Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training

How to Manage Pricing Constraints in the Fiscal Calendars for Budgeting and Legal Entities through Dynamics 365

Pricing Constraints in D365 Fiscal Calendars for Budgeting

Pricing Constraints Examples | Fixed Asset Depreciation | Fixed Asset Depreciation Schedule | Closing Periods | Examples of Pricing Constraints

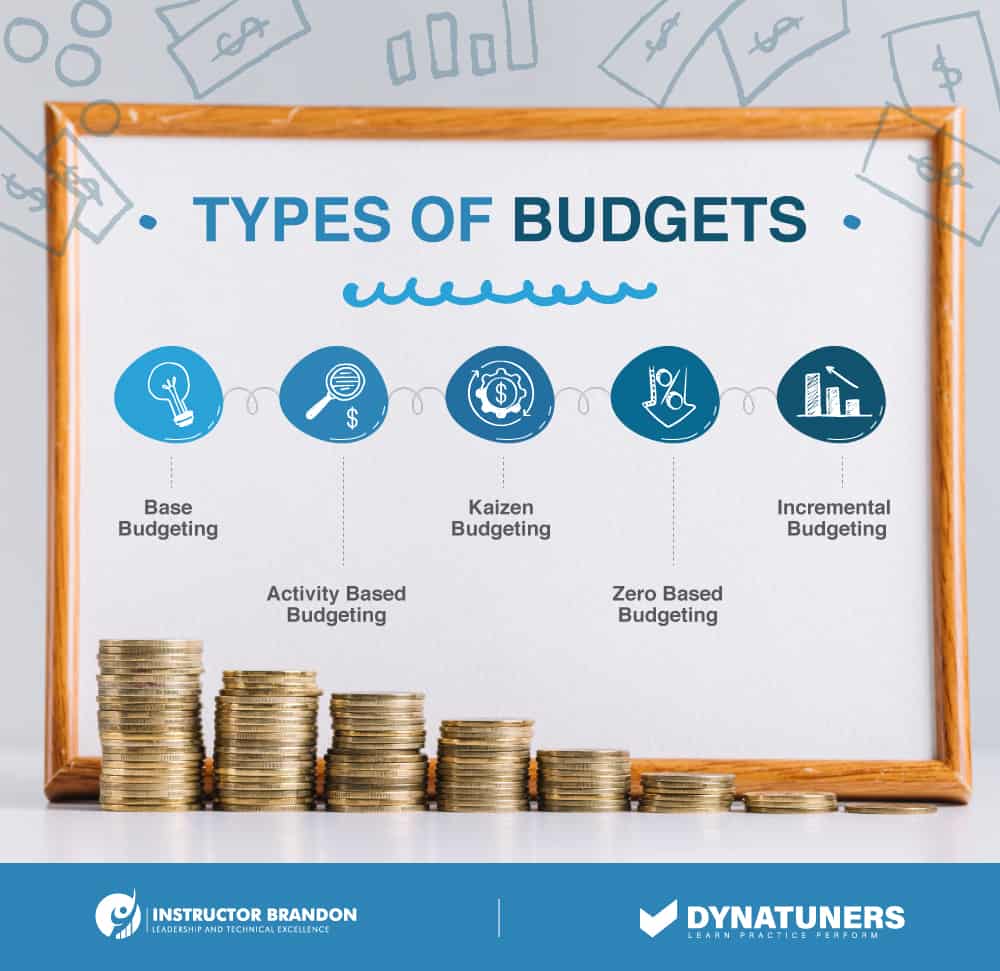

What is Budgeting?

The process of budgeting involves the creation, implementation, and operation of budgets. The administrative process of budget planning and preparation, budgetary control, and the procedures accompany these processes. Budgeting is the most advanced form of accounting in the future, indicating a specific course of action rather than just reporting.

It is a necessary component of managerial strategies such as long-range planning, cash flow management, capital expenditure management, and project management.

Purchase orders may be either paper-based or computerized. One of the advantages of implementing an electronic purchase order is that decision-makers can monitor purchases, view information, and execute payments quicker.

SUMMARY

Budgeting is the future’s most sophisticated form of accounting, suggesting a defined course of action rather than just reporting. For which long-range planning, cash flow management, capital expenditure management, and project management are all required managerial tactics.

The Budget’s Purpose and Goals

Budgeting’s general objective is to plan various stages of company operations, coordinate the actions of the firm’s many divisions, and maintain effective control over it.

To do this, a budget seeks to fulfill the following goals:

- First, to forecast the firm’s future sales, manufacturing costs, and other expenditures to maximize revenue while minimizing the risk of company loss.

- To forecast the firm’s future financial state and future need for cash to be used in the company to ensure the firm’s viability.

- Determine the capitalization composition in order to guarantee that funds are available at a fair cost.

- To coordinate the work of the firm’s many divisions toward shared goals.

- Increase the efficiency of the organization’s many divisions, subdivisions, and cost units.

Budgeting

Budgeting often starts when managers get upper management’s predictions and marketing project goals for the following year, as well as a timeline for budget completion. The projections and objectives established by upper management serve as guidance for the preparation of departmental budgets. Dynatuners is available to assist you with Help Desk Support throughout the installation, update, or migration of your Microsoft Dynamics 365 projects. To contact us, please click here.

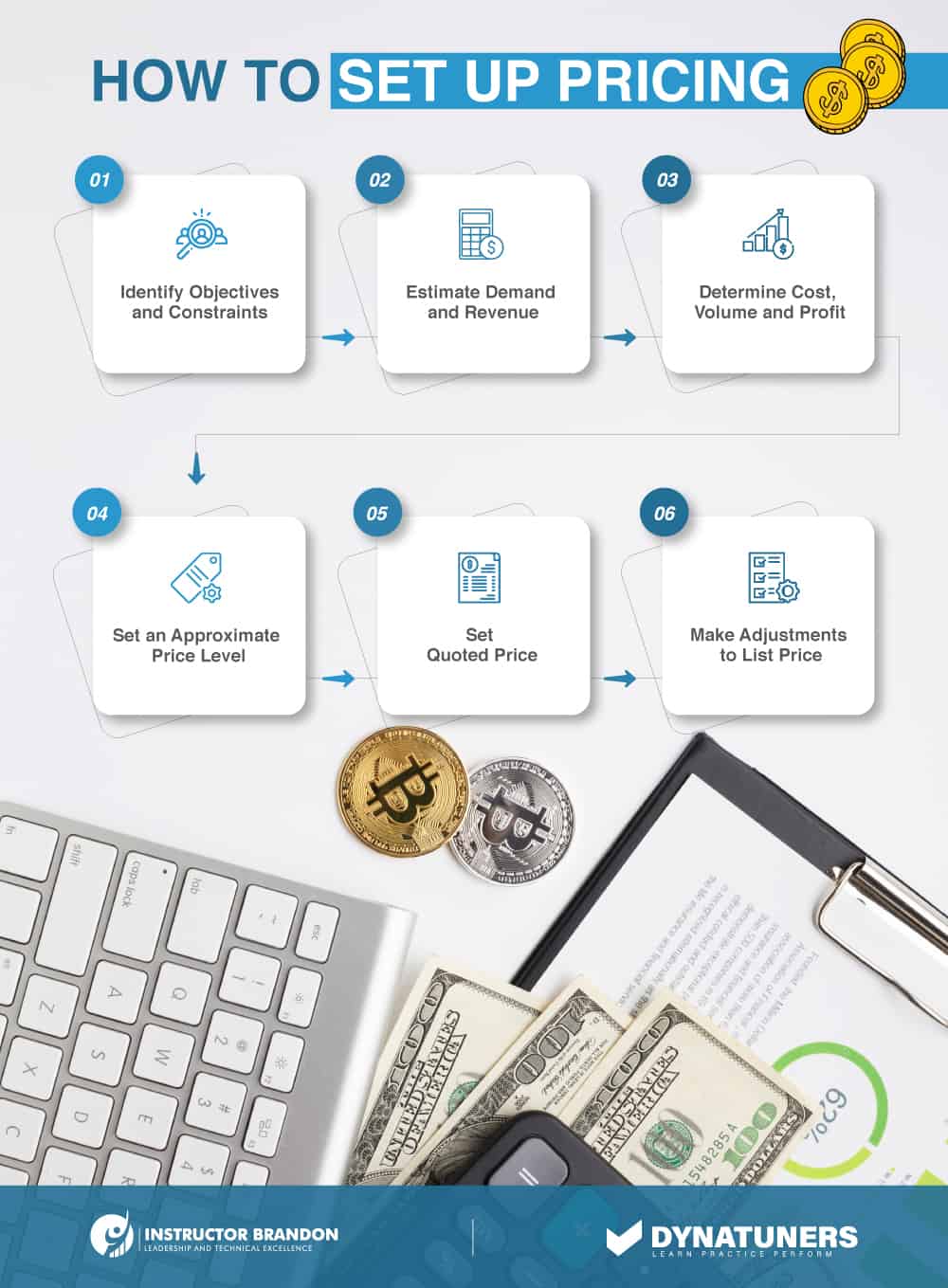

Appropriate pricing of your goods or services may make or break your business in a new market. So, it’s a vital component of any worldwide marketing plan, affecting everything from perceptions of quality to how your brand compares to the competition, even if your product is cheap in your target market.

To get optimal pricing, various areas of knowledge must collaborate, including finance, accounting, sourcing, legal, responsibilities, insurance, and marketing. However, even with all of the above, additional limits apply when your goods or services are across international boundaries. To read more on our latest blog, click here.

SUMMARY

Budgeting’s general objective is to plan various stages of company operations, coordinate the actions of the firm’s many divisions, and maintain effective control over it. Appropriate pricing of your goods or services may make or break your business in a new market.

Pricing Constraints Overview

By understanding the seven primary price restrictions that your company may encounter, you can guarantee that your pricing plan is competitive, lawful and most importantly, profitable. Competitive marketplaces may be classified into four types: monopoly, oligopoly, monopolistic competition, and pure (or perfect) competition. We have discussed these four market structures in-depth as part of competitive forces. The chart below summarizes the pricing constraints.

Constraints on pricing are the variables that restrict the flexibility with which a corporation may determine its prices. Pricing is subject to several limits. As primary price limitations, we shall evaluate the following:

- Demand for the product category, the product itself and the brand

- Product novelty: stage in a product’s life

- Difference between a single product and a product line

- Costs associated with manufacturing and marketing the product

- The cost of adjusting prices and the time during which they take effect

- Competitive market segments

- Prices of competitors

Firms may choose to price their products to maximize their present earnings or their long-run profitability. Maximizing their current profit aims, such as for this quarter or year, is widespread owing to the rapid evaluation of performance and realization of outcomes. On the other hand, the disadvantage of a short-run profit orientation is that enterprises may make quality sacrifices in pursuit of quick profit.

When corporations choose to price for long-term profitability, as Japanese automobile and computer manufacturers do, they are ready to forego immediate profit to build high-quality goods that will eventually dominate markets.

Return on Investment (ROI)

Additionally, firms may have a target return aim. It entails a business defining a target for return on investment (ROI) for example, 20%.

- ROI = 100 percent (Net profit after taxes / Investment)

- Revenue from Sales Objective

- Revenue = price multiplied by amount sold

Businesses may pursue a price aim that enables them to improve their sales revenue. However, increased sales income does not guarantee increased profits since costs are included in earnings. Increased sales income, on the other hand, would result in a rise in market share. The market share is calculated as the ratio of its sales revenues or unit sales to those of the industry. Gaining market share promotes brand recognition and revenue. Therefore, businesses may price their goods to increase their market share.

Businesses may price according to unit volume or the amount sold. According to the law of demand, price and quantity desired are inversely connected. Reduced costs increase the amount requested. The effect on revenue is dependent on the demand elasticity, which we shall define in the next lesson.

Profits, sales income, unit volume, and market share are often less significant than survival for a business. As a result, market competition may compel certain enterprises to reduce their pricing to the point of experiencing losses.

|

Sr. |

Determinants of Pricing | |

| Factors Related to Price | Factors Affected by Price | |

|

1. |

Price Index Relative to Product Group |

|

|

2. |

Price Index Relative to Lookalike Products | |

|

3. |

Cumulative Price Change Over Time | |

|

4. |

Promotional Mechanics | |

|

5. |

Price Itself | |

|

6. |

Discounts | |

SUMMARY

Competitive marketplaces may be classified into four types: monopoly, oligopoly, monopolistic competition, and pure (or perfect) competition. By understanding the seven primary price restrictions your company may encounter, you can guarantee that your pricing plan is competitive, lawful, and profitable. Profits, sales income, unit volume, and market share are often less significant than survival for a business. Businesses may price their goods to increase their market share. According to the law of demand, price and quantity desired are inversely connected.

Fiscal Calendars, Fiscal Years, and Periods

Fiscal calendars, fiscal years, and fiscal periods allows us to use them diligently in the context of legal companies, fixed assets, and budgeting.

The fiscal calendars serve as a foundation for an organization’s financial operations. Each budgetary calendar comprises one or more fiscal years, each of which is incorporated of many periods.

You may construct a single fiscal calendar for the five legal entities that share a fiscal year and then separate fiscal calendars for the other legal organizations.

SUMMARY

Fiscal calendars serve as a foundation for an organization’s financial operations. Each fiscal calendar is self-contained inside your business and maybe utilized by various legal organizations. As a result, the number of fiscal calendars or fiscal years created for a fiscal calendar is unlimited.

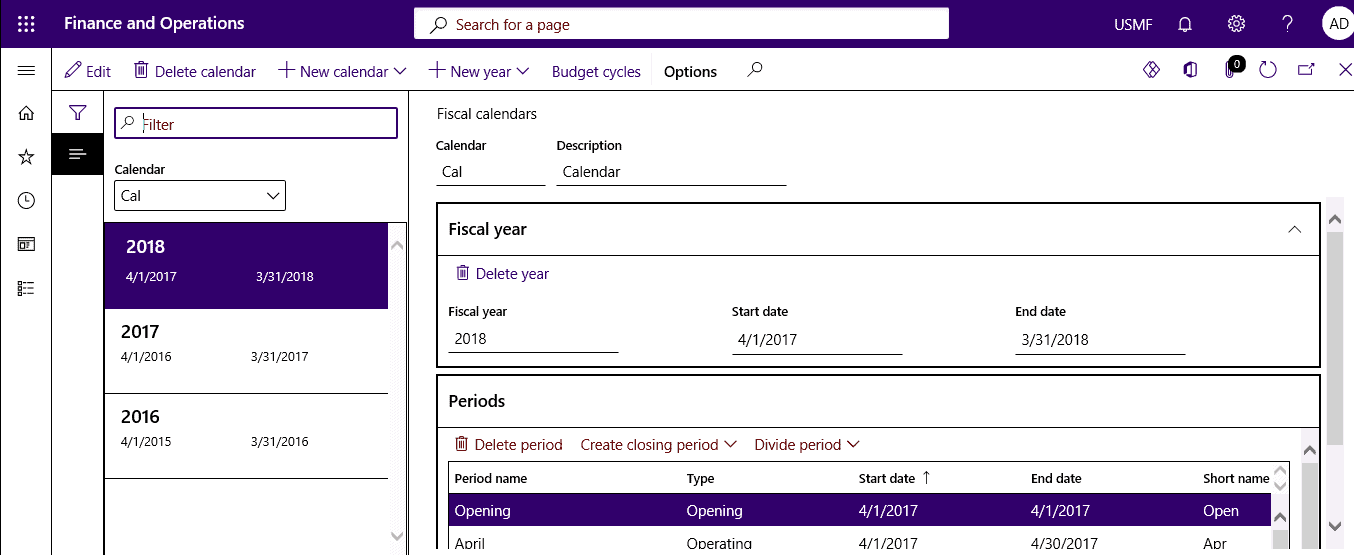

Create Fiscal Calendars, Fiscal Years, and Periods in Dynamics 365

You may create and remove fiscal calendars, fiscal years, and periods on the Fiscal calendars page. Additionally, you may split current periods and construct closing periods to conclude a fiscal year.

A closure period is used to categorize general ledger transactions at the end of a fiscal year. When closing transactions are contained inside a single fiscal period, generating financial statements that include or omit various kinds of closing entries is simpler. When a fiscal year is split into twelve fiscal periods, the closing period is often the thirteenth. However, a closure period may be produced from any open period. When creating a closure period, choose one that is open and contains the dates you wish to utilize.

SUMMARY

You may create and remove fiscal calendars, fiscal years, and periods on the fiscal calendars page. You may also construct closing financial periods to conclude a fiscal year. Closing transactions are contained inside a single fiscal period to make it easier to generate financial statements.

Choose from a range of Fiscal Calendars for General Ledger, Fixed Assets, and Budget Cycles

Fiscal calendars are used to monitor fixed asset depreciation, financial transactions, and fiscal cycles. When you create a fiscal calendar, you may use it for a number of purposes. For example, you may convert a fixed asset book to a fixed asset calendar by selecting a fiscal calendar. Likewise, you may convert a ledger’s fiscal calendar to a ledger calendar by choosing a fiscal calendar. Additionally, you may make it a budget calendar by selecting a fiscal calendar for a budget cycle. All of these may be accomplished using the same fiscal calendar.

SUMMARY

Fiscal calendars are used to track depreciation on fixed assets, financial transactions, and fiscal cycles. You may convert a fixed asset book to a fixed-asset calendar by selecting a fiscal calendar. Additionally, you may make it a budget calendar for a budget cycle. All of these can be accomplished using the same calendar.

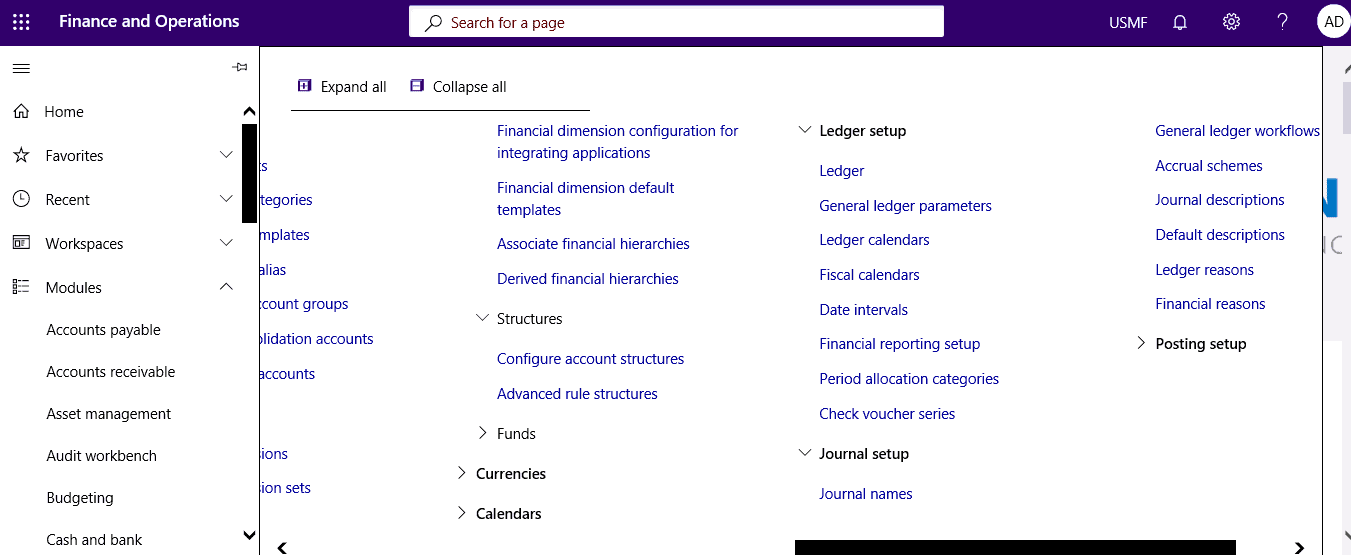

Functional Walkthrough for Fiscal Calendars for Budgeting and Legal Entities in Dynamics 365

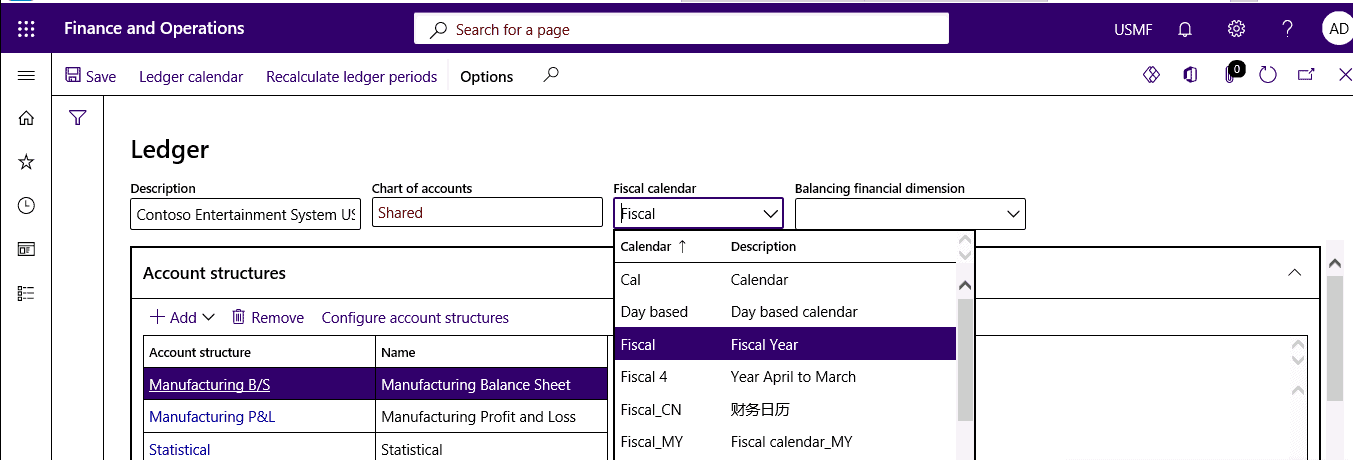

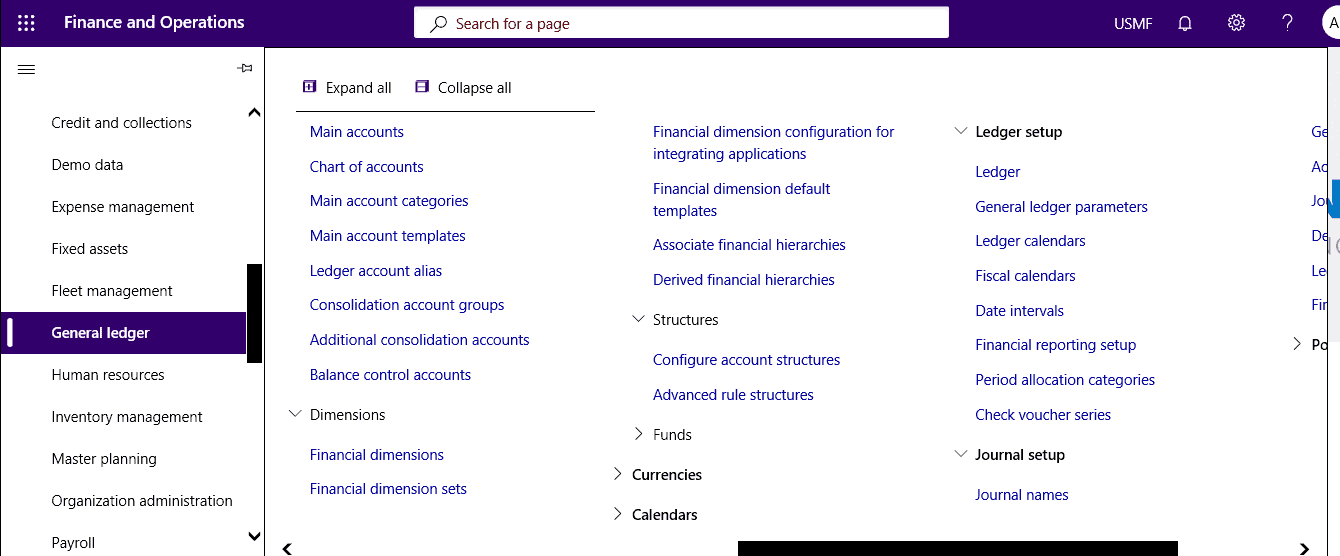

STEP 1: Select a fiscal calendar for your legal entity

In the Ledger form, choose the fiscal calendar for your legal entity’s Ledger. Each legal organization must have a fiscal calendar set on the Ledger page. After selecting a fiscal calendar, you can configure period statuses and permissions for any period comprising a fiscal year on the Ledger calendar page.

Step 1

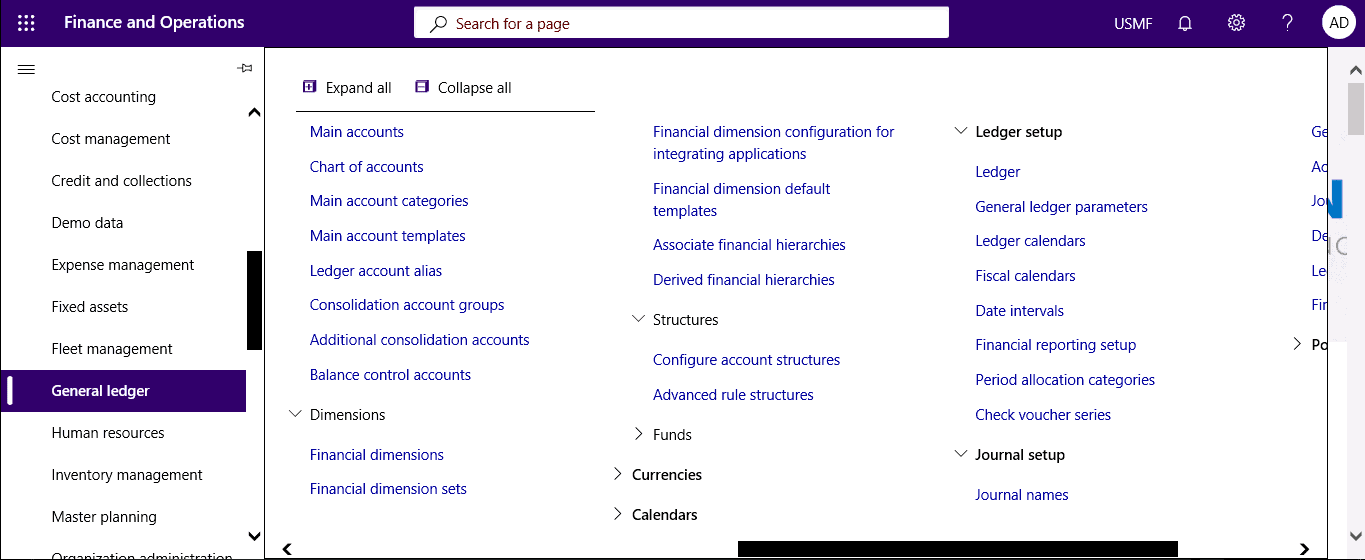

Go to General ledger > Ledger Setup > Ledger.

Step 2

Choose the fiscal calendar for your legal entity’s ledger.

Step 3

From Ledger, go to Ledger calendar in the action pane. Set up period statuses and permissions on the Ledger calendar page.

STEP 2: Decide on a fiscal year for fixed assets

You may provide a fiscal calendar for a fixed asset book, in which all fixed assets that reference the specified text will be utilized. You may choose between any of the fiscal calendars set on the Fiscal calendars page.

Step 1

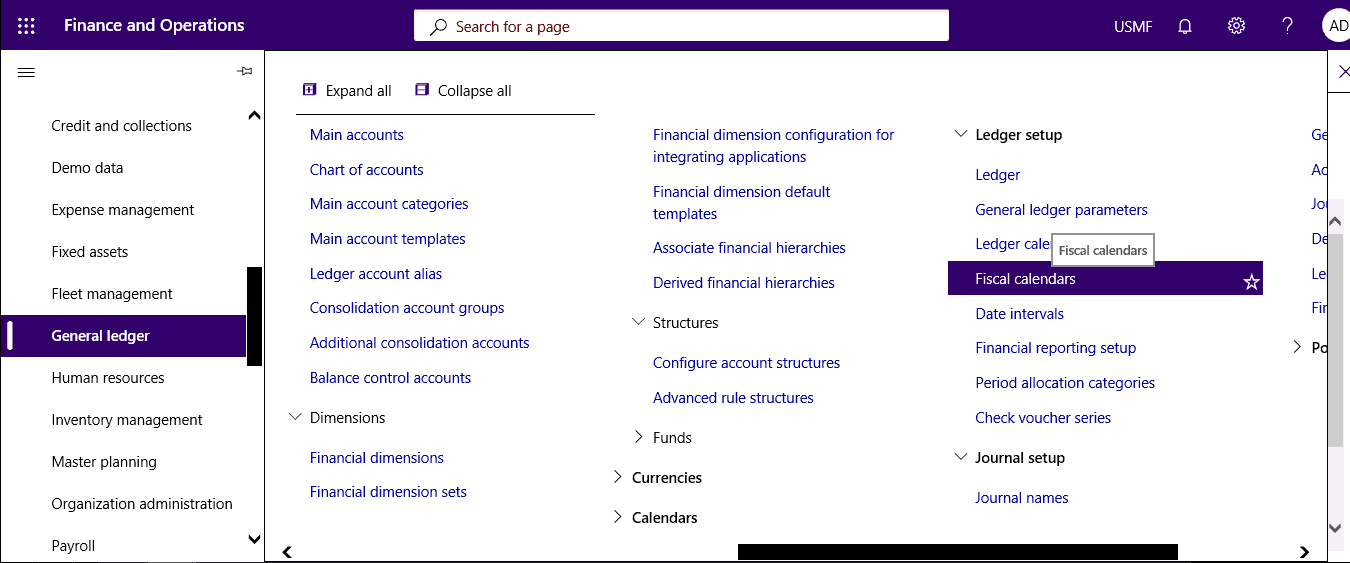

Select General ledger > Ledger setup > Fiscal calendars.

Step 2

You can select from any fiscal calendar that is defined on the Fiscal calendars page.

STEP 3: Define the Time Lengths for Budget Cycles

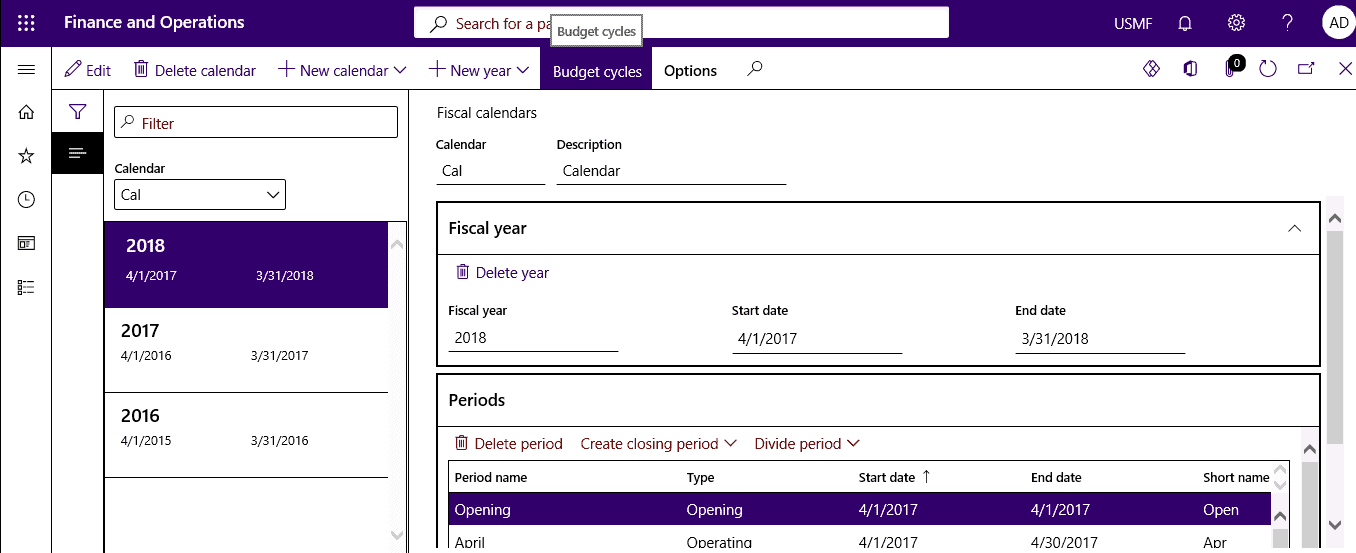

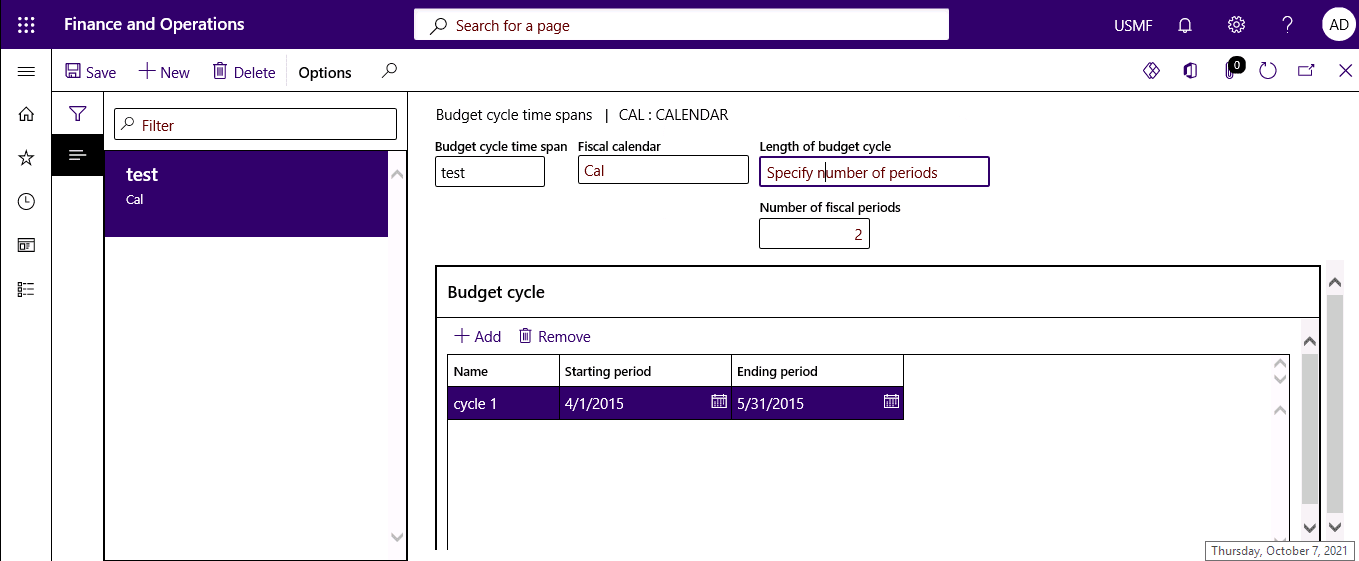

Budget cycles may span a single fiscal year or numerous fiscal years, such as a two-year or a three-year budget cycle.

Step 1

Select General Ledger > Ledger setup > Fiscal calendars.

Step 2

In the action pane, choose Budget cycles.

Step 3

Specify the budget cycle time on the Budget cycle time span page.

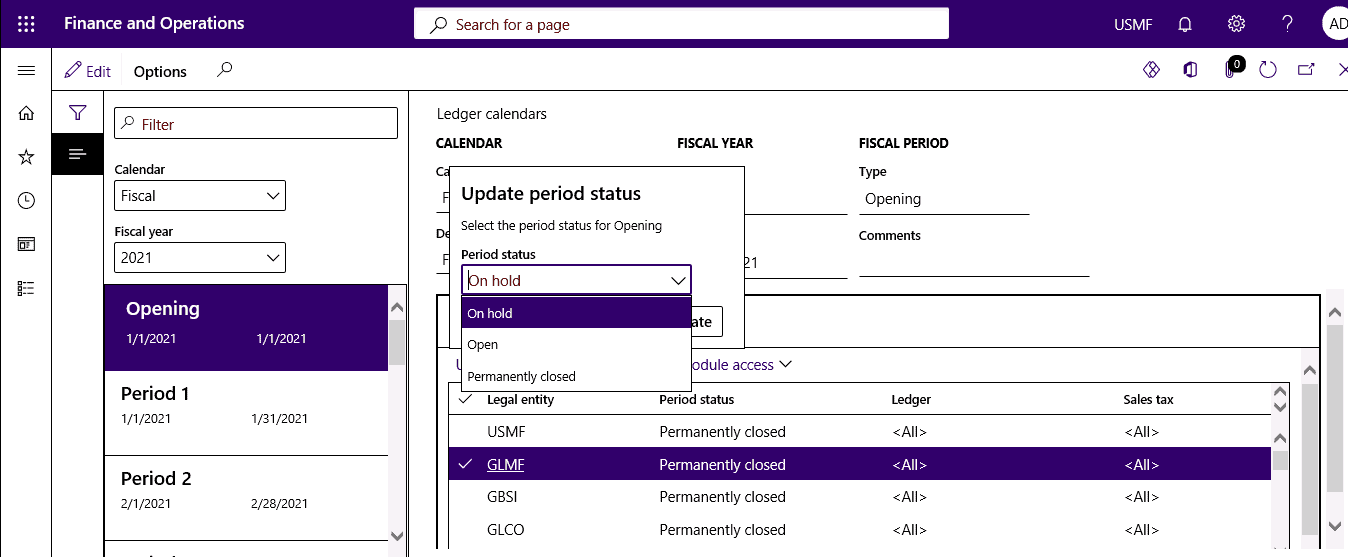

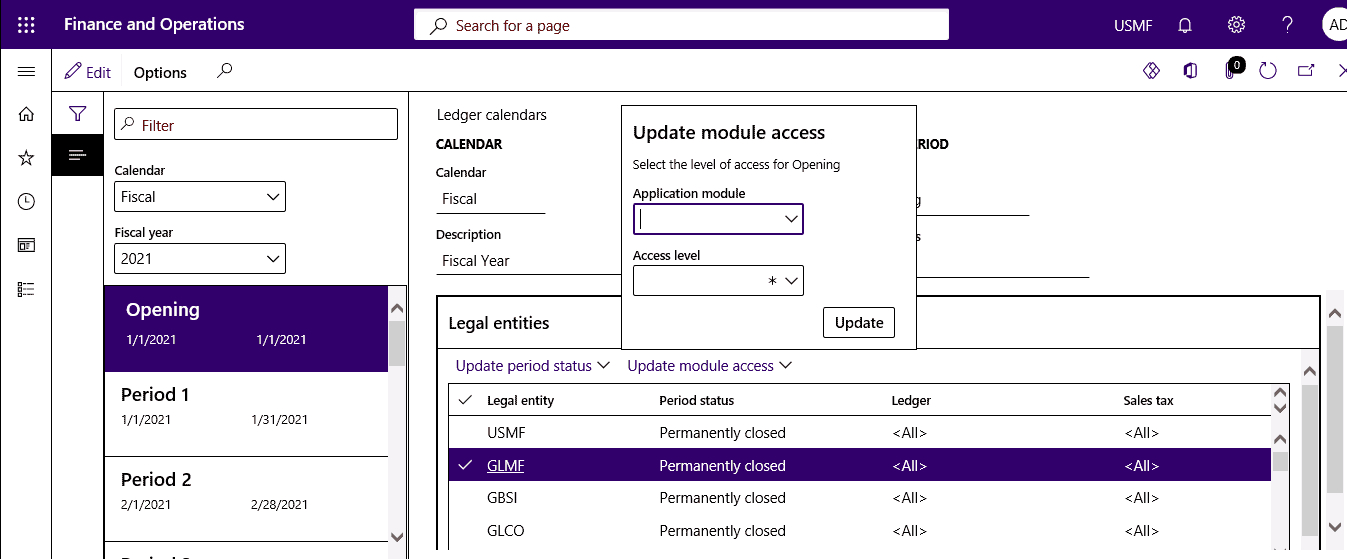

STEP 4: Establish a schedule for your organization

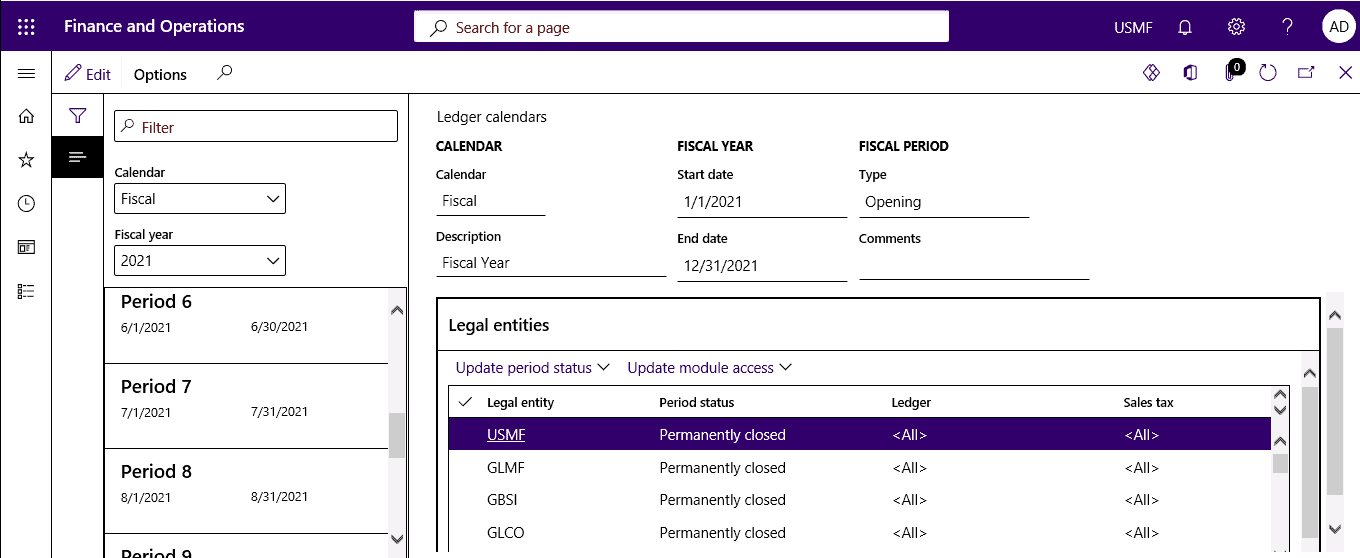

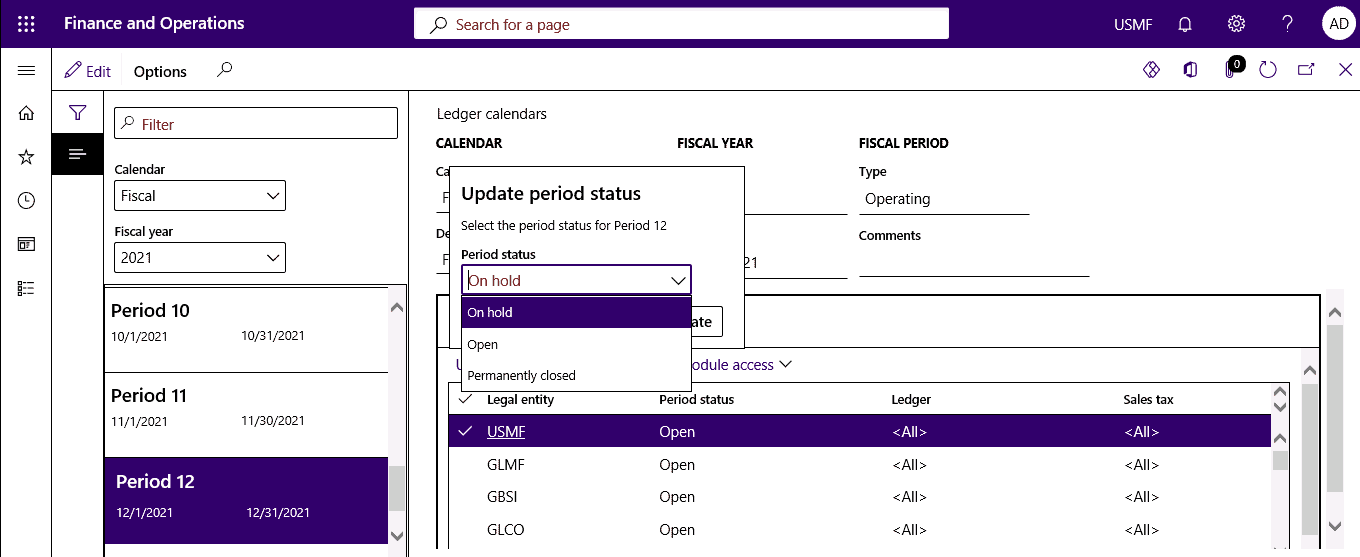

The Ledger calendar page allows you to access detailed information about your organization’s fiscal calendar, fiscal years, and periods. Additionally, you may modify the status of the periods and specify which individuals are permitted to publish accounting transactions to them. For instance, at the start of a new period, you may want one set of users to complete posting financial transactions from the previous period, while another group works exclusively on the current period’s transactions.

Step 1

Select General Ledger> Ledger setup> Ledger calendars.

Step 2

View the details of the fiscal calendar, fiscal year, and period used by your organization on the Ledger calendars page.

Step 3

Change the status of the periods and select which users can post accounting transactions to periods.

SUMMARY

By following the steps above, you may learn how to use fiscal calendars, fiscal years, and periods for legal entities, fixed assets, and budgeting.

Advantages of Using Microsoft Dynamics 365 Fiscal Calendar Feature

Revenue forecasting and progress monitoring are critical for accurate estimates and outcomes in conjunction with your organization’s fiscal cycle. To effortlessly satisfy this need, your sales team may use Dynamics 365 bespoke fiscal calendar capability. Revenue changes may occur for various causes, including the Christmas season, weekend shopping, and weather conditions. As a consequence, businesses often establish their fiscal calendars to standardize reporting times. Regrettably, firms that keep their projections in a spreadsheet may have trouble generating these period-to-period comparisons. Dynamics 365 addresses this problem by enabling administrative users to create forecasts that align with their organization’s fiscal cycle. No more ignoring sales swings during financial reviews or laboriously factoring in revenue seasonality through a spreadsheet.

Dynamics 365 alleviates the burden by including logic that enables sales teams to establish a bespoke fiscal calendar quickly. This feature allows for sales teams to set a custom fiscal term that corresponds to their company. This capability for customized fiscal period’s increases forecast comparison accuracy, providing sales teams with a clearer picture of their revenue objectives and sales success. Enroll in one of our courses to get real-world hands-on experience in our custom-designed laboratories.

SUMMARY

Sales teams may use Dynamics 365’s bespoke fiscal calendar capability. This allows users to create forecasts that align with their organization’s fiscal cycle. No more ignoring sales swings during financial reviews or laboriously factoring in revenue seasonality through a spreadsheet for forecast comparison accuracy.

Final Thoughts

Consider the following factors when setting prices: competition, production costs, customer demand, industry needs, and profit margins. You don’t have to master all of these things at the same time. All you have to do is sit down, crunch some numbers, and establish the most important price factors of your business. Begin with what you need; this will aid you in selecting the most effective pricing strategy for your company.

Most importantly, remember that pricing is an ever-changing process for organizations, but with the correct pricing plan, you can successfully manage your pricing constraints effectively and timely.

At Instructor Brandon | Dynatuners, we always seek innovative method to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on how we can help you manage your pricing constraints and budgets, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What is a constraint on price? ” answer-0=”Constraints on pricing are the variables that restrict the flexibility with which a corporation may determine its prices. Pricing is subject to several limits. As primary price limitations, we shall evaluate the following: Demand for a product class, a specific product, and a particular brand. ” image-0=”” headline-1=”h2″ question-1=”What are the pricing constraints factors that limit a firm’s price range? ” answer-1=”Constraints on a business’s price range include demand, product novelty, costs, rivals, other items offered by the firm, and the kind of competitive market it is operating in. ” image-1=”” headline-2=”h2″ question-2=”Which variables determine and contribute to the elasticity of prices?” answer-2=”The four elements that determine demand’s price elasticity are (1) the availability of alternatives, (2) whether the commodity is a luxury or a necessity, (3) the percentage of money spent on the good, and (4) the amount of time since the price changed. ” image-2=”” count=”3″ html=”true” css_class=””]

2543

2543