Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

Recognizing and Overcoming the Accounting Challenges of Foreign Currency Transactions and Revaluations in Dynamics 365

Transaction Risks in Foreign Currency Revaluation in D365

Transaction Risks | Fixed Assets | Foreign Currency Revaluation | Accounting Entries | Ledger Account | Reverse Transaction

What is an International Business?

The production and selling of products and services between nations is international business. A company may be multinational in a variety of ways:

- It manufactures things in the United States and sells them locally and globally.

- Manufacture things in another nation but sells them locally.

- It manufactures items in another country and markets them both locally and abroad.

SUMMARY

The production and selling of products and services between nations is international business. A company may be multinational in various ways, including one that manufactures things in the U.S. and sells them globally or one that makes things in another country but sells them locally.

Common Challenges Faced by International Businesses

Following are some of the challenges that many international businesses face:

-

Language Obstacles

When doing business worldwide, it is essential to consider the languages spoken in the nations you want to grow.

Does the message of your product transfer well into another language? Consult an interpreter and a native speaker, and a resident of each nation.

Additionally, it is vital to examine the languages spoken by the team members of your organization who work in overseas offices. Investing in interpreters, once again, may assist in guaranteeing that your company continues to run efficiently.

-

Cultural Distinction

Just as each nation has its unique linguistic composition, it also has its own distinct culture or fusion of civilizations. The term “culture” refers to the festivals, arts, customs, meals, and social standards observed by a particular group of people. Therefore, it is critical and rewarding to get knowledge of the cultures of the nations in which you will do business.

-

Exchange Rates and Inflation Rates

A dollar’s value in your nation will not always equal the same amount in other countries’ currencies, nor will currency values continuously be worth the same quantity of products and services.

Acquaint yourself with the currency conversion rates between your nation and the countries you want to do business with. The exchange rate indicates the relative worth of the two currencies. For example, the current exchange rate between the Canadian and U.S. dollars is 0.77, which equates to 77 cents in U.S. cash. Please make a point of regularly monitoring currency rates since they are subject to fluctuation.

Additionally, it is critical to monitor inflation rates, which are the rates at which an economy’s overall price levels grow year over year, represented as a percentage. Inflation rates vary by country and may affect the cost of materials, labor, and product price. Understanding and carefully monitoring these two rates may give valuable insight into the worth of your company’s goods in different areas over time.

Should you like to read more on our latest blog, click here.

SUMMARY

Consider the languages spoken in the nations into which you want to grow. Each country has its own distinct culture or fusion of civilizations. Please make a point of regularly monitoring currency rates since they are subject to fluctuation. Monitor inflation rates, which are the rates at which an economy’s overall price levels grow year over year.

Recent Trends in Businesses

Businesses often manufacture things offshore to take advantage of reduced labor costs or taxes, and they offer products and services globally to capitalize on the tremendous potential for expanding their audience, acquiring new customers, and increasing income.

Recent currency fluctuations have reintroduced exchange-rate risk for businesses that deal with suppliers, producers, or consumers in multiple currencies. Although official or “nominal” exchange rates get the most attention, what matters to businesses are changes in real terms—that is, changes in currency values once inflation differences are taken into account. In a perfect world, if prices fell in response to rising currency values or vice versa, the buying power of businesses’ cash flows would remain consistent, and there would be no actual currency risk. This often works out in the long run, but not always for all currencies and not always in the near term.

Financial Instruments

Numerous businesses seem to handle just the most evident risks, such as exposure to a significant transaction in a developing country, which may be hedged using financial instruments such as currency futures, swaps or options. However, these strategies may not apply for all currency risks—and businesses often face considerably larger exposure to less visible risks that are significantly more difficult to control; such as risk associated with mismatches between expenses and investments in one currency and revenues in another. Moreover, exchange rate volatility is a fact of life. From the traveler planning a vacation overseas and unsure of when and how to get local currency to the multinational corporation buying and selling in numerous countries, the consequences of doing it wrong may be significant.

SUMMARY

Recent currency fluctuations have reintroduced exchange-rate risk for businesses dealing with suppliers, producers, or consumers. What matters to businesses are changes in real terms once inflation differences are taken into account. In a perfect world, prices would fall in response to rising currency values, and there would be no actual currency risk.

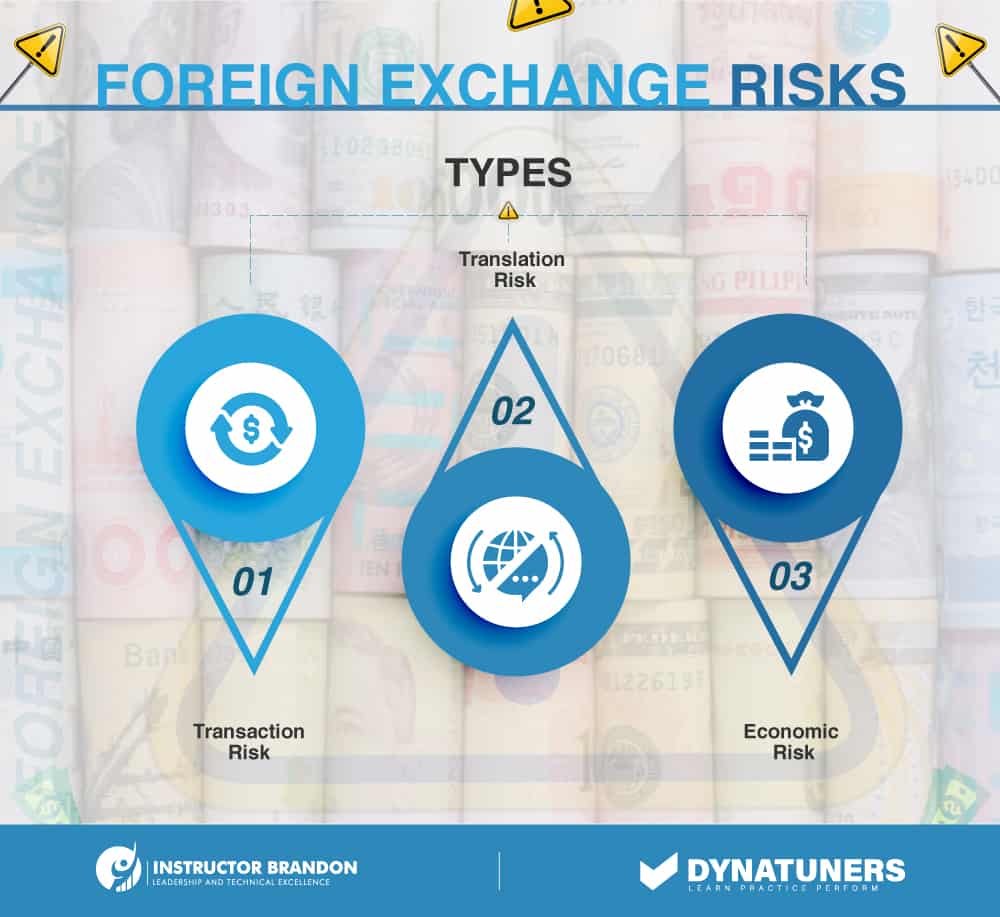

Types of Foreign Exchange Risks

Fundamentally, there are three types of Foreign Exchange Exposure company’s face: transaction exposure, translation exposure and economic exposure.

-

Transaction Exposure

This is the most basic kind of foreign currency exposure, and it occurs when a commercial transaction is conducted in a foreign currency, as the name implies. The exposure arises from the time gap between a customer’s right to receive cash and the actual physical receipt of the money, or, in the case of a payable, the period between placing the purchase order and invoicing settlement.

-

Translation Exposure

This is the process of converting a foreign subsidiary’s financial statements (such as the P&L or balance sheet) from its native currency to the parent’s reporting currency. This is due to the parent company’s duties to shareholders and regulators, requiring it to present a consolidated set of accounts for all subsidiaries in its reporting currency.

-

Economic Exposure

This final form of foreign exchange exposure is long-term and is produced by the impact of inevitable currency fluctuations on a company’s future cash flows and market value. Longer-term strategic choices, such as where to invest in manufacturing capacity, might be influenced by this sort of exposure.

SUMMARY

There are three types of foreign exchange exposure company’s face: transaction exposure, translation exposure, and economic (or operating) exposure. The exposure arises from the time gap between a customer’s right to receive cash and the actual physical receipt of the cash. In addition, longer-term strategic choices, such as where to invest in manufacturing capacity, might be influenced by this sort of exposure.

Foreign Currency Transaction and Translation Adjustments Impact on the Cash Flow Statements

As of year-end, the balance sheet and income statement have been adjusted for any measurement of transactions to be paid in a currency other than the functional currency. In addition, the translation of the statements from CAN to U.S. dollars has influenced equity and the statement of other comprehensive income. As a result, the cash flow statement is the final analysis statement.

To correctly create the cash flow statement, generate separate cash flow statements in each entity’s functional currency, convert them to the reporting currency (using the appropriate exchange rates), and consolidate them. For example, the cash flow statement of the parent firm is in U.S. dollars, whereas the cash flow statement of the Canadian subsidiary is in CAN dollars. After you’ve completed the cash flow statement for the Canadian subsidiary in CAN dollars, you’ll need to convert it to U.S. dollars, which is the reporting currency.

Cash Flow Statements

The difference between the exchange rates used for conversion and at the period ending on the cash provided will be the amount required to balance the statement after it has been converted. The amount will be shown as the “impact of exchange rates on cash and cash equivalents” on the consolidated cash flow statement. This amount is often assumed to be equivalent to the current year translation amount shown in cumulative comprehensive income. However, this is wrong! Therefore, the cash flow statement is incorrect if these two figures agree. Although it takes more time to create the cash flow statement correctly, others often utilize it to assess the financial condition of the combined organization. As a result, it’s critical to double-check that the statement accurately represents the quantities.

Dynatuners is at your service to provide Help Desk Support during the implementation, upgrade, or migration of your projects with Microsoft Dynamics 365. To get in-touch with us book an appointment now.

SUMMARY

As of year-end, the balance sheet and income statement have been adjusted for any measurement of transactions to be paid in a currency other than the functional currency. As a result, the cash flow statement is the final statement to analyze – and takes more time to create.

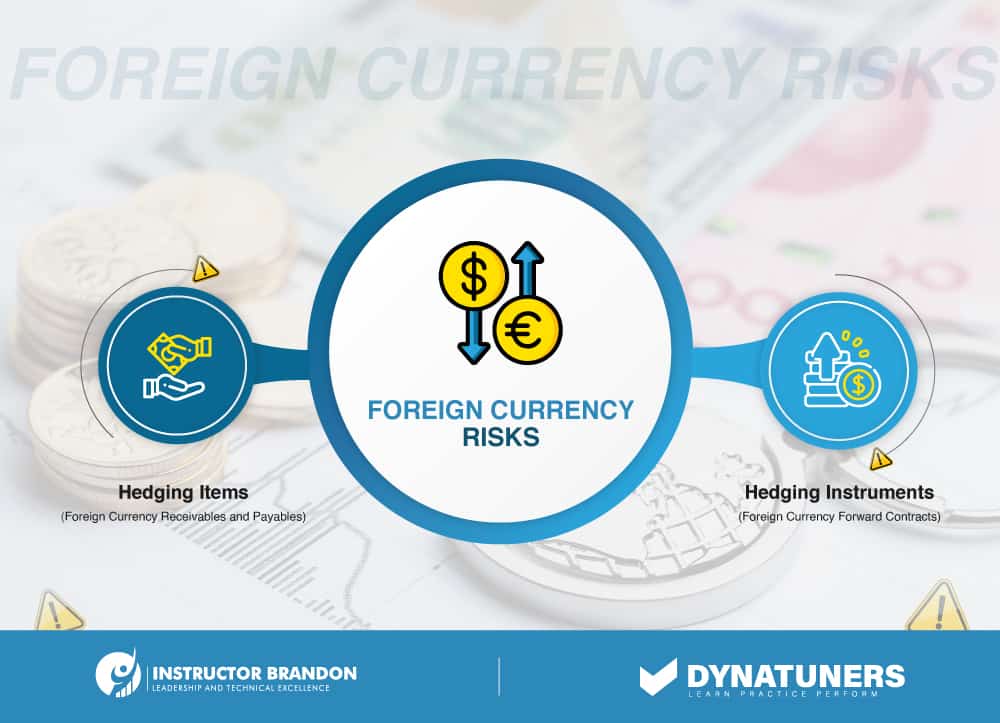

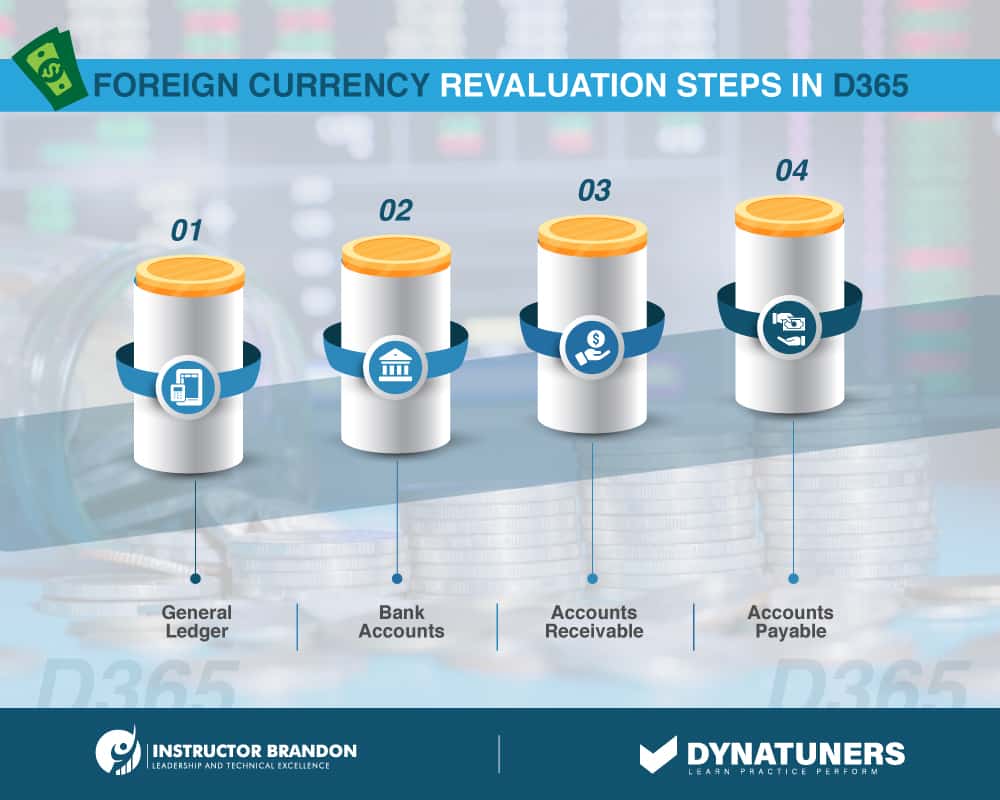

Foreign Currency Revaluation in D365FO

The foreign currency revaluation tool in Dynamics 365 converts the value of all open foreign currency accounts to the reporting currency. As a result, all payable and receivable transactions using foreign currency are subject to transaction risk, defined as the ‘adverse effect that exchange rate changes may have on a company’s accounts.

These revaluations result in discrepancies in the company’s monetary assets and liabilities, reported as “unrealized gain/loss“. When the transaction is resolved, the value discrepancies between the firm sale or buy commitment, and the payment date are reported on the balance sheet as realized foreign exchange gains/losses.

In Dynamics 365, foreign currency revaluation may be applied to all open transactions at the ledger and sub-ledger levels.

SUMMARY

All open transactions using foreign currency are subject to transaction risk, defined as the ‘adverse effect that exchange rate changes may have on a company’s accounts. Therefore, in Dynamics 365, foreign currency revaluation may be applied to all open transactions at the ledger and sub-ledger levels.

Functional Walkthrough of Foreign Currency Revaluation in Dynamics 365

Process 1: Prepare to run foreign currency revaluation

Setup required for running the revaluation process are:

Step 1

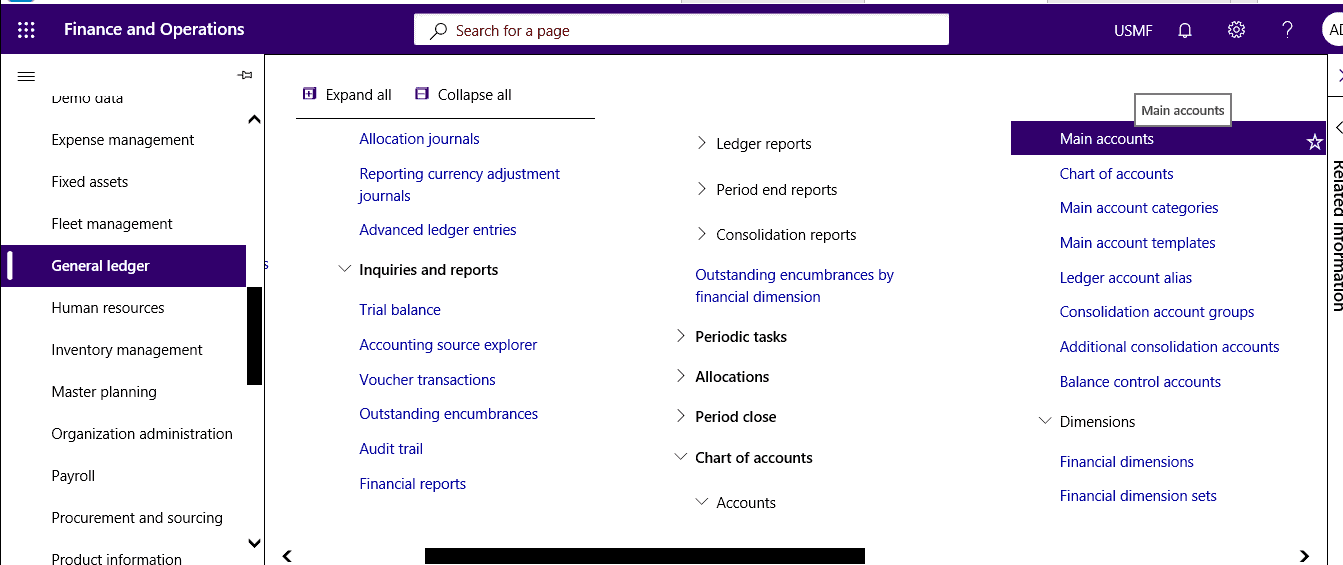

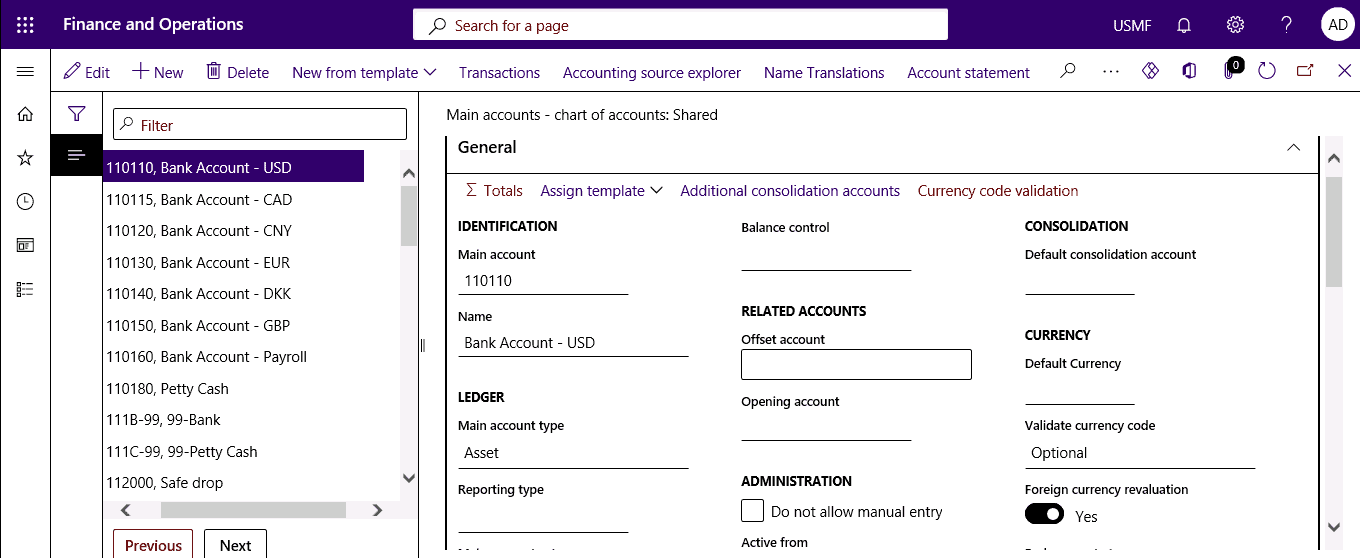

Select General ledger > Accounts > Main accounts.

Step 2

Select Foreign currency revaluation.

Step 3

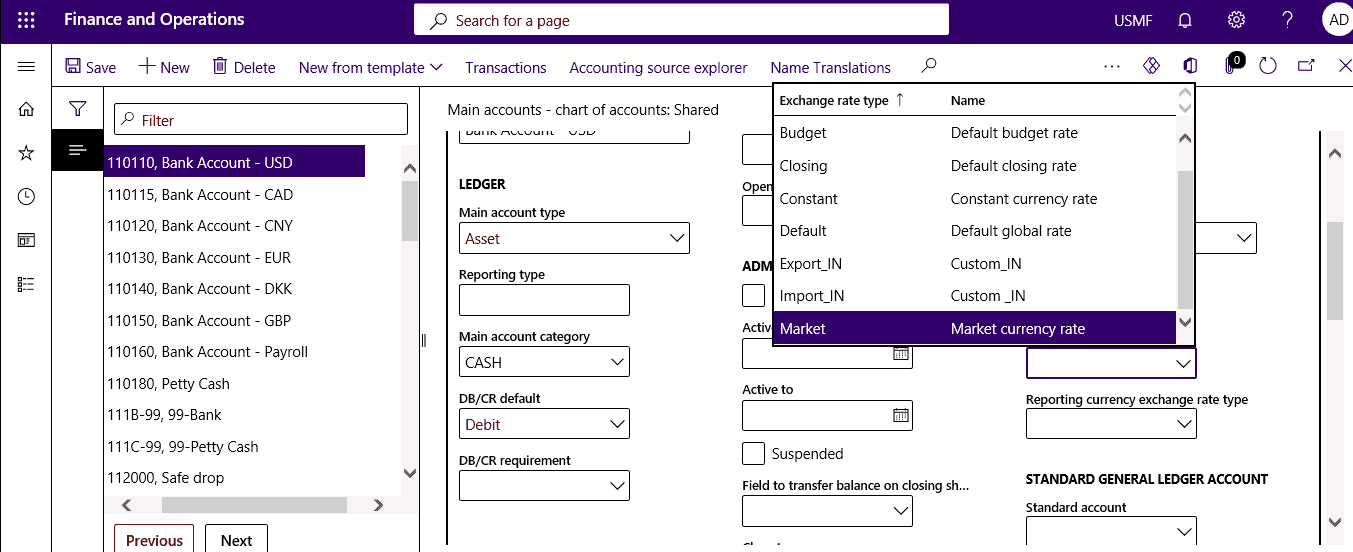

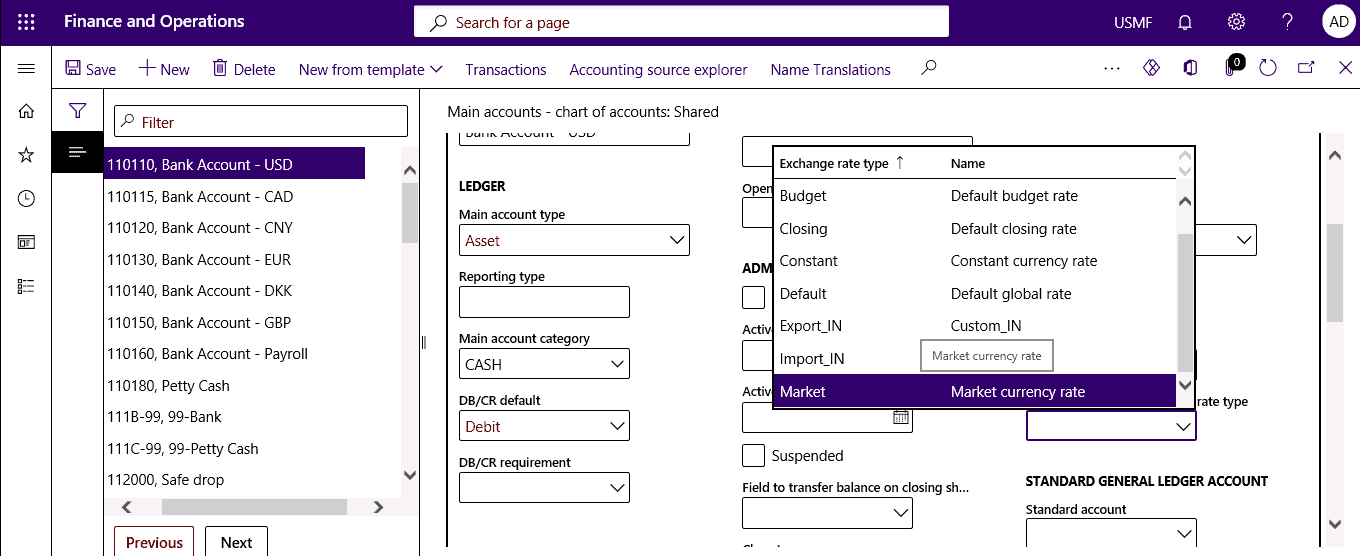

Enter the Exchange rate type for revaluing the main account.

Step 4

Enter Financial reporting exchange rate for financial reporting.

Step 5

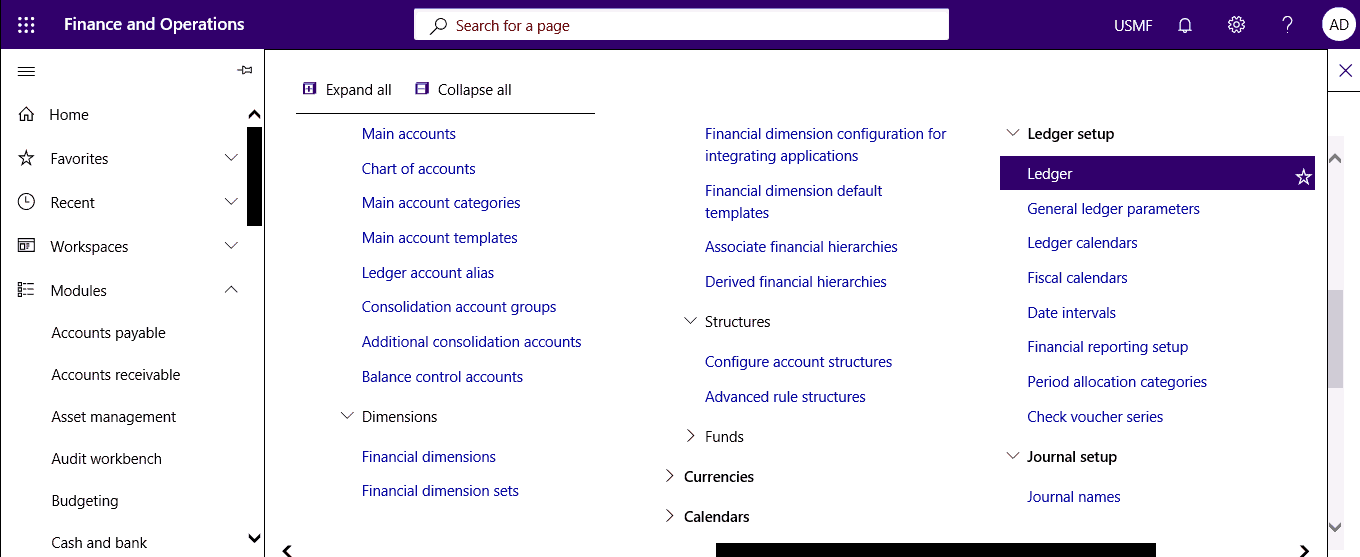

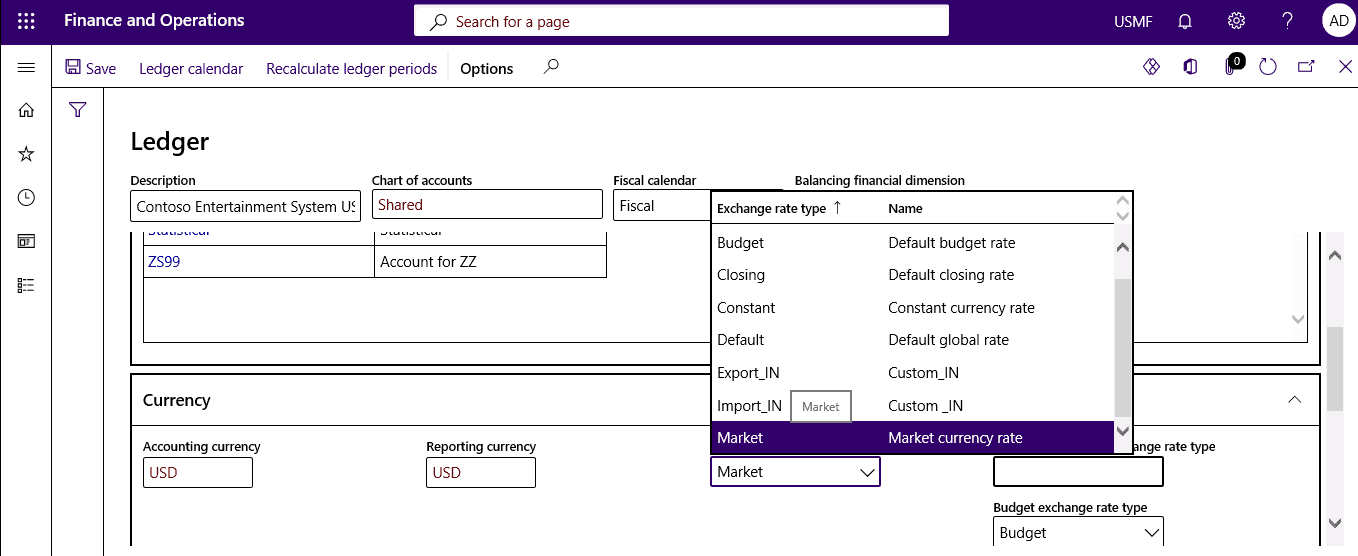

Select General ledger > Ledger setup > Ledger.

Step 6

Specify the Exchange rate type.

Step 7

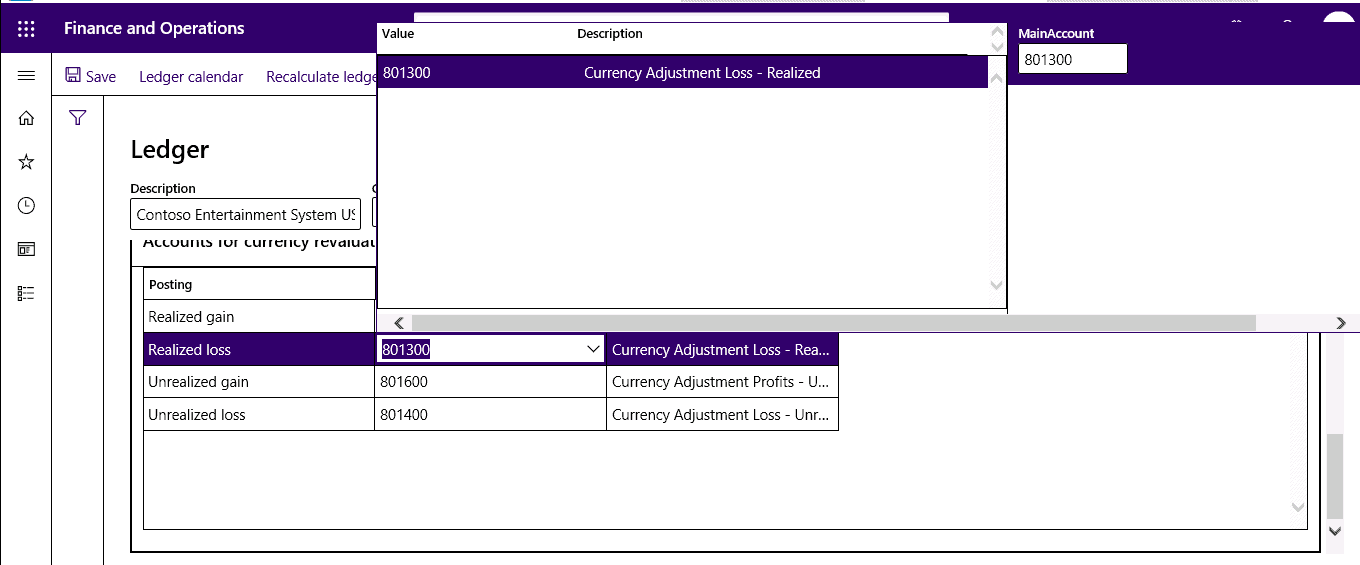

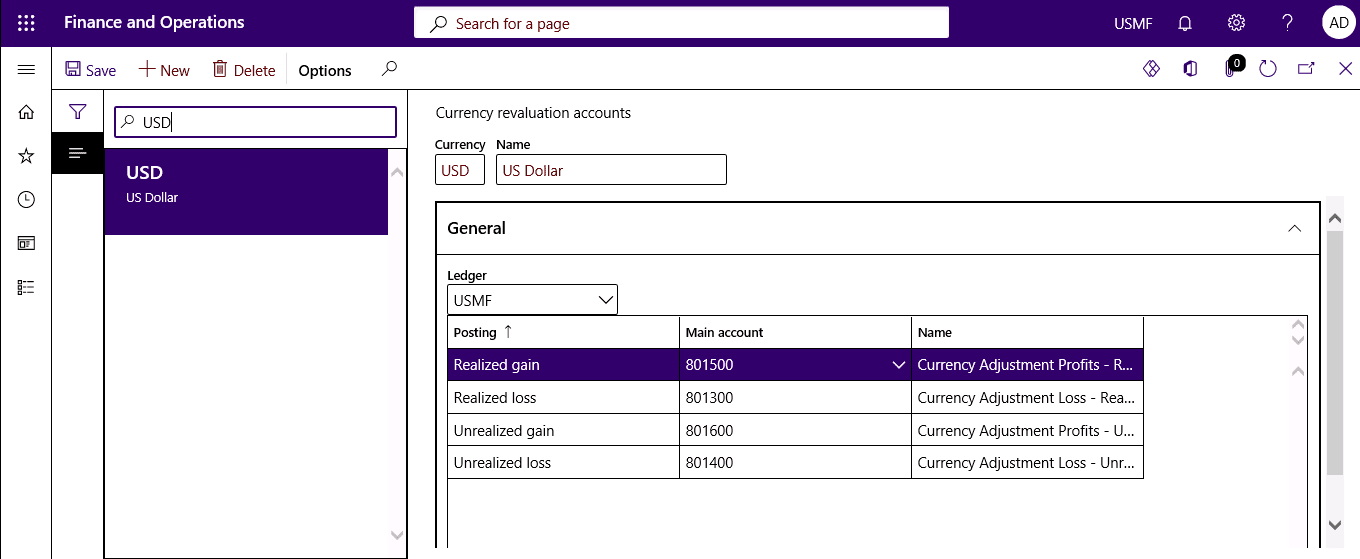

Specify the realized gain, realized loss, unrealized gain, and unrealized loss accounts for currency revaluation.

Step 8

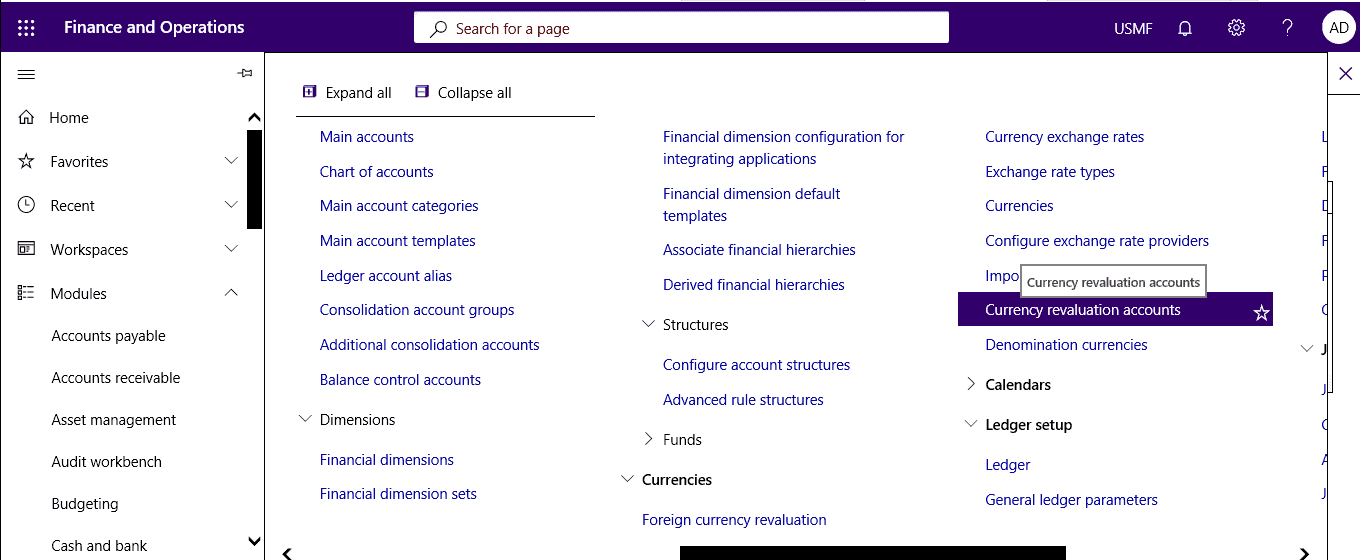

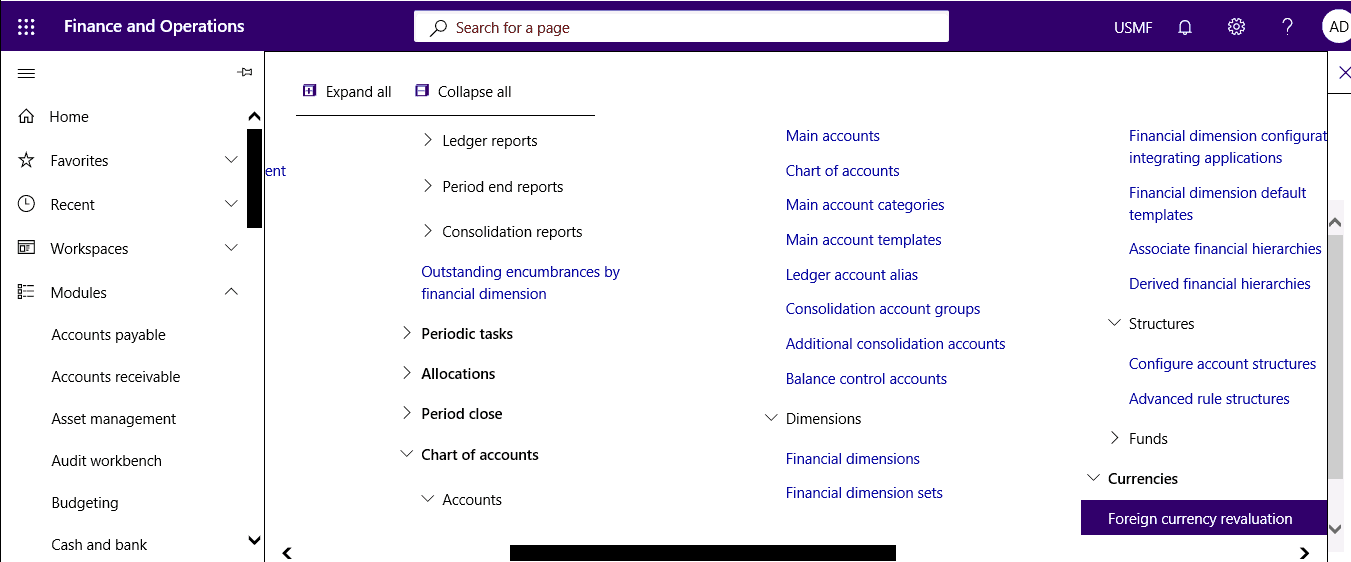

Select General ledger > Currencies > Ledger.

Step 9

Select different currency revaluation accounts for each currency and company.

Process 2: Process Foreign Currency Revaluation

Step 1

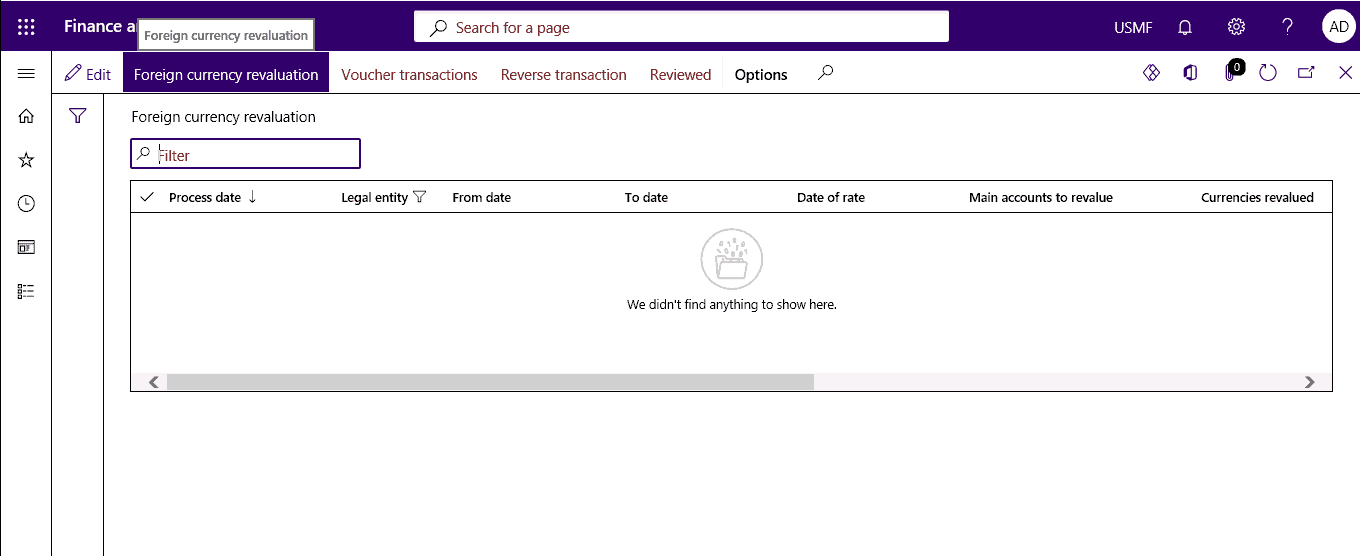

Select General Ledger > Currencies > Foreign currency revaluation.

Step 2

Select the foreign currency revaluation button.

Step 3

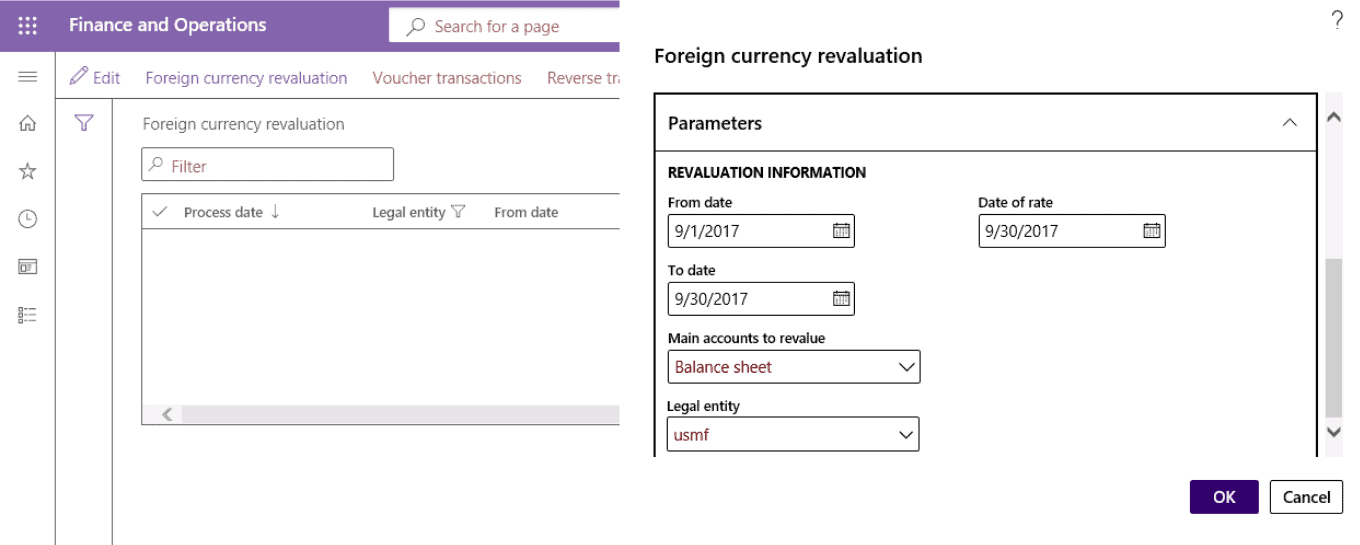

Specify From Date and To Date values that will define the date interval for calculating the foreign currency balance revalued.

Step 4

Specify the date of the rate to define the date for which the exchange rate should default.

Step 5

Select which main accounts to revalue: All, Balance sheet, or profit and loss accounts.

Step 6

Select the legal entities for which you want to run the revaluation process.

Step 7

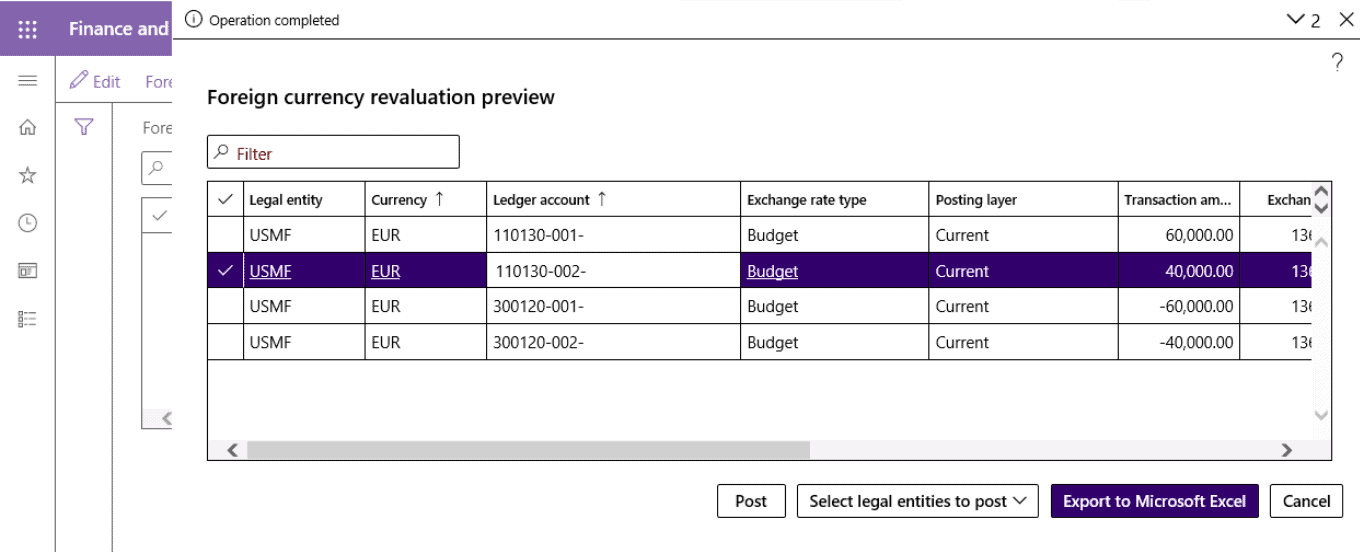

Set Preview before posting to Yes.

Step 8

From the preview, the user has the option to post the results of all legal entities using the Post button.

SUMMARY

Following the above steps, you will be able to perform a foreign currency revaluation function for the general ledger.

How To Mitigate Currency Risks

The currency risk strategy that a business adopts is determined by its risk tolerance. Some companies may choose to cover 90% of their currency risk, while others will prefer to protect 50% because they can withstand the remaining effect of an adverse exchange rate variance. Regardless of how much international commerce a company does, controlling foreign currency risk is a four-step process:

- Identify the company’s foreign exchange risk requirements and problems.

- Determine the most effective hedging method for mitigating this risk.

- Choose appropriate hedging products.

- Execute/revise the exchange rate plan in response to changing demands and obstacles.

|

Sr. |

Critical Takeaways from Exchange Rates | |

| Factors Influencing Exchange Rates | Key Takeaways of Exchange Rates | |

|

1. |

Inflation Differentials | Aside from variables such as interest rates and inflation, the currency exchange rate is one of the most significant predictors of a country’s relative degree of economic health. |

|

2. |

Interest Rate Differentials | A stronger currency makes imports cheaper and exports more costly in overseas markets. |

|

3. |

Current Account Deficits | Exchange rates are relative and are represented in terms of a comparison between two nations’ currencies. |

|

4. |

Public Debt | Excessive demand for foreign currency devalues the currency of the nation until local products and services become affordable to foreigners and foreign assets become too costly to produce revenue for domestic interests. |

SUMMARY

The currency risk strategy that a business adopts is determined by its risk tolerance. Some companies may choose to cover 90% of their currency risk, while others will protect 50%. Regardless of how much international commerce a company does, controlling foreign currency risk is a four-step process.

How to Reduce Foreign Currency Risks

Numerous financial instruments are available to assist company owners in mitigating foreign currency risk:

- Forward contracts, in which the exchange rate is fixed at the time of sale but payment is made later.

- Currency options provide the business with the right (but not the responsibility) to swap a certain quantity of foreign currency at a specified rate if the foreign currency loses value.

- Currency swaps, which allow a business to “switch” its forward contract for one with a different expiration date – are also a viable solution for companies facing cash flow constraints since they minimize foreign currency risk.

Risk Mitigation Strategy

Given the complexity of the causes affecting currency swings, it is not worthwhile for you as a company owner to spend time attempting to forecast currency moves. That is why it is vital to plan and develop a risk-mitigation strategy. Your trader may collaborate with you to create the optimal exchange rate management plan for your business, considering the way you operate, your risk tolerance, and your risk tolerance level. Additionally, your industry and profit margins will influence your hedging approach. The narrower the profit margin, the more crucial it is to implement a hedging plant. Finally, keep in mind that the primary objective of a hedging plan is to safeguard your company’s income, not to speculate on currency swings. Therefore, your business should be concentrating its efforts on its principal objective – operations – while limiting or eliminating risk in areas where you lack competence.

The Dynatuners range includes some of the world’s most advanced Dynamics performance tuning solutions, with several successful deployments. Contact us at HE**@IN***************.COM if you have any questions.

SUMMARY

It is not worthwhile for you to spend time attempting to forecast currency swings, so it is vital to plan and develop a risk-mitigation strategy. The primary objective of a hedging plan is to safeguard your company’s income, not to speculate on currency swings. Your trader may collaborate with you to develop the optimal exchange rate management plan for your business.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on how we can help you manage your cashflows perfectly, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What happens during a currency’s revaluation? ” answer-0=”When a government undertakes a revaluation, or revalues its currency, it adjusts the fixed exchange rate in order to increase the value of the currency. Due to the fact that most exchange rates are bilateral, a rise in the value of one currency results in a decrease in the value of another. ” image-0=”” headline-1=”h2″ question-1=”What is D365 foreign currency revaluation? ” answer-1=”The foreign currency revaluation tool in Dynamics 365 is used to convert the value of all open foreign currency accounts to the reporting currency. In Dynamics 365, foreign currency revaluation may be applied to all open transactions at the ledger and sub-ledger levels. ” image-1=”” headline-2=”h2″ question-2=”How does currency conversion work? ” answer-2=”The foreign currency translation adjustment, also known as the cumulative translation adjustment CTA, aggregates all of the changes produced by fluctuating exchange rates. Businesses that operate on a global scale must convert transactions such as asset acquisitions or service purchases into their functional currency. ” image-2=”” count=”3″ html=”true” css_class=””]

3719

3719