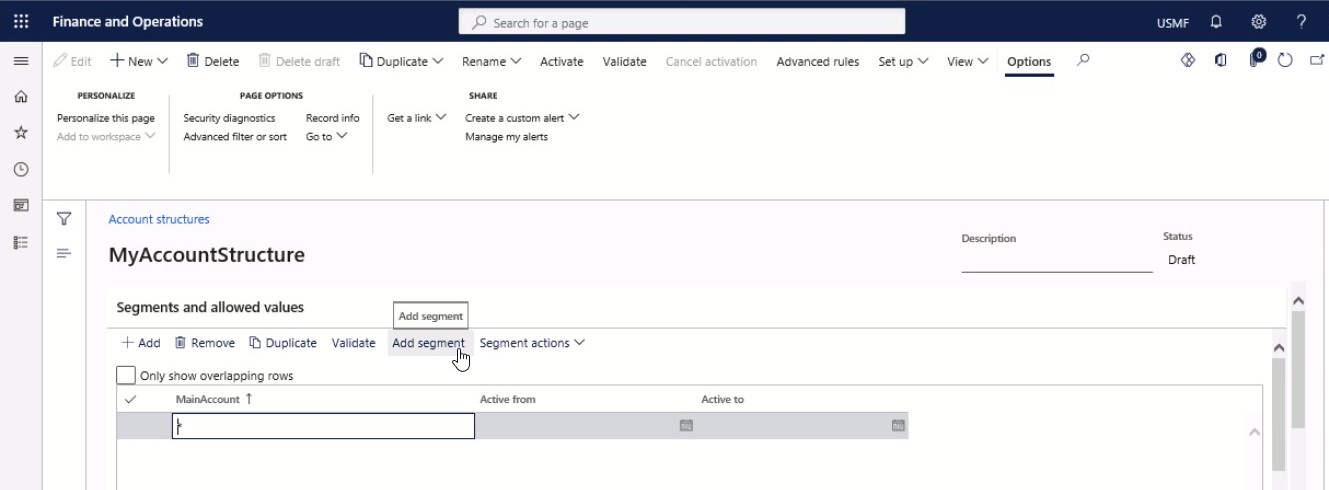

Step 5

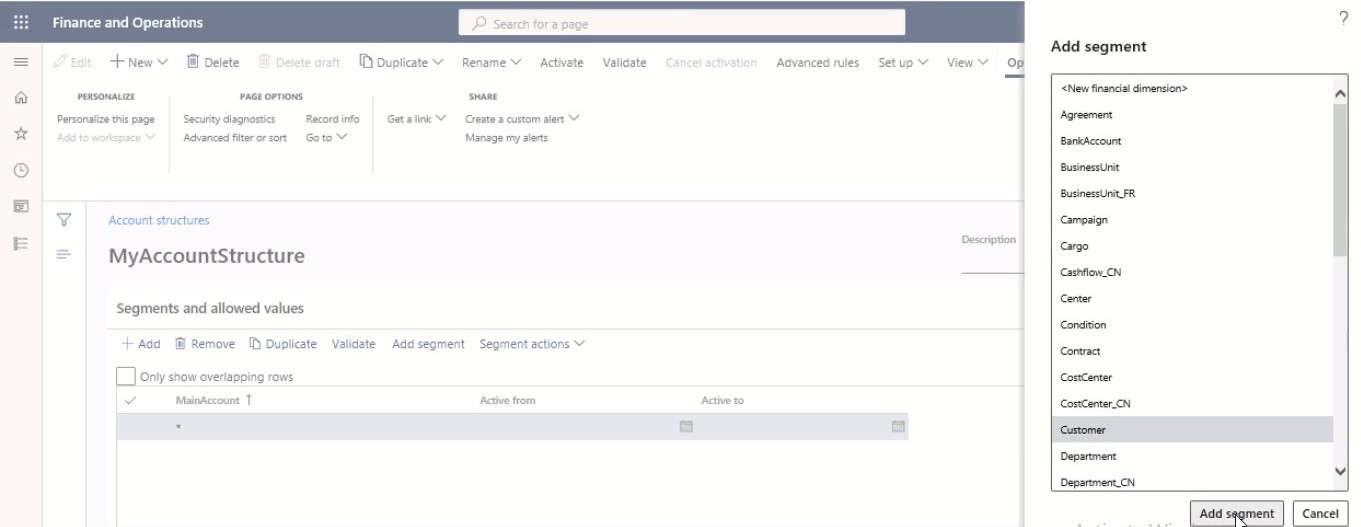

On the FastTab Segments and allowed values, select Add segment.

Step 6

Choose segments you want to add—for example, Customer.

Step 7

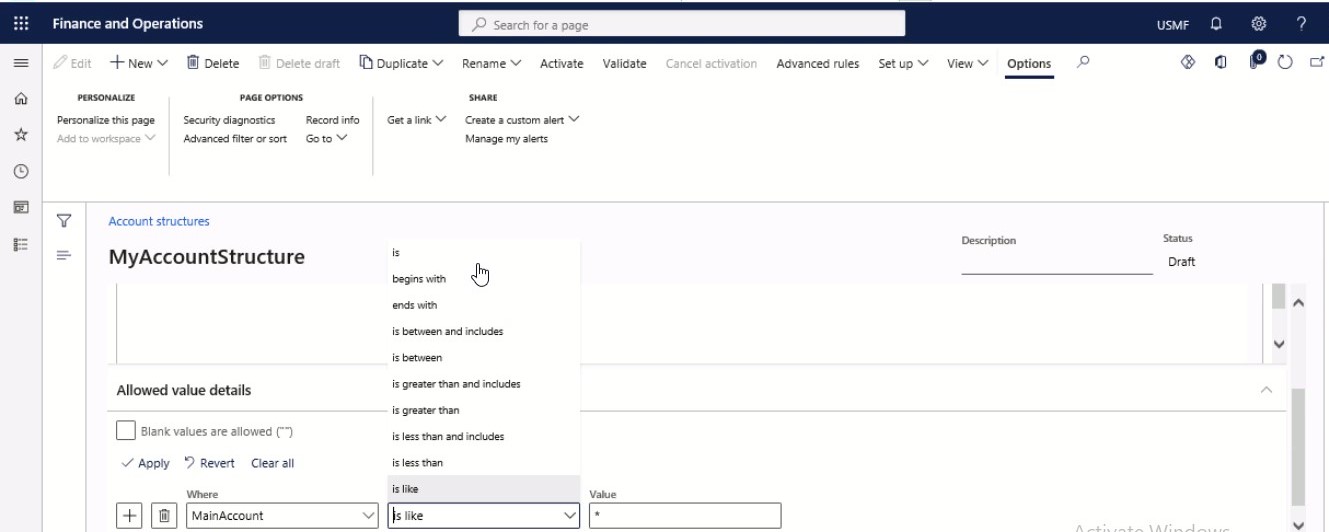

On Allowed value details Fasttab, enter related information.

Step 8

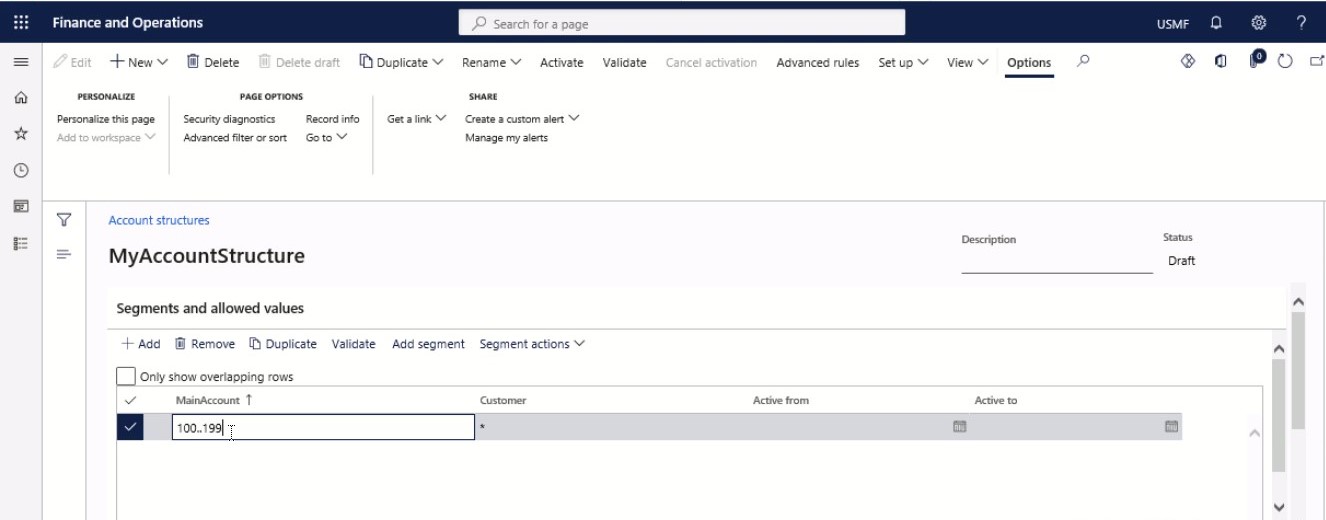

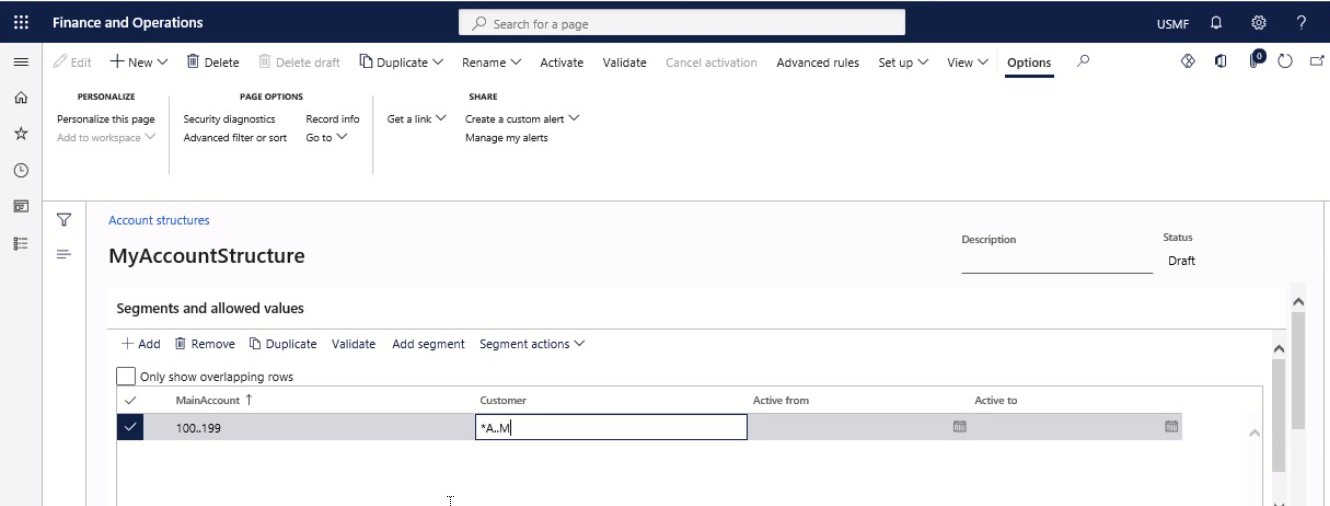

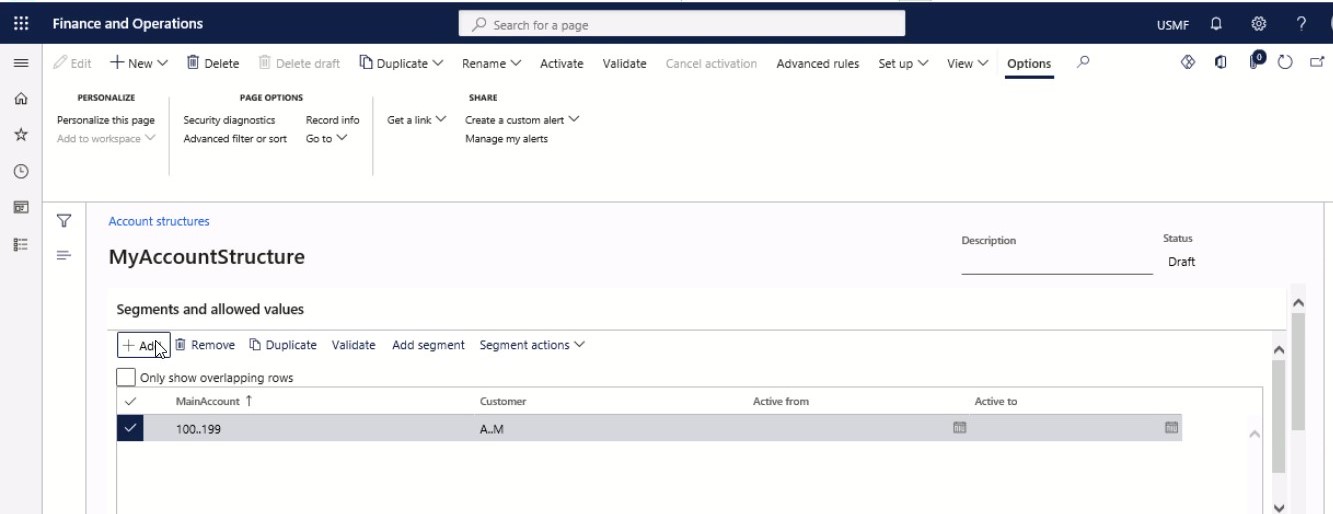

On Segments and Allowed values FastTab, add values for Main Accounts.

Step 9

Enter values for Customers.

Step 10

Select Add to enter more values.

Step 11

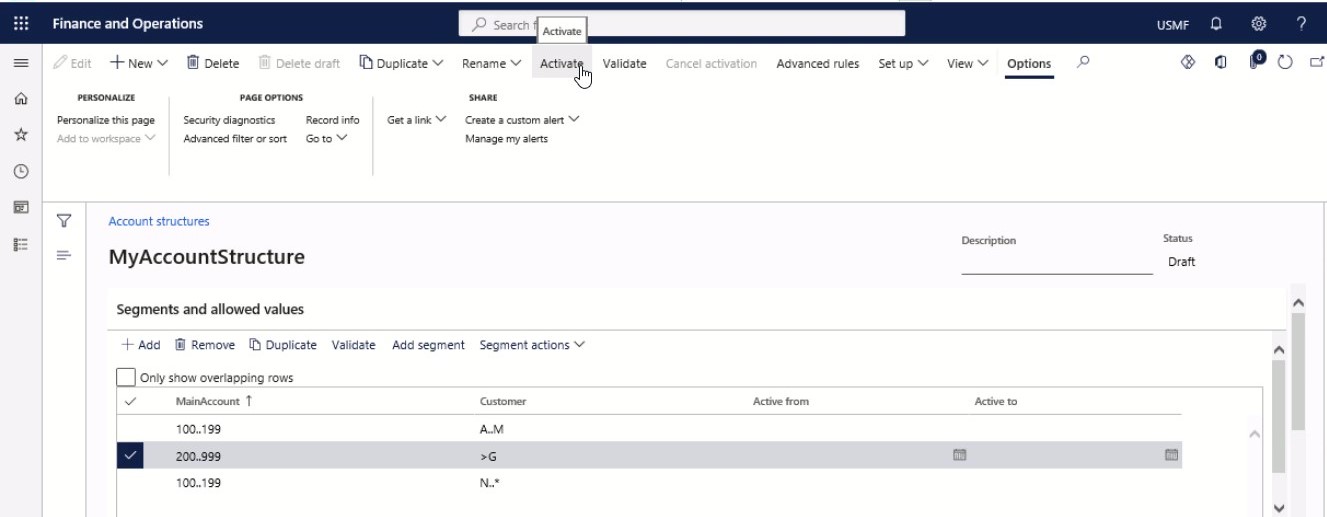

To activate, select Activate in the action pane.

Step 12

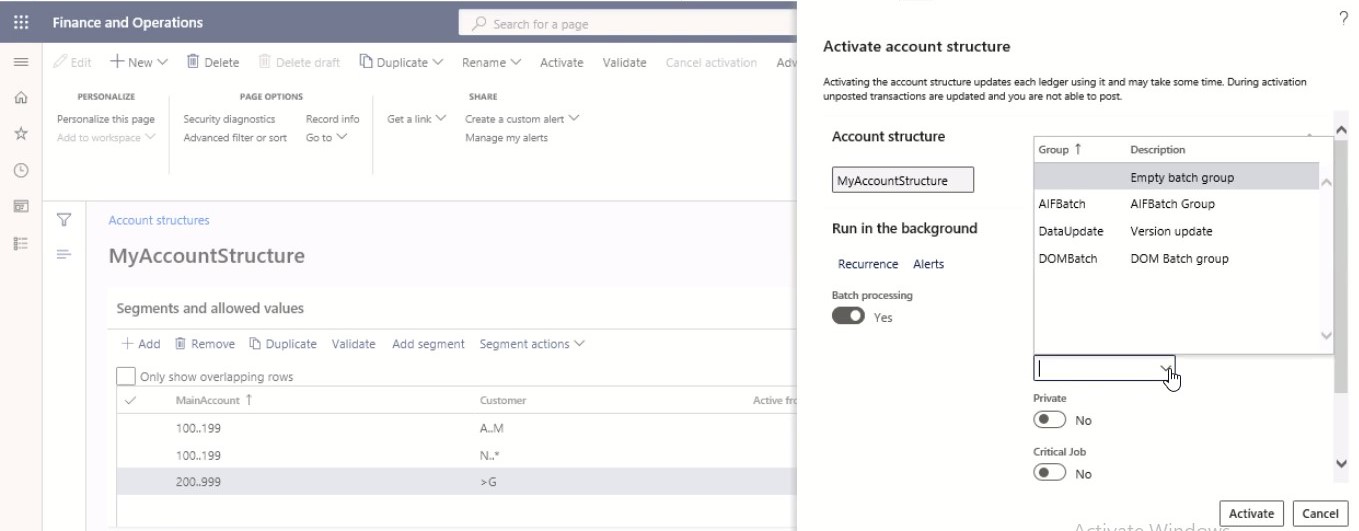

Select Batch Group.

Step 13

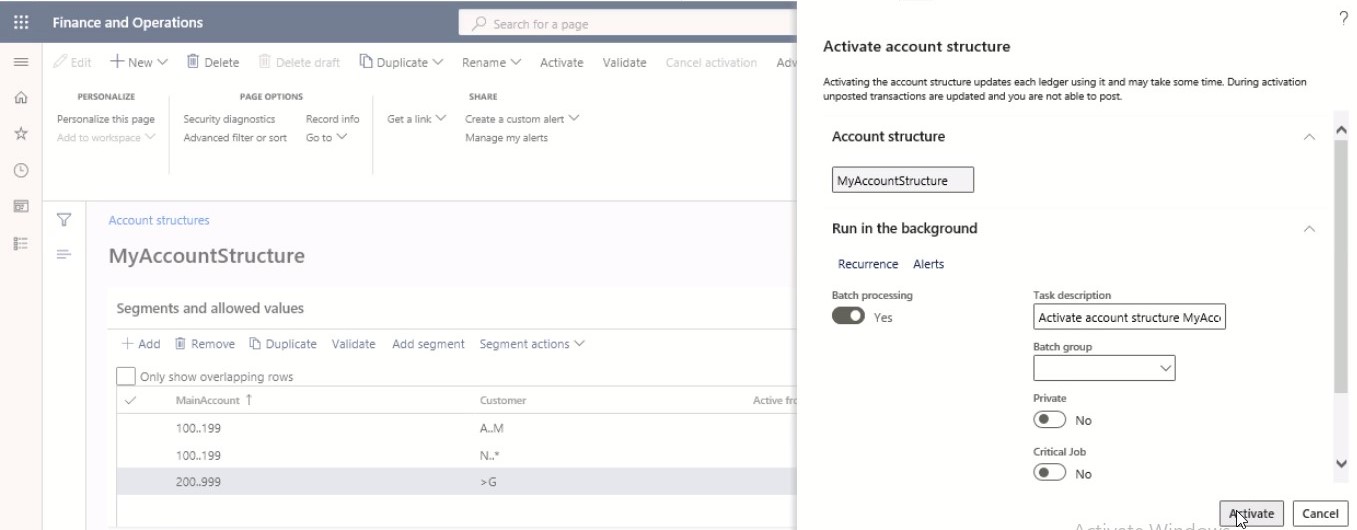

Click Activate.

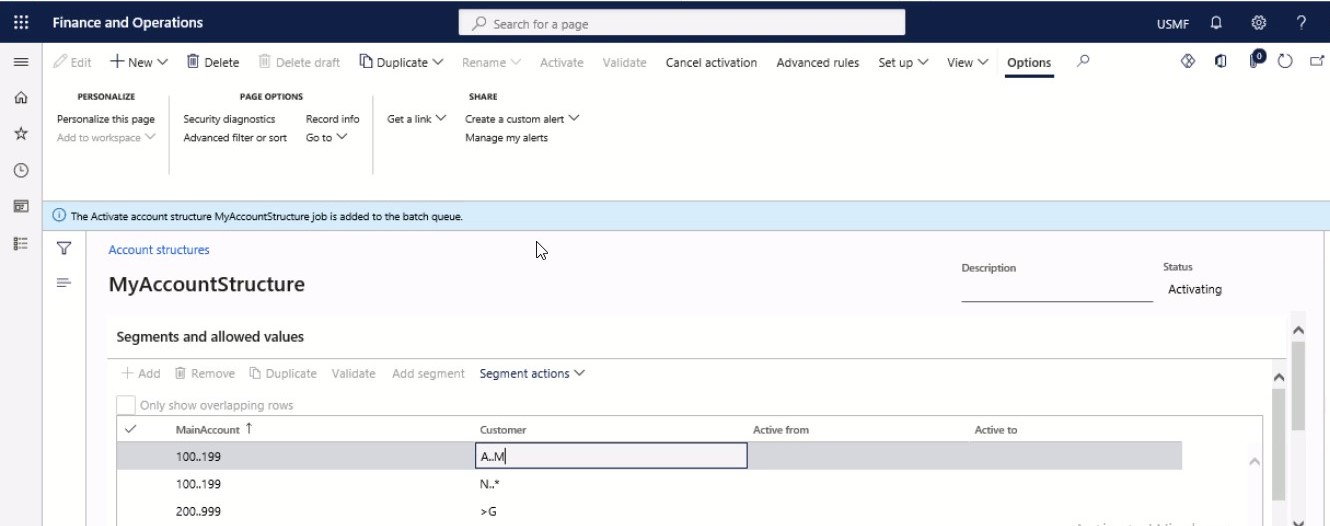

SUMMARY

Following the above processes, you will be able to create account structures in Dynamics 365.

BEST PRACTICES FOR ACCOUNT STRUCTURES IN DYNAMICS 365 FINANCE & OPERATIONS

To meet your unique company needs, you may simply customize General Ledger in Microsoft Dynamics 365. For example, configure the proper amount of periods and a fiscal year that is unique to you. Establish accounts and sub-accounts to suit operational requirements and accurately depict your divisional organization for accounting and reporting reasons. Simple configuration and user-defined settings let you manage your time and company more effectively.

With several posting choices and the ability to input transactions for any preceding or future fiscal period, you get the freedom to handle your money the way you conduct business. For example, concurrently manage installments and prepayments.

The following are some recommended practices to follow while using this feature:

- Create the primary account first to ensure that users have the best-guided experience possible throughout account creation.

- Where feasible, reuse account structures to decrease maintenance costs across your legal organizations.

- Consider developing sophisticated rules that enable account structures to be re-used to address differences across legal entities. Our Part 2 of this blog post is a comprehensive guide on how to configure advanced rules

- When specifying acceptable values, make liberal use of ranges and wildcards.

- Do not just mark each part of the account structure with an asterisk. This is challenging to handle and often results in human mistakes during maintenance.

If you’re a Dynamics 365 user looking to optimize your supply chain through further automation, it’s time to dive into the various features and functions. Then, start leveraging the built-in reporting and analytics capabilities to optimize your financial management operations. Our custom-designed labs at Instructor Brandon provide a hands-on learning experience in the real world; enroll now.

|

Sr. |

Accounting KPIs | ||

| KPI | Description | Calculation Method | |

|

1. |

Cost per Invoice | KPI that indicates the total average cost of processing a single invoice from receipt to payment. | Cost per Invoice = Total AP Department Expenses / # of Invoices Processed |

|

2. |

Invoice Cycle Time | Monitors the average duration of the invoice payment cycle, from receipt to payment. | Number of days taken for invoicing = Sum (Cycle time * number of lines invoiced) / Sum (number of lines invoiced) |

|

3. |

Payment Error Rate | This key performance indicator assesses the accounts payable department’s accuracy. | Payment Error Rate = Total # of Payments Made Containing Errors / Total # of Payments Made |

|

4. |

Invoice Exception Rate | This accounting KPI indicates the proportion of invoices that include errors and need human intervention as a result of missing or erroneous data. | Invoice Exception Rate = Total Invoices with Exceptions / Total Invoices |

|

5. |

Days Payable Outstanding (DPO) | This is a financial ratio that illustrates the average number of days it takes for a firm to pay its invoices. | DPO = (Accounts Payable / Cost of Goods Sold) x # of Days |

SUMMARY

General Ledger in Microsoft Dynamics 365 is a valuable tool for managing your time and business more successfully. Simple setup and user-defined parameters allow you to manage your money the way you choose – but there are certain best practices to follow while using this function.

FINAL THOUGHTS: LEDGER ACCOUNT DIMENSIONS

Effective financial management and accounting are critical components of every business. It is crucial in tracking revenue and expenses, ensuring compliance, forecasting and budgeting, and providing vital information to guide corporate choices and strategy. Numerous firms depend on enterprise resource planning (ERP) software to improve their financial and accounting management.

D365 Finance

Businesses have complete control over their money using D365 Finance. The general ledger accounts payable and receivable, and bank reconciliation functions are all included in this solution. Additionally, it can manage fixed assets and perform month- and year-end closure. Finally, it is a complete financial management system that streamlines and enhances business planning and budgeting processes. Several of its financial skills are as follows:

Simplify Financial Administration

Dynamics 365 Finance enables speedier book closing with its comprehensive financial reporting features and its ability to manage the foreign currency. Additionally, it allows for the simultaneous use of several legal organizations and currencies.

Financial Operations Automation

Dynamics 365 Finance enables the automation of many financial activities. For example, you may save time and money by automating invoice submission to processes and matching vendor invoice lines to generate receipts. Additionally, it assists you in managing credit risks and collections. For example, you can create a collection automation system based on rules and prediction to assist you in increasing on-time payment and improving cash flow.

Artificial Intelligence-assisted Insights

Finance insights enhance Dynamics 365 Finance with AI and automation capabilities like client payment forecasting, automated budget suggestions, and cash flow forecasting. It forecasts which payments will be late, allowing you to contact at-risk consumers instantly. Budgeting may be simplified by generating budget estimates using previous data and trends. Finally, it assists you in developing more precise cash flow estimates via AI, unified data, and “what if” research.

Automated Billing

D365 Finance’s automatic recurring billing makes it simpler to prosper in a subscription-based economy. It adapts readily to changing revenue recognition rules, minimizes audit expenses, and produces accurate financial statements.

Reduce Financial Complexity

A rules-based chart of accounts and no-code globalization services are available to assist you in simplifying tax computation, regulatory reporting, and international payments. Additionally, you may assist in ensuring compliance across 43 nations.

Effectively Manage Growth

You can swiftly deploy new subsidiaries and product lines with Dynamics 365 Finance. With onboarding, you can quickly and cost-effectively duplicate the configuration of an existing legal entity to a new business.

Therefore, if you’re interested in automating common operations, allocations, and reports to streamline monthly and year-end closure procedures, you’ve come to the right place to learn about this feature in Dynamics 365.

SUMMARY

D365 Finance from Microsoft is a comprehensive financial management solution that automates and optimizes planning and budgeting operations. It offers faster book closure due to its full financial reporting and foreign currency management capabilities. With Dynamics 365, you can swiftly and cost-effectively replicate the configuration of an existing legal entity to a new firm.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on how to effectively use work split to optimize your accounting processes, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What is a Ledger? ” answer-0=”A ledger is a physical or electronic book or record used to gather and organise past transactions data from a journal. Throughout the accounting period, the ledger maintains the transaction history and current balance for each accounting system account. ” image-0=”” headline-1=”h2″ question-1=”What is the function of a ledger? ” answer-1=”A general ledger is used in accounting to record all of a business’s transactions. Transactional data is categorized in a general ledger into assets, liabilities, income, costs, and owner’s equity. The accountant prepares the trial balance once each sub-ledger has been closed. ” image-1=”” headline-2=”h2″ question-2=”What are the ledger’s rules? ” answer-2=”Credits and debits must be equal in order for a general ledger to be balanced. The credits add to asset, cost, and dividend accounts, while debits subtract from them. Credits enhance the balances of obligation, income, and equity, while debits diminish them. ” image-2=”” count=”3″ html=”true” css_class=””]

5873

5873