Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

How to Implement Asset Leasing Automation to Fix Compliance Complexities through Dynamics 365 Finance and Operations

Implement Asset Leasing Automation in MS Dynamics 365 F&O

Asset Leasing | Financial Automation | Dynamics 365 | Fixed Asset Accounting

Every business residing on leases must have a close eye on strong financial agreements in order to avoid unnecessary spending of business financials. However, regular monitoring for legal contract renewals, varying rates, and service agreements can help businesses to comply with lease accounting processes.

But when your leasing details are spread across multiple platforms, managing them could become a tedious task.

A central software like Dynamics 365 Finance can take all the manual effort out of your way. Built-in classification tests and functionalities in the system can perform critical reporting on your behalf. To put the cherry on top, Dynamics 365 Finance abides under IFRS 16 and US GAAP standards, making all your transactions completely legal.

Such advanced solutions of incorporating complex calculations and functionalities are critical components for journal entries, amortization schedules, and disclosure summaries.

The topic of asset leasing is extensively broad and packed with a lot of financial technicalities, including asset leasing elements, components, and lease classification tests. Therefore, we will cover only a few aspects that are closely related to setting up a lease agreement for an asset in Dynamics 365 Finance.

Why do Companies go for Asset Leasing?

As inclusive support, leasing assets can significantly reduce your financial risks. At the same time, Dynamics 365 automation tools can help you with all the legal terms of the FASB and IFRS accounting regulations.

Once you start putting in all the required information into the Dynamics 365 system, it will perform calculations regarding all leasing management criteria and financial impacts.

Above all, with Dynamics 365 Finance, your financial statements will be free from all sorts of manual errors.

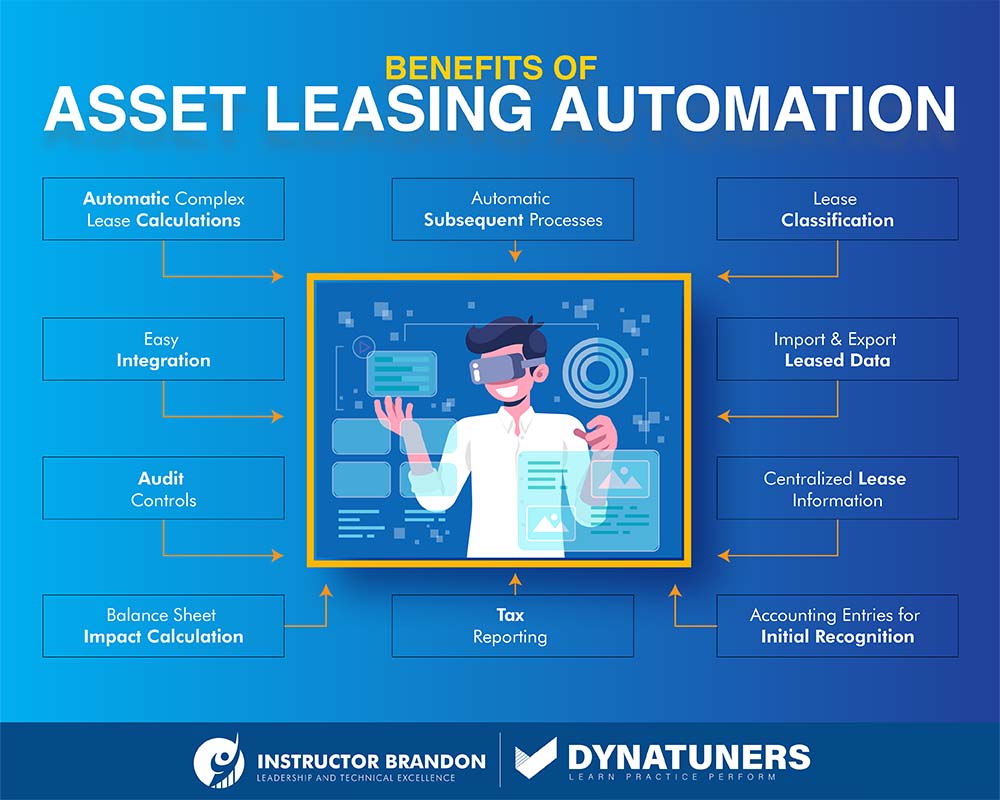

Why Utilize Dynamics 365 for Asset Leasing?

- Dynamics 365 automates complex lease calculations and provides accurate present value of the asset.

- The system Automates subsequent processes, including future lease payment, right-of-use asset depreciation, lease liability, and expense schedules.

- Lease classification is crucial in financing; Dynamics 365 classifies a lease as short-term or low-value by running several tests.

- You can centralize your lease information, including commencement and expiration dates, payment frequency, and transaction currency.

- The functionalities of Dynamics 365 helps generate accounting entries for Initial recognition with lease liability and right-of-use assets.

- With a modernized leasing system, your firm can avoid manual adjustments for transactions due to lease modifications.

- With Dynamics 365, you can use accommodation layers to get precise reporting for taxes.

- Using a balance sheet impact calculator, you can represent leases on a balance sheet complying with all accounting standards.

- You can increase the accuracy of your leasing data with audit controls.

- Audit controls can further help you match posted financial transactions, calculated present value, future payments, and liability amortization.

- Dynamics 365 Finance also allows you to import or export your lease data from Excel with data management.

- The most prominent feature of Dynamics 365 helps you prepare accurate asset leasing reports and disclosure notes.

- System automation also allows easy integration of account charts, vendor journals, fixed assets, data management, currencies, and number sequences.

SUMMARY

Keeping a firm track of your asset leases is a troublesome task, especially without an integrated system. However, all of these features offered in Dynamics 365 Finance are remarkable to revolutionize your lease financing while keeping your firm legally compliant.

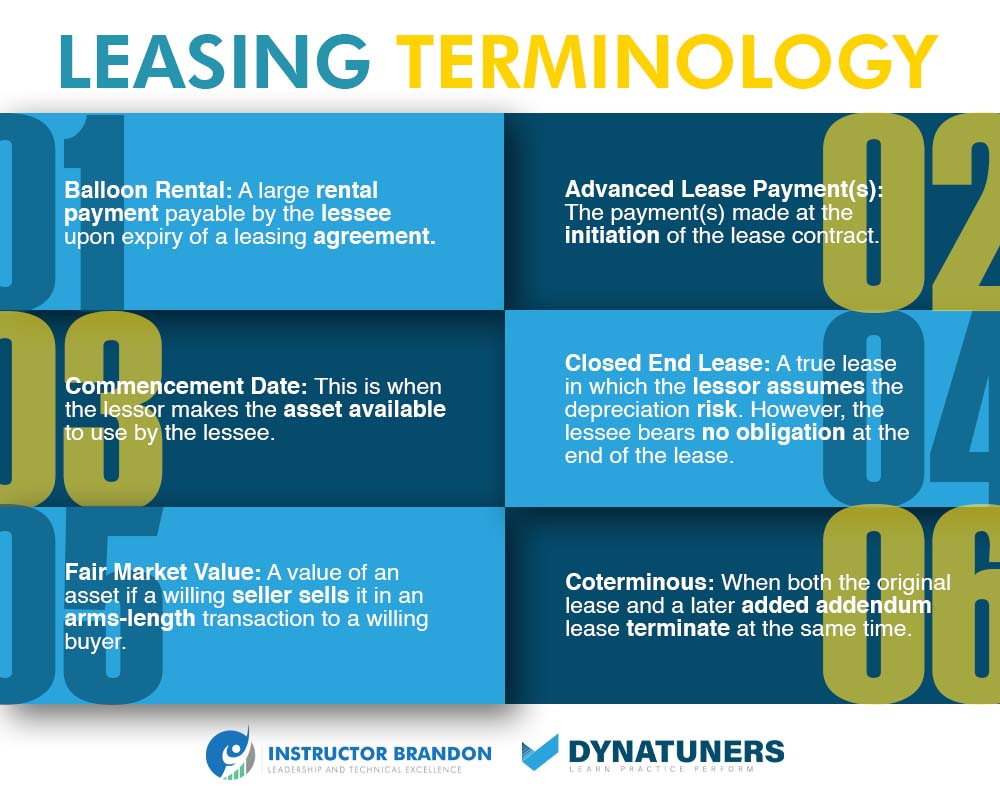

Important Leasing terms

Setting up a leasing agreement in Microsoft Dynamics 365 Finance and Operations is a piece of cake; however, the financial terms may get confusing. So, here are some important leasing terms to help you understand the financial terminologies.

-

Lease

A lease is a contractual term where the owner or the lessor allows the right to use a particular good for some time to the other party. In comparison, the lessee or tenant will pay for the transfer of the right to use an asset regularly.

-

Financial Lease

When all risks and rewards are associated with the transfer of ownership to the lessee is called financial lease under IFRS. A few additional sub-criteria can define this lease type; for example, minimum lease payments’ net present value (NPV) should be at least 90% of the asset’s fair value.

-

Commencement Date

This is when the lessor makes the asset available to use by the lessee. The lessor can assess how they should account for the lease.

-

Fair Market Value

It is a value of an asset if a willing seller sells it in an arms-length transaction to a willing buyer.

-

Incremental Borrowing Rate (%)

The annual % rate for borrowing, expressed as a single percentage representing the actual yearly cost of funds over a term. This includes any fees or additional charges linked with the transaction. If the rate is per month, the annual rate must be calculated based on the lease details.

-

Balloon Rental

A large rental payment payable by the lessee upon expiry of a leasing agreement.

-

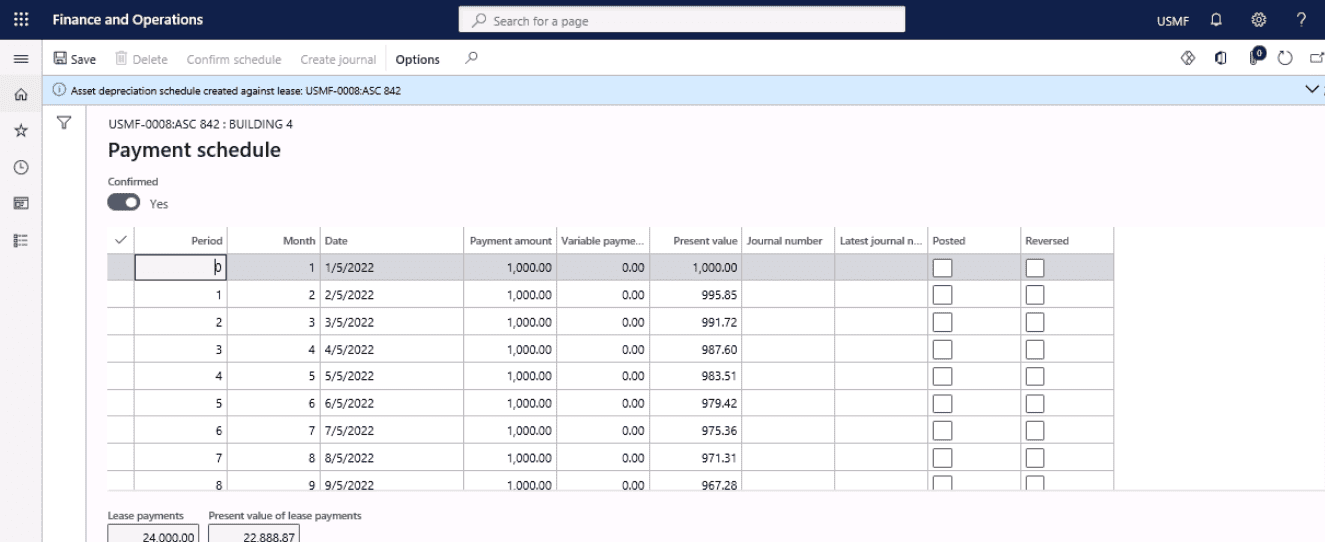

Payment Schedule

Based on the time covered by lease payment, amount of payment, compounding period, and annuity type, the system calculates the net present value through the payment schedule.

-

Incremental Borrowing Rate or Interest Rate

This is the interest rate that Dynamics 365 will use to calculate the net present value. It will use the implicit rate defined in the lease data to calculate the net current value of the lease payments. If the assumed rate isn’t defined, the system will use the incremental borrowing rate.

-

Initial Recognition

It is the calculated net present value to report on the balance sheet. This transaction debits the right-of-use asset account and credits the operating lease liability So, if a fixed asset is associated with the lease, the initial recognition entry will be reflected as a fixed asset acquisition. In this scenario, you must define fixed assets posting a profile to post to the right-of-use asset account.

-

Asset Depreciation

The right-of-use asset depreciates over the asset’s useful life or the lease term, whichever is less. The system calculates the depreciation by dividing the straight-line lease expense and the interest amount. However, the lease depreciation affects the profit and loss statement by debiting interest expense. In addition, the balance sheet is involved by crediting accumulated right-of-use asset account for the financial leases.

SUMMARY

Once you get started with configuring asset leasing terms in Dynamics 365, you will come across all of the above terms. Giving them a quick look will help you a lot in understanding the whole asset leasing framework.

The role of Asset Leasing Framework in Dynamics 365

| Asset Leasing Framework | |||

| Finance | Automation | Integration | Control |

| Complies with accounting standards of IFRS 16 & ASC 842 | Automates lease classification test | Chart of company accounts | Audit controls |

| Dual Currency IAS 21 | Automates complex lease calculations of present value | Fixed assets | Security for lease forms and transactions |

| Adjustments and Index revaluation | Counting lease entries | Accounts payable | |

| Import & export data entries | |||

The above asset accounting framework shows how Dynamics 365 handles leasing agreements. To elaborate, it has four distinct components, finance, automation, integration, and control.

Under its financial component, Dynamics 365 complies with international accounting standards of IFRS 16 & ASC 842 to make every accounting transaction authorized. Secondly, the system provides the option for dual. That means you can specify your own currency with the current exchange rate based on the agreed terms of asset leasing.

Financial Component of Asset Leasing Framework

The financial component of the asset leasing framework automatically makes adjustments and index revaluations. If you have ever worked on asset leasing, you might be familiar with the changing discount and interest rates. These rates can change annually or quarterly, and Dynamics 365 allows you to set those varying rates for your current assets.

Moving onto the automation, the system automates nearly everything. Starting from classification tests, complex calculations, and lease counting entries. Such automation makes the process easier, as it excludes the need for handling multiple spreadsheets.

The asset classification test categorizes leases into four types when it comes to categorizing asset leasing: a low-value lease, short-term lease, operating lease, and financial lease. The below table clearly shows the sorting of leasing types through a simple if then, else gate.

The above chart shows how the leasing classification table classifies leases in an organized way. Without such an automated classification system, you might have to spend several working days just to sort your leases under a single spreadsheet. In addition, the system also signifies which lease you should put on the balance sheet and which one should go on income statements.

SUMMARY

Integration is the most incredible feature of Dynamics 365 Finance. It incorporates all accounting charts, your previously owned fixed assets, accounts payable, and each data entry for import and export.

Further, Dynamics 365 allows you to have control over your company audits. Here you can limit any user to perform specific transactions. Such limitations can let you increase security for leasing forms and transactions.

We are all familiar with the leasing terms and Dynamics 365 framework. Next, we can move to the functional part; this is where you can learn how to set up a leasing agreement in Dynamics 365 Finance.

Creating a Lease for an Asset in D365

Step 1

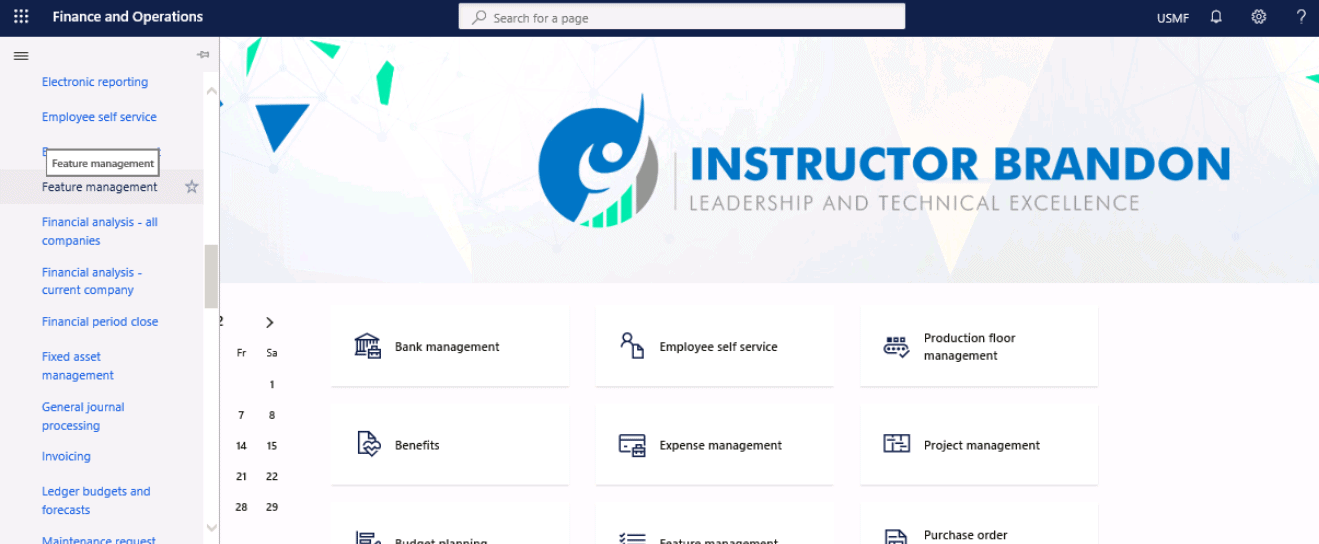

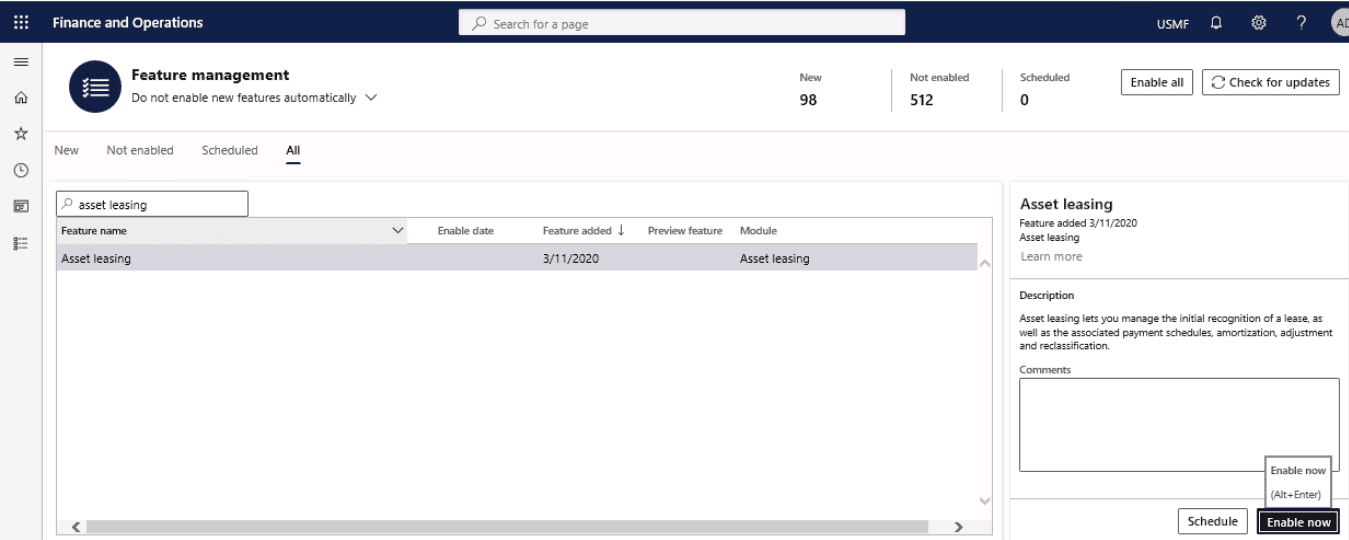

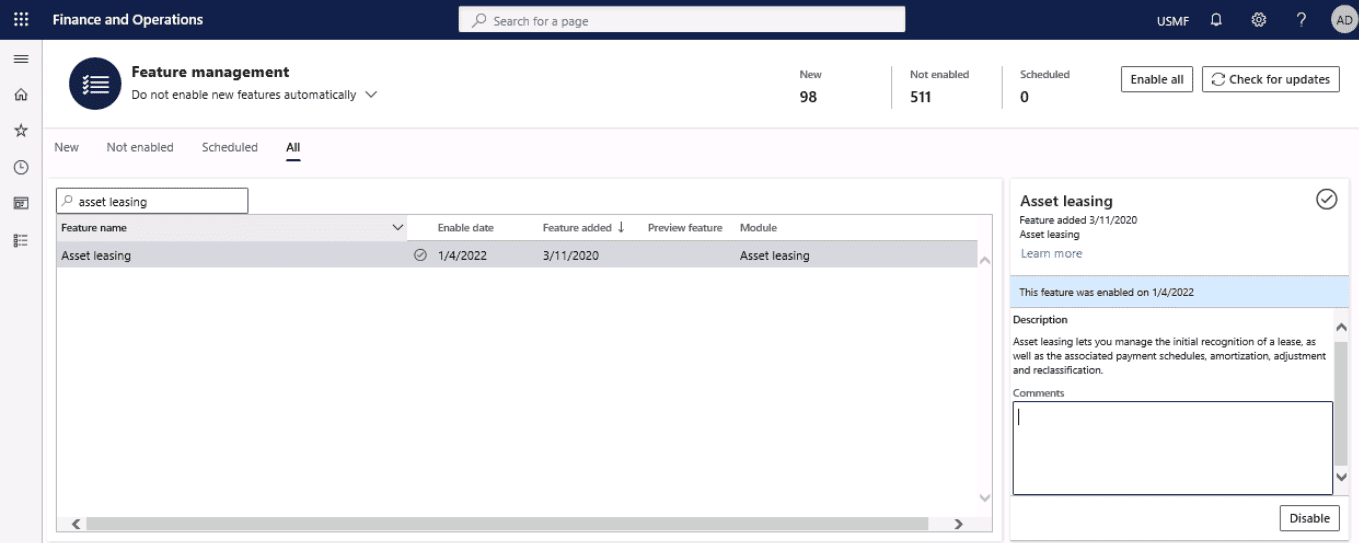

First, Go to Feature management workspace.

Step 2

Search and select the feature named Asset leasing.

Step 3

At the bottom right corner of the screen, Click Enable Now.

Step 4

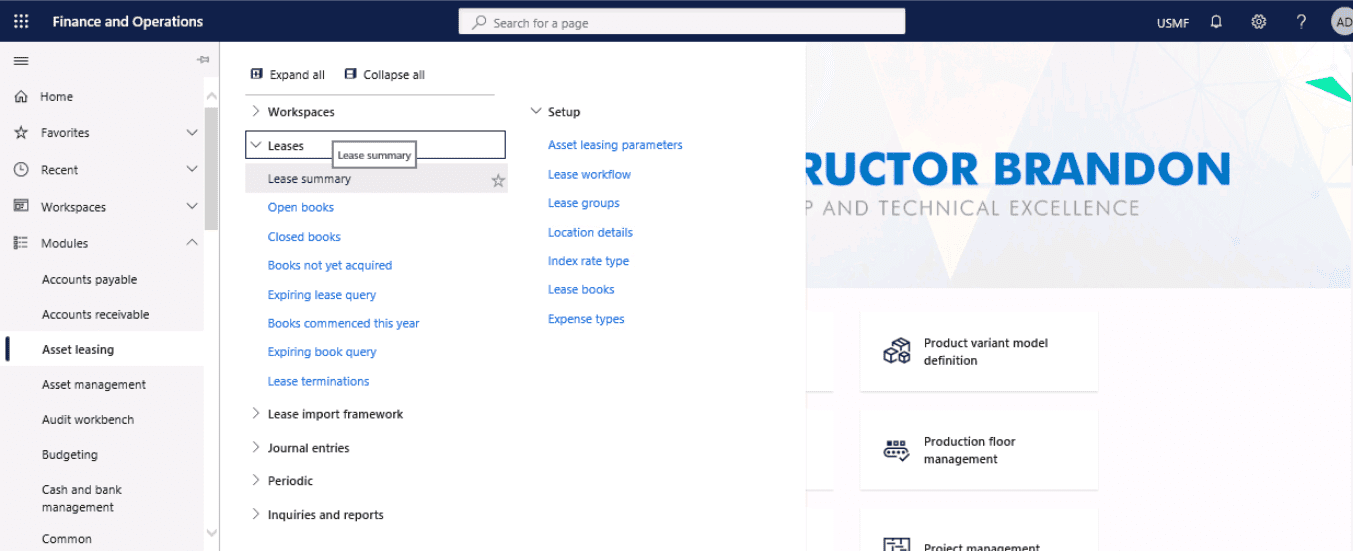

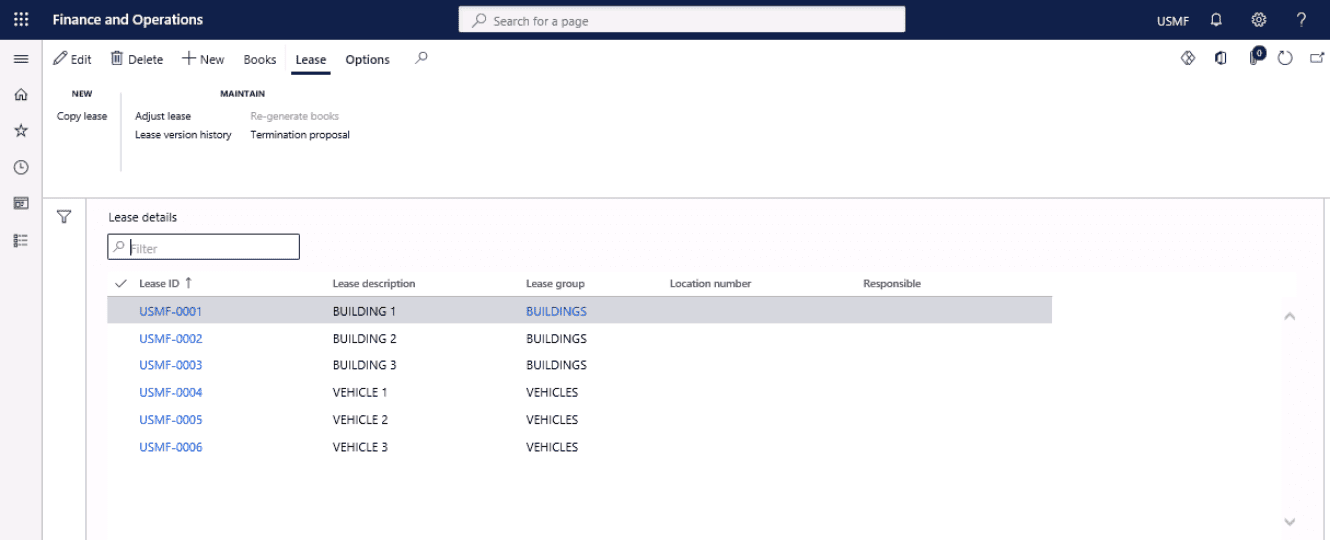

Go to Asset leasing > Lease summary.

Step 5

Click New to create a leasing agreement.

Step 6

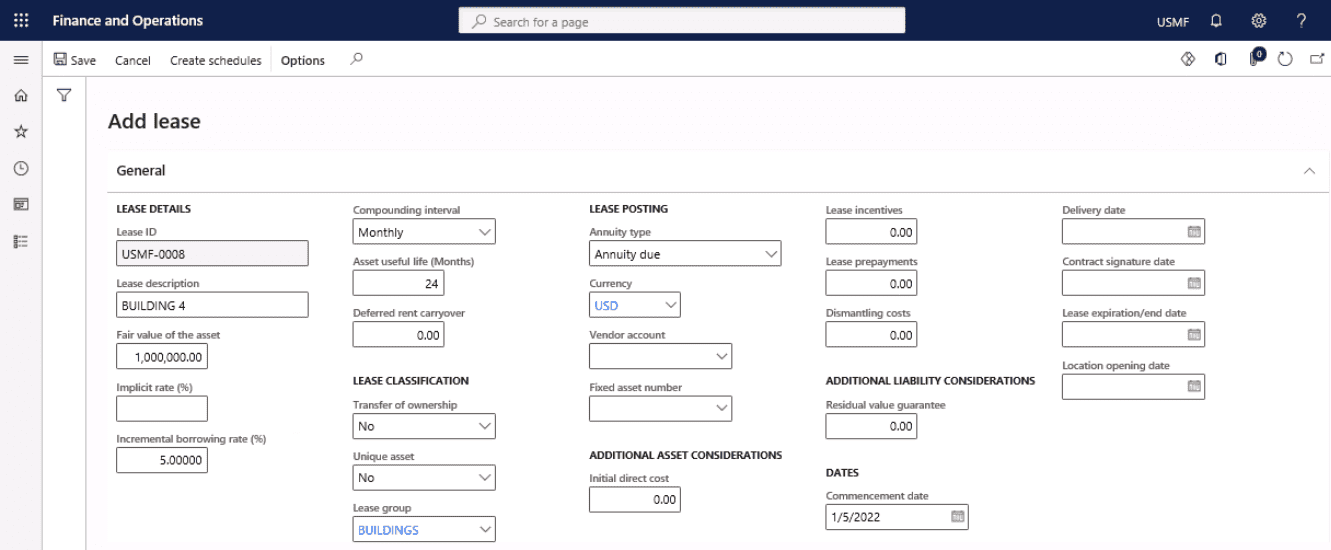

Here you will enter the following fields on the General FastTab.

- Lease details

- Asset useful life (Months)

- Lease group

- Incremental borrowing rate (%)

- Compounding interval

- Annuity type

- Currency

- Commencement date

Step 7

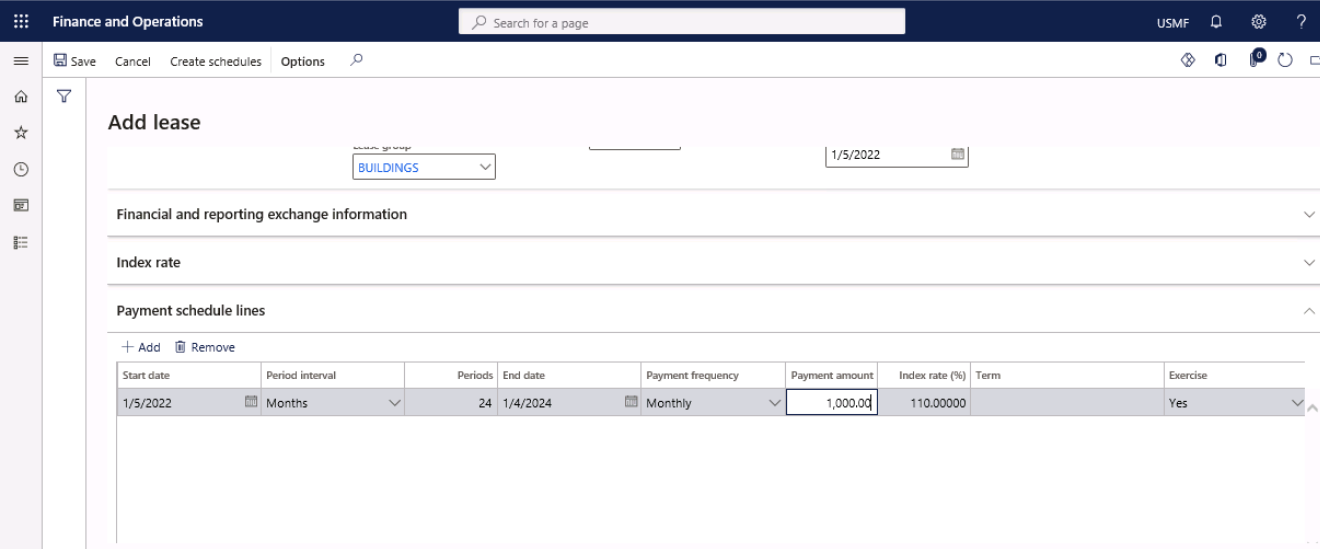

Go to Payment schedule lines FastTab and enter a payment line.

Step 8

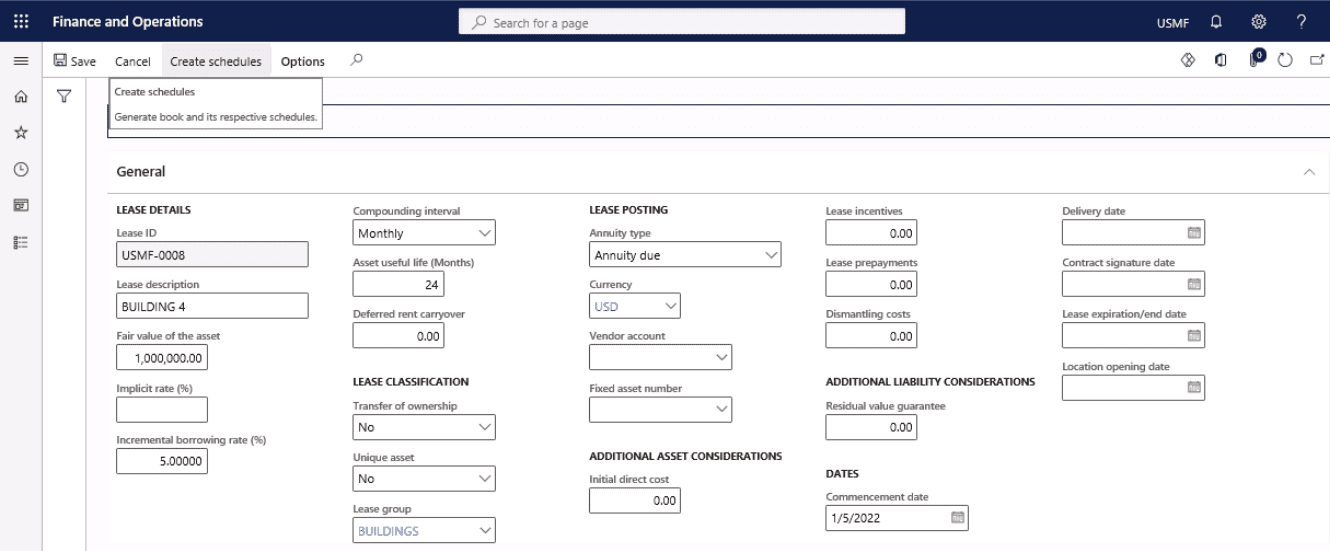

Select Create schedules.

Step 9

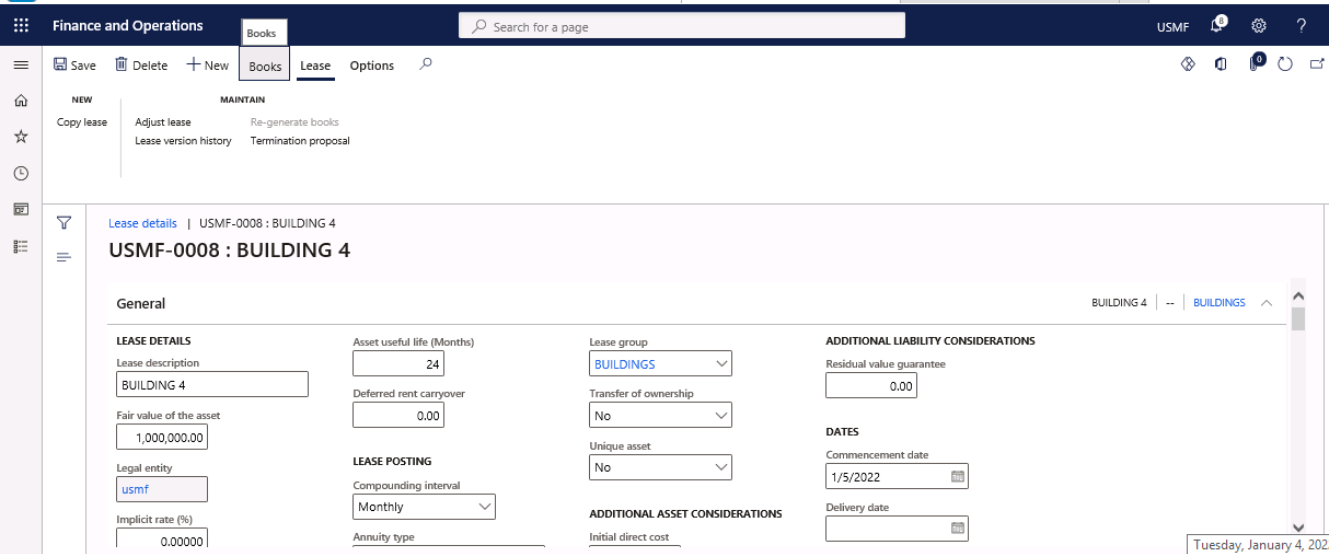

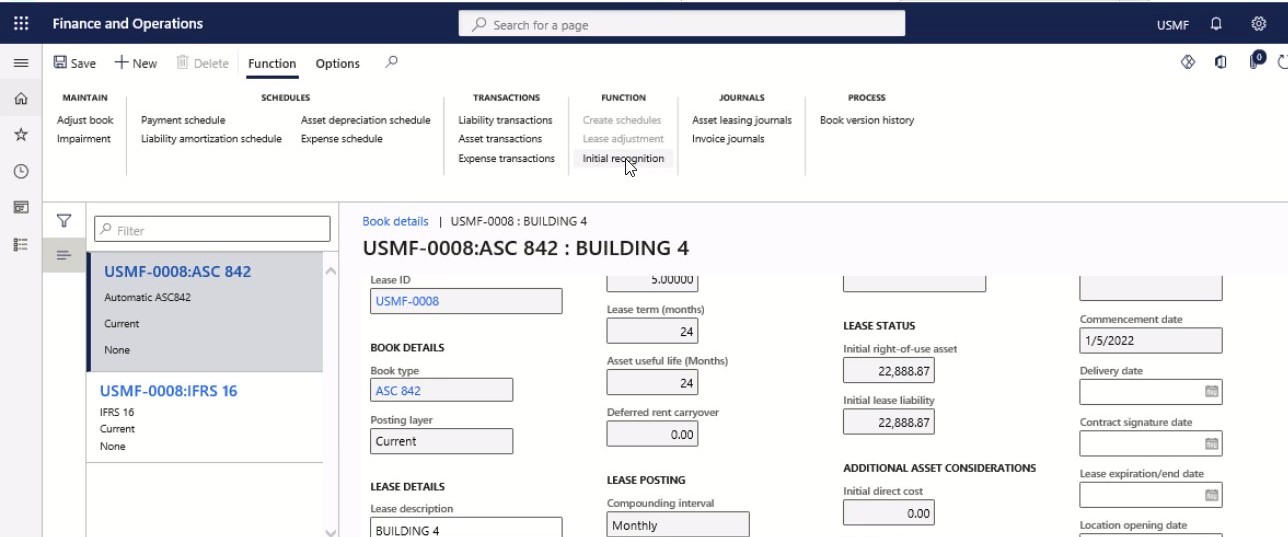

Select Books.

Step 10

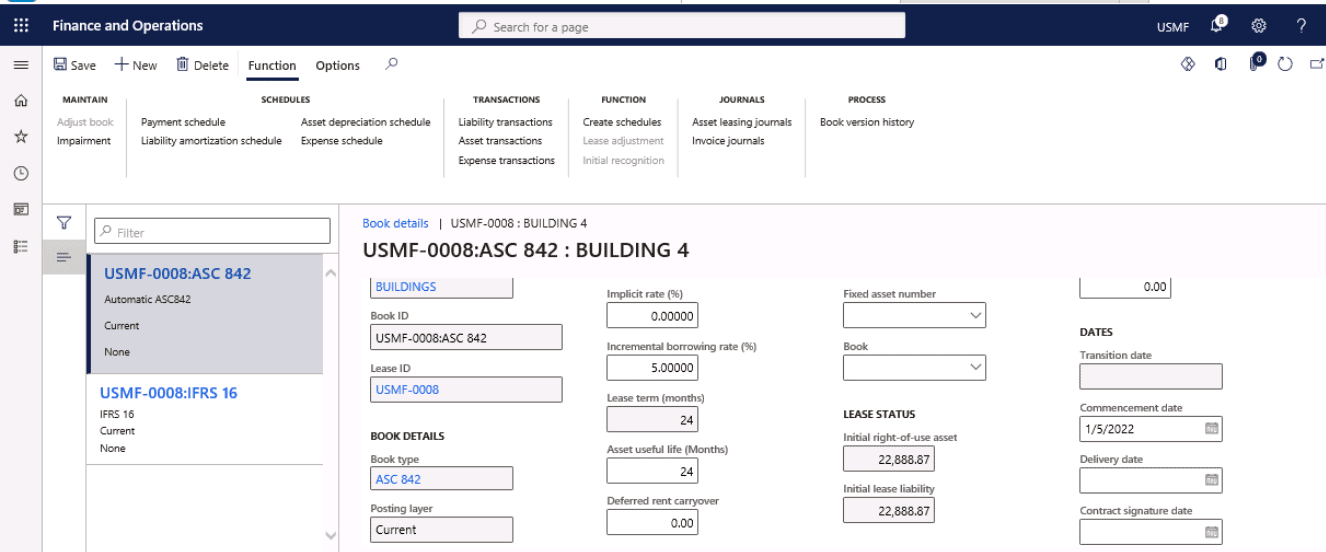

In General FastTab, the Initial right-of-use asset and lease liability are calculated.

Creating payment schedules for lease ID

Step 11

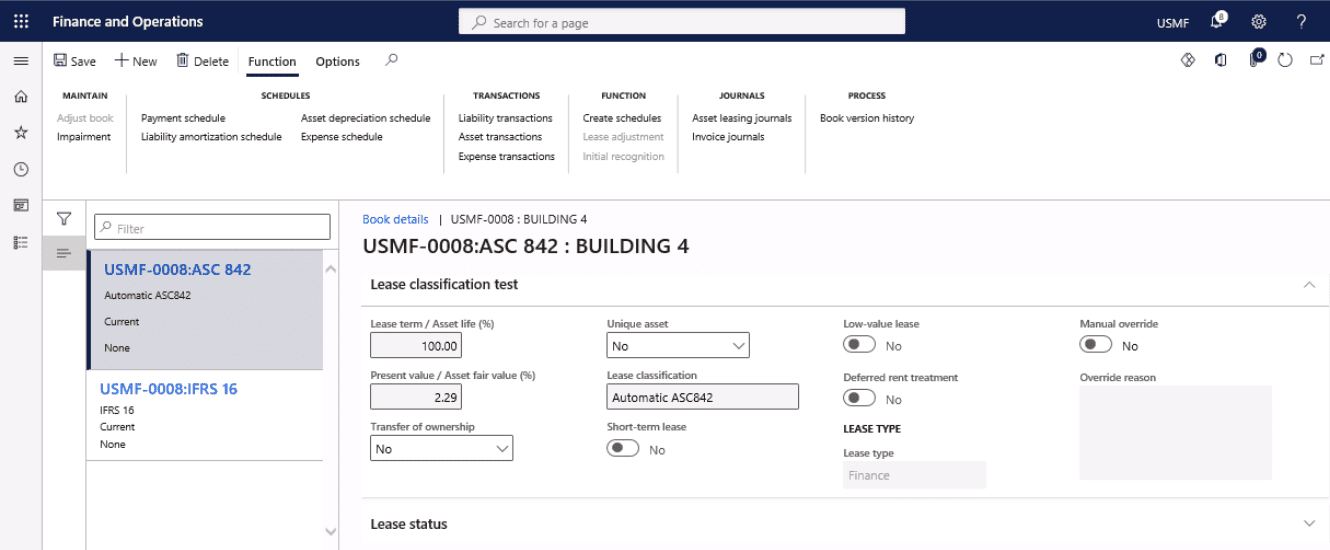

Move to the Lease classification test FastTab to check the value in the Lease type field. The automatic Lease type is classified based on the criteria that are defined on the Books page.

Step 12

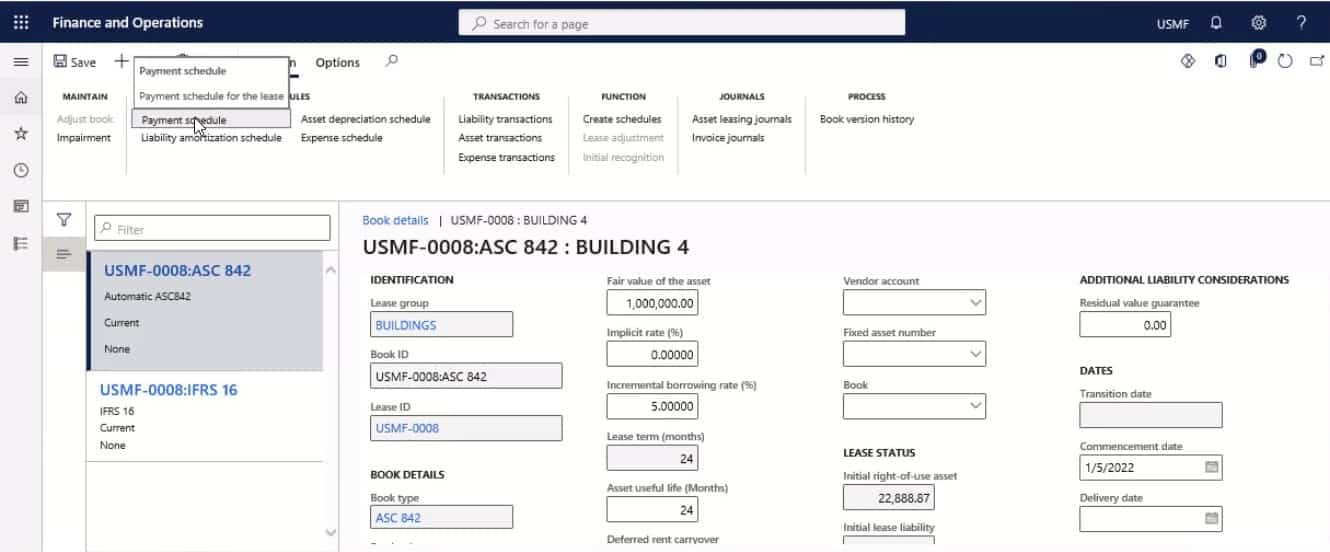

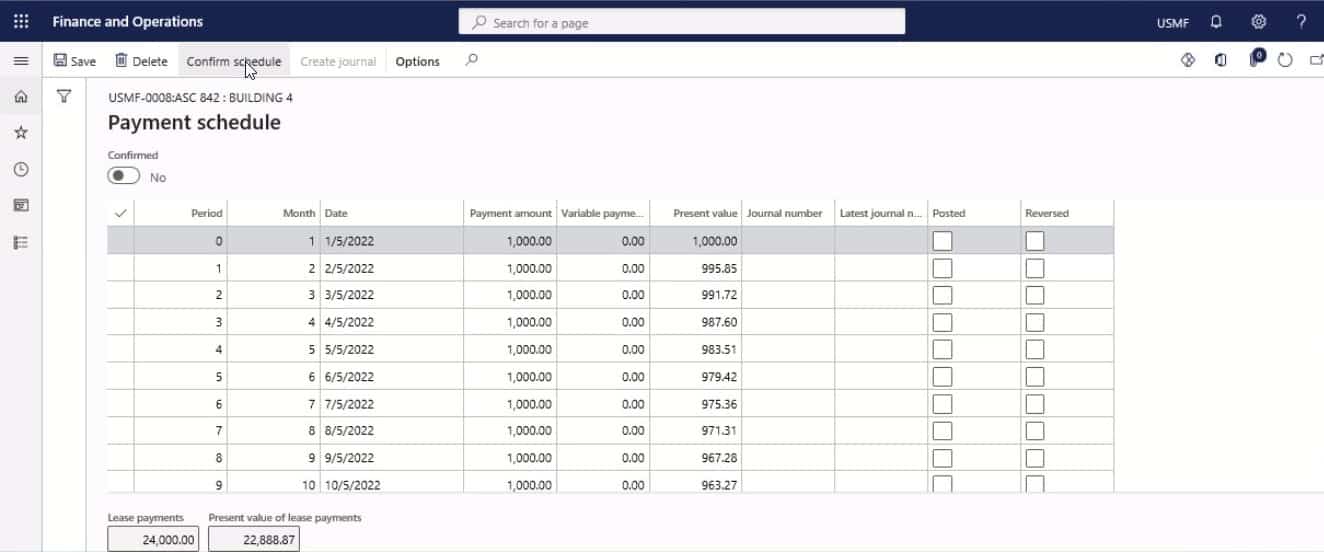

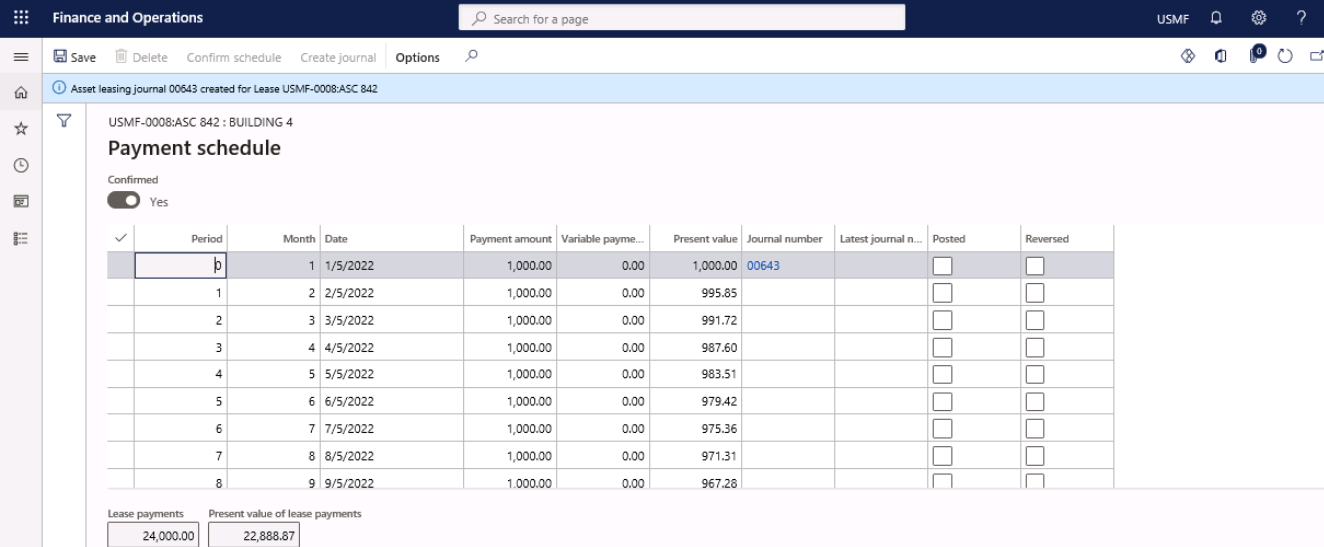

Go to Payment schedule under the Function section. The Payment schedule page lists future payment schedules for a lease ID.

Step 13

Select Confirm schedule.

Creating Journals for initial recognition, lease interest payment, lease payment & lease liability

Step 14

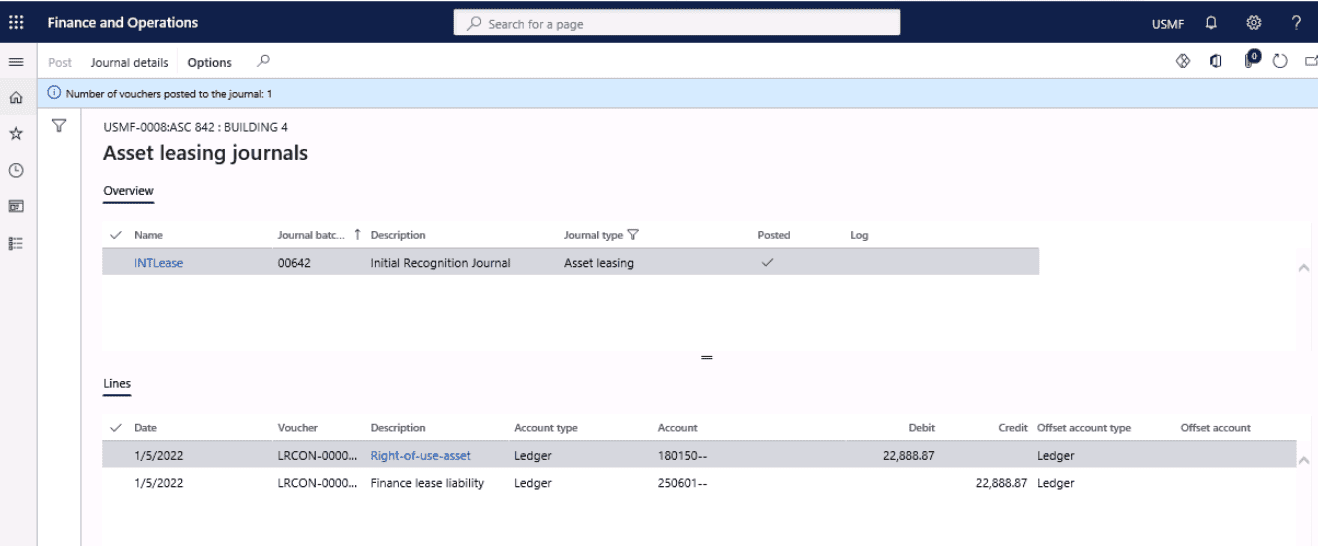

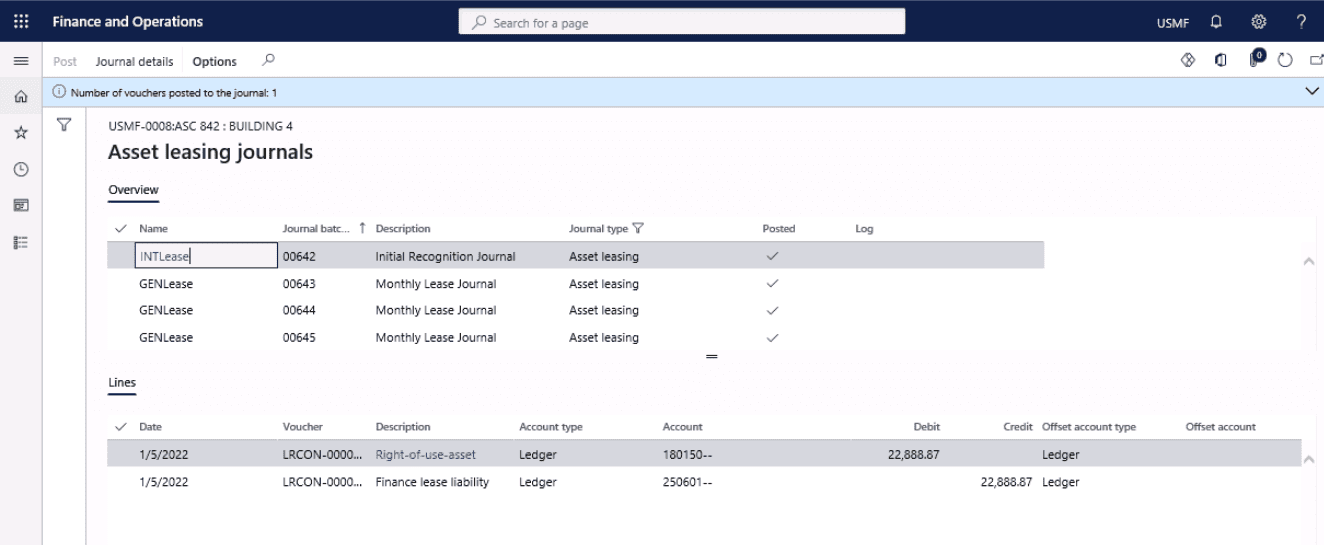

Back in Books page, select Initial recognition to create initial recognition journal.

Step 15

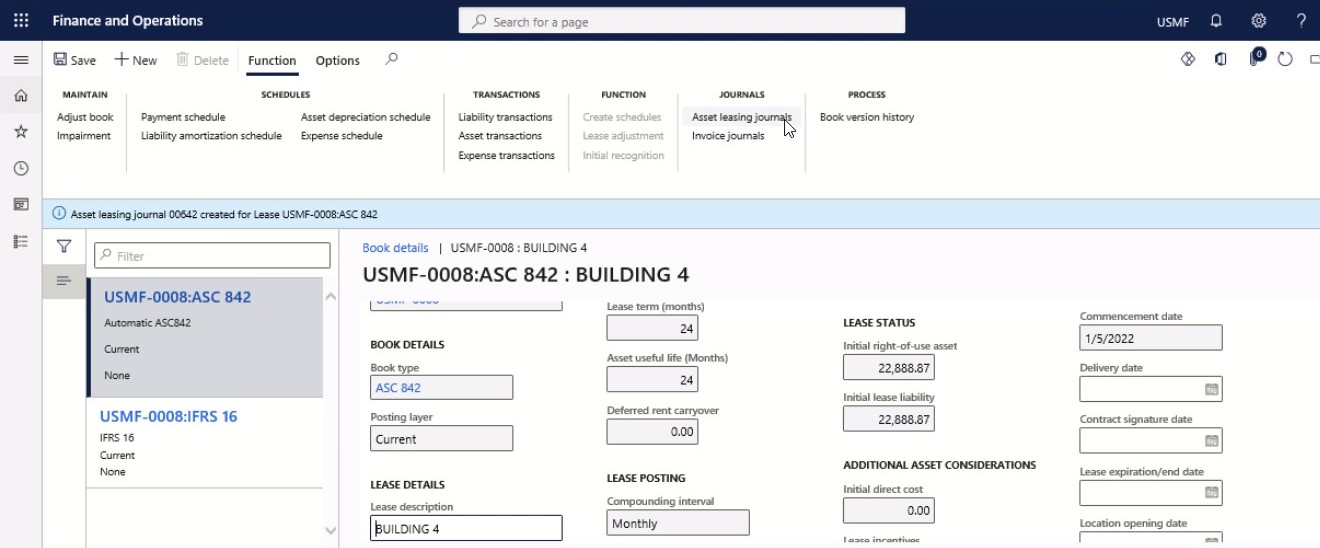

Select Asset leasing journals to post the initial recognition transaction.

Step 16

Back in Books, go to Payment schedule and create a journal.

Step 17

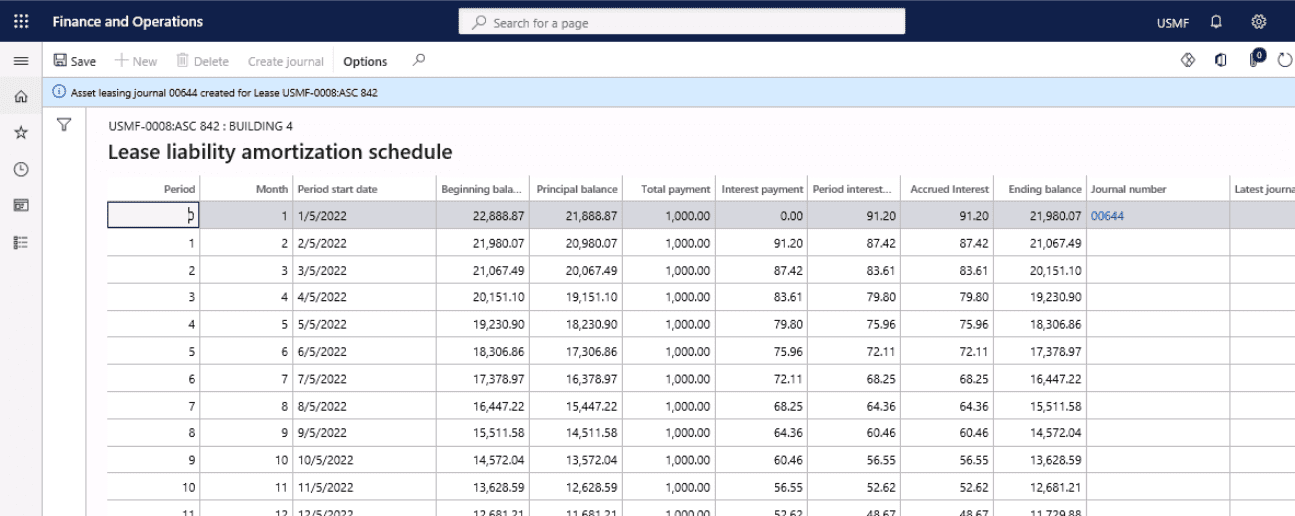

Back in Books, go to Lease liability amortization schedule and create a journal. The Lease liability amortization schedule shows the interest amount that’s calculated for each period.

Step 18

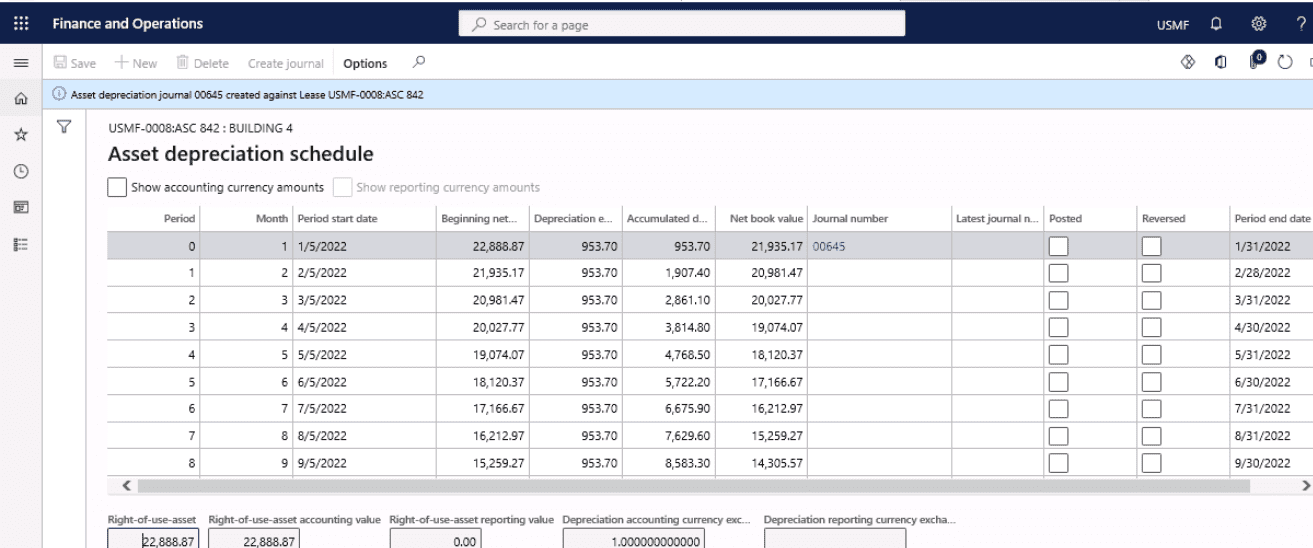

Back in Books, go to Asset depreciation schedule and create a journal The Asset depreciation schedule page shows the depreciation transactions for the selected lease ID.

Step 19

Go to Asset leasing journals and post all the journals created.

Step 20

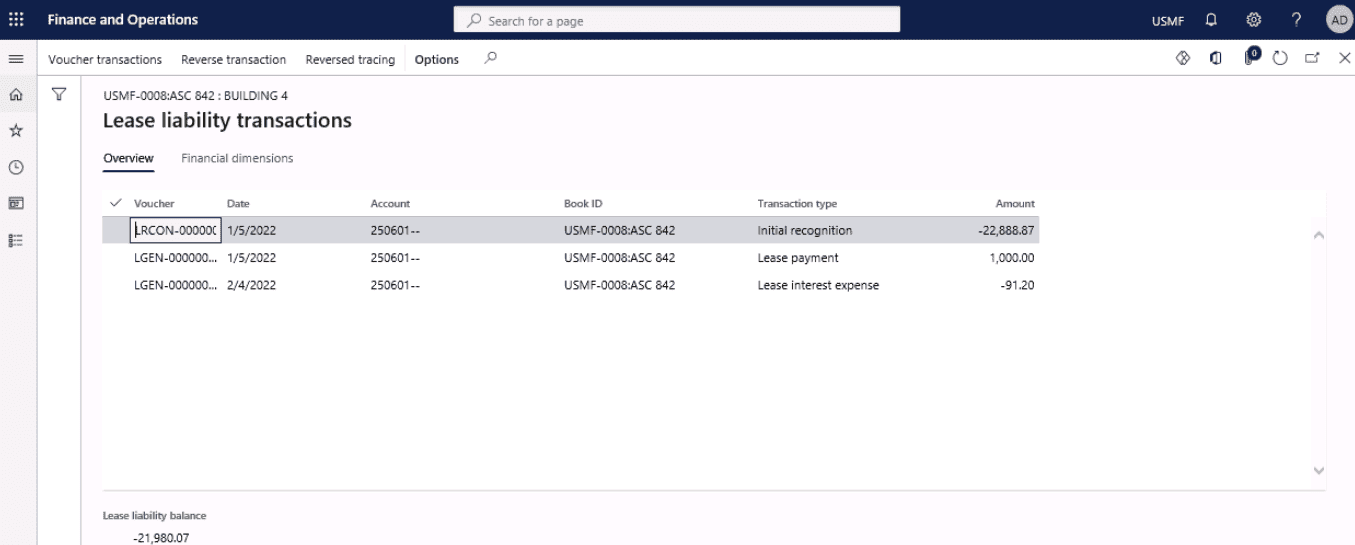

The Lease liability transactions page shows the initial recognition, lease interest payment, lease payment, and the lease liability balance.

Step 21

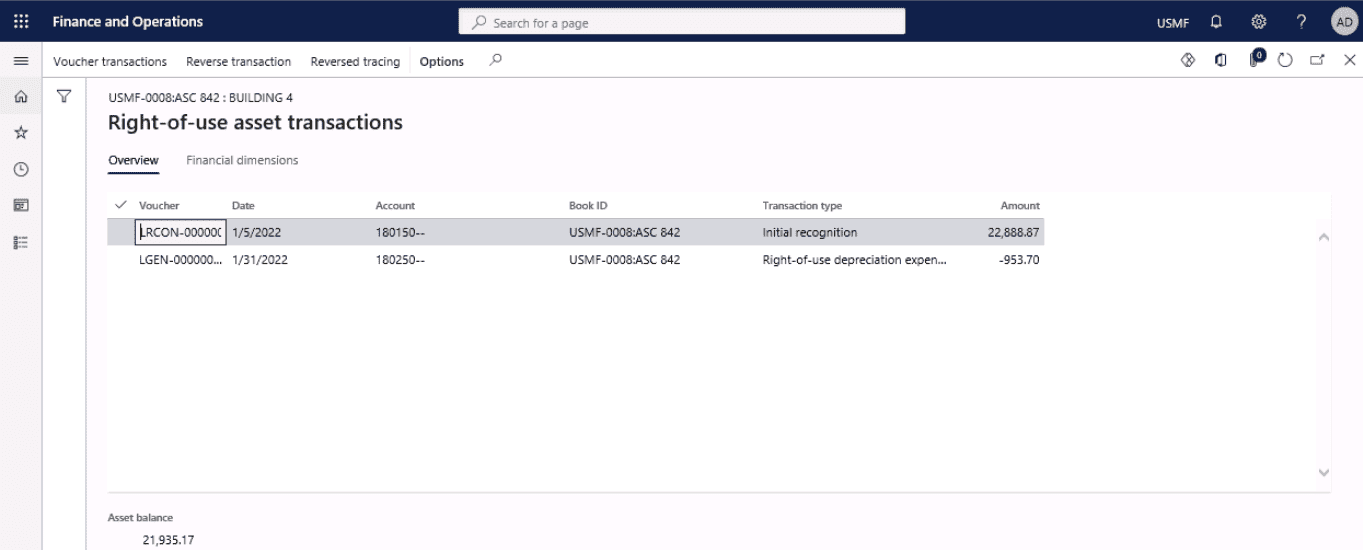

The ROU asset transactions page lists initial recognition and accumulated depreciation.

SUMMARY

The process of setting up an asset lease in Dynamics 365 breaks down into three processes. Starting with enabling asset lease, scheduling payments, creating journals for initial recognition, lease interest payment, lease payment, and the lease liability. The above configuration steps can help you set up a leasing agreement for any asset.

The Bottom Line

Dynamics 365 is a cloud-based system where businesses can migrate their lease information and receive all the benefits outlined above. Further, you can also utilize our critical analysis and advice to get knowledge of the leasing industry and negotiate improved deals.

Automating asset leasing will allow you to cut costs while improving the performance of your leasing portfolio. There will be significantly less time spent seeking and comparing alternative bids, and there will be no more questioning if the quoted agreement is the best available. In addition, the beauty of automated software like LOIS Dynamics 365 eliminates the time and effort involved in lease accounting and management.

Instructor Brandon | Dynatuners has several years of experience as a trusted Dynamics 365 Finance and Operations partner. Like our several satisfied clients, we can assist you with a smooth Asset leasing implementation in Microsoft Dynamics 365 F&O. We can help you automate the system and provide timely and reliable results. Asset leasing is a simple module in D365 that assists users with its different features and components. To get started, Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”Is there a minimum lease value, or are all leases subject to the new standards? ” answer-0=”Unfortunately, the new norm does not have a materiality level. So, your $10/month ice machine on lease should technically be included in your portfolio. This contrasts with IFRS 16, a low-value expedient that eliminates leases valued at $5000 or less. ” image-0=”” headline-1=”h2″ question-1=”What is a right-of-use (ROU) asset, and how do I calculate it? ” answer-1=”The initial amount of the lease debt plus any lease payments made before lease commencement is used to calculate the ROU asset under ASC 842. Next, you add the initial direct expenses (IDC) and remove any lessor leasing incentives (for example, tenant improvement allowances). This formula is the same for both operational and financial leases. These ROU assets are included separately from fixed assets under long-term investments. ” image-1=”” headline-2=”h2″ question-2=”How will I determine the classification of leases under ASC 842? ” answer-2=”Under ASC 840, you would always run the four tests to determine whether the lease was an operating or a capital lease. The FASB removed the FAS 13 bright lines test for ASU 2016-02, similar to how ASC 606 allows for broader management discretion. However, these tests can still be used to determine if the lease is an operating or a finance (previously capital) lease. ” image-2=”” count=”3″ html=”true” css_class=””]

3603

3603